Market Round Up of 2025: Navia’s Annual Highlights

- 📈 A Look Back at the Indian Stock Market in 2025

- Market performance in 2025: Returns masked divergence

- Major shifts that defined 2025

- Sectoral Movements

- Company Performance in 2025

- Looking ahead to 2026: Why the setup looks stronger

- Nifty 50 outlook for 2026

- Key opportunities and risks in 2026

- Conclusion: 2025 resets the base, 2026 builds the trend

📈 A Look Back at the Indian Stock Market in 2025

2025 may be characterised less by headline returns and more by a period of market reset to Indian equities. After a powerful run in 2023 and 2024, markets entered 2025 carrying rich valuations, cautious global sentiment and uneven earnings momentum. What followed was a long spell of consolidation, bursts of volatility and sharp divergence across sectors that tested investor patience.

The market did not fall apart in 2025, but it clearly changed its rules. Easy liquidity and broad-based rallies gave way to a more selective environment, where the quality of earnings and balance sheets mattered far more.

Indian equities ended calendar year 2025 in the green, but the journey was not uniform.

Benchmark indices recorded positive returns;

➣ BSE Sensex rose 9.1%

➣ BSE 100 gained 9.1%

➣ Support came largely from steady domestic flows and improving macro stability

Breadth narrowed sharply;

➣ Large caps, especially financials and select defensives, held up better

➣ Mid caps delivered modest gains

➣ Small caps corrected meaningfully as valuations normalised after years of outperformance

Why 2025 mattered beyond returns?

Crucially, 2025 was not a wasted year from a long term perspective. It set the base for a healthier next phase.

✅ Inflation fell to multi decade lows

✅ Monetary policy turned clearly supportive

✅ The rupee regime shifted towards greater market linkage

✅ Domestic demand indicators steadily improved

✅ By the final quarter, markets broke out of a 14 month consolidation phase, setting up a more constructive 2026

Market performance in 2025: Returns masked divergence

While headline indices delivered mid to high single digit gains, the underlying trend was more selective.

◆ Large caps outperformed on earnings visibility and balance sheet strength

◆ Speculative pockets in small and mid caps corrected as liquidity tightened and earnings delivery lagged expectations

◆ Markets rewarded pricing power and cash flows, and penalised leverage and aggressive assumptions

Major shifts that defined 2025

Geopolitics and global trade: Uncertainty, not disruption

Geopolitics remained a steady overhang, with the India and US trade relationship becoming a key watch point. The US imposed tariffs up to 50% in select categories on Indian exports from August 2025, partly linked to India’s Russian oil imports.

➨ Markets reacted to headlines, but no comprehensive trade agreement was finalised by year end

➨ Negotiations continued on parallel tracks, including a broader Bilateral Trade Agreement and an interim framework deal

➨ Domestic demand resilience and policy credibility helped absorb uncertainty, reinforcing that India’s growth engine is increasingly internally driven

Monetary policy pivot: RBI’s decisive shift towards growth

One of the most consequential developments of 2025 was the shift in monetary policy. In December, the RBI cut the repo rate by 25 basis points to 5.25%, marking the fourth cut of the year and a total reduction of 125 basis points. The RBI also upgraded its FY26 GDP growth forecast to 7.3% and lowered its inflation outlook sharply.

Governor Sanjay Malhotra referred to a rare Goldilocks phase, with exceptionally low inflation and robust growth. CPI inflation fell close to zero by October 2025, creating policy space while macro stability remained broadly intact.

● The RBI supported transmission with liquidity measures such as open market operations and dollar rupee swaps

● Liquidity conditions improved materially by year-end

● Credit growth held up, and financial markets stabilised

Federal Reserve: Global easing cycle takes shape

In December, the US Federal Reserve delivered its third rate cut of 2025, taking the federal funds rate to 3.50% to 3.75%. While the Fed signalled a slower pace ahead, the direction was clear.

For India, synchronised easing reduced external constraints, eased pressure on bond yields, and had implications for external conditions and capital flow dynamics.

Rupee regime shift: From defence to flexibility

One of the most underappreciated shifts of 2025 was the repositioning of the rupee. After the IMF reclassified India’s exchange rate regime from stabilised to a crawl, like arrangement, the RBI allowed greater two-way movement.

🔹 The rupee crossed Rs 90 per US dollar during the year, driven more by policy choice than by economic stress

🔹A more flexible rupee improves shock absorption, supports export competitiveness and aligns India with broader emerging market norms

🔹While depreciation created short-term discomfort, it improved long-term credibility and transparency, which matters for global investors

Earnings and liquidity: The true anchors of 2025

Corporate earnings stayed stable but not euphoric, reflecting a consolidation phase after the post-pandemic rebound. Balance sheets remained healthy and systemic stress was largely absent. Companies focused on cost control, margin protection and disciplined capital allocation. This earnings resilience, combined with domestic liquidity, helped anchor markets despite valuation concerns and intermittent global volatility.

Geopolitical risk: The persistent threat of large-scale conflict

Geopolitical risks remained the biggest tail risk through 2025, given the possibility of escalation across regions such as Eastern Europe, the Middle East and parts of Asia.

▶ Any escalation may have the potential to disrupt supply chains and influence energy prices

▶ For India, higher crude can widen the trade deficit and trigger shor-term volatility through foreign outflows

▶ These risks are exogenous and difficult to price in advance, even when domestic fundamentals remain resilient

Gold and silver: Safe havens shine in 2025

Gold and silver were among the stronger-performing asset classes in 2025. Gold hit record highs, supported by central bank buying, expectations of global rate cuts and geopolitical uncertainty. Silver outperformed as it benefited from both defensive demand and rising industrial usage. For Indian investors, rupee depreciation further boosted returns, underlining the role of precious metals as portfolio stabilisers and hedges against macro and currency risks.

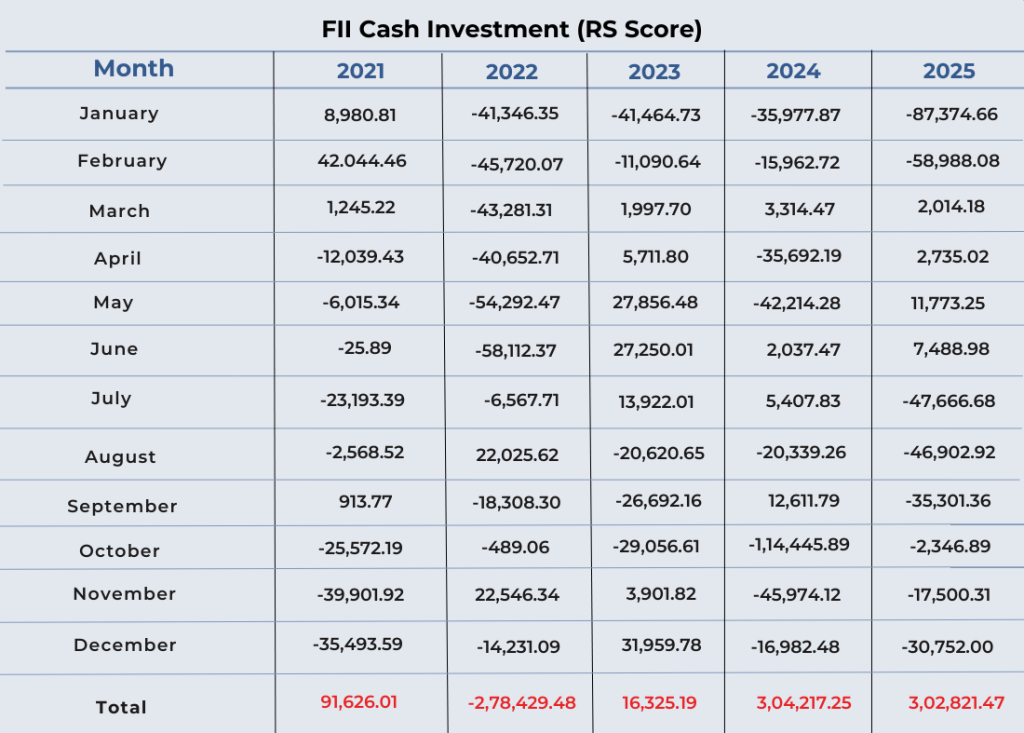

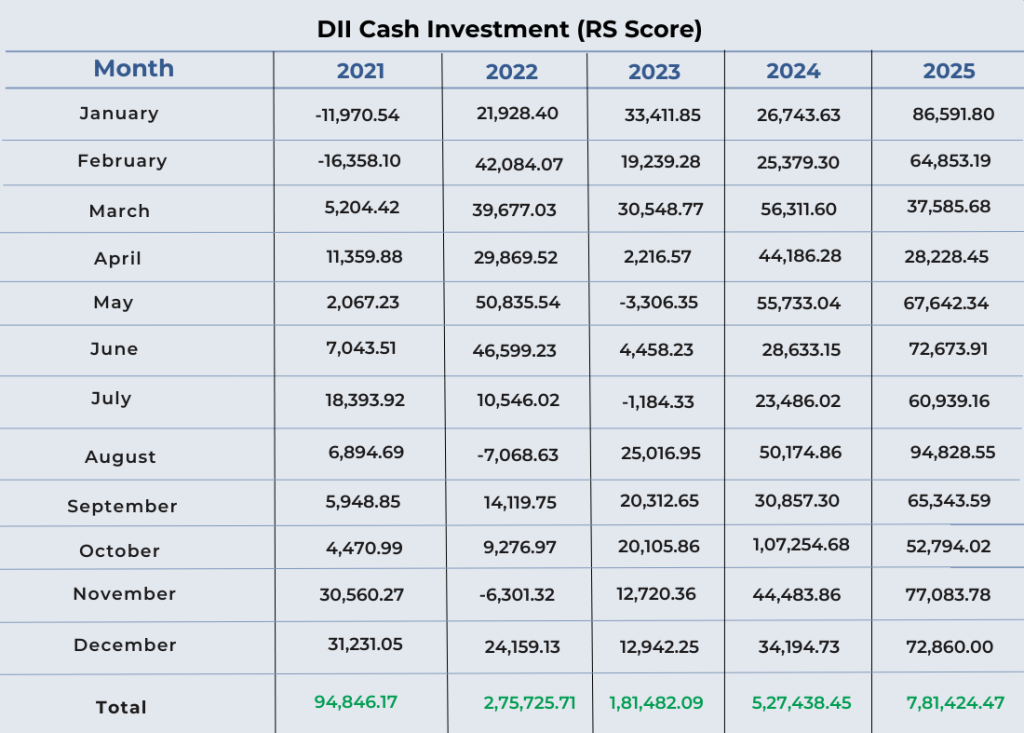

FII and DII flows: Domestic capital takes the driver’s seat

The flow data highlighted a clear shift in market ownership from foreign to domestic investors.

FIIs

▪️Persistent net sellers through 2025

▪️Withdrawals of around Rs 3.03 lakh crore

▪️Drivers included global risk aversion, elevated US bond yields for much of the year, trade-related uncertainty and profit booking after a strong multi-year rally

DIIs

▪️Record buying of Rs 7.81 lakh crore in 2025

▪️Supported by steady SIP contributions, insurance flows and long-term domestic allocations

▪️Domestic participation absorbed FII selling pressure and reduced vulnerability to global capital swings

Sectoral Movements

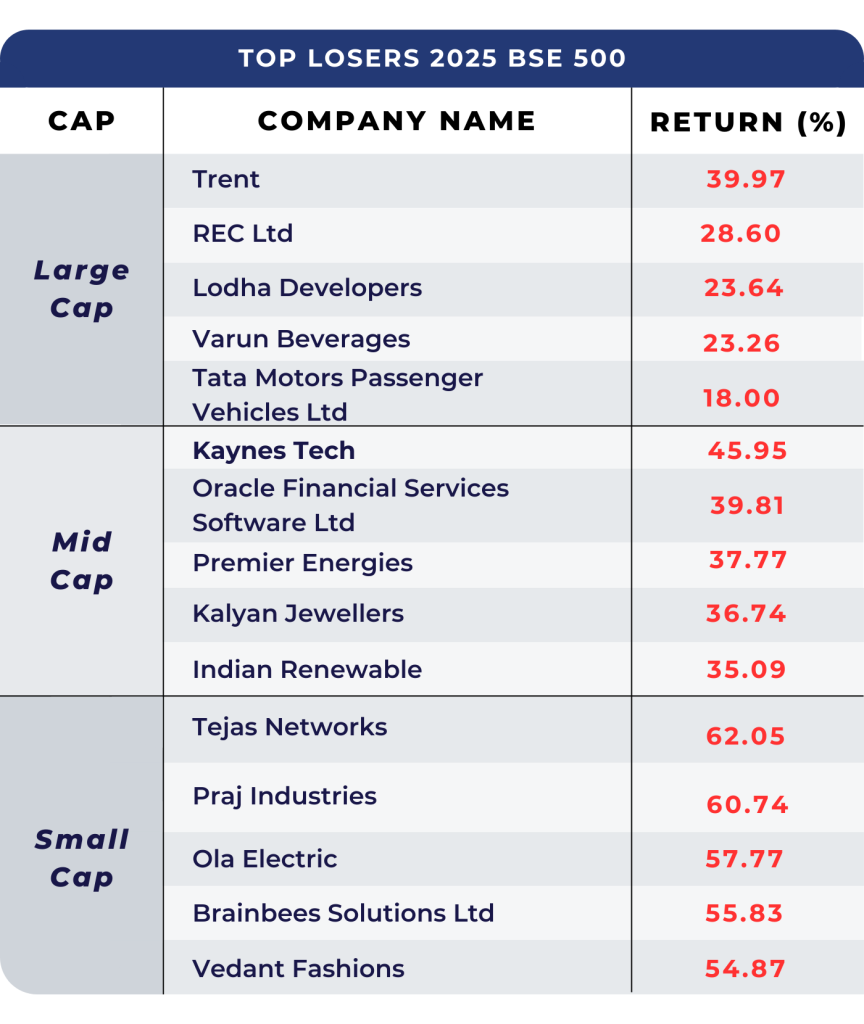

Company Performance in 2025

Looking ahead to 2026: Why the setup looks stronger

As markets enter 2026, the contrast with early 2025 is stark. Valuations have cooled, policy is supportive and earnings visibility is improving.

◉ India’s FY26 GDP growth is projected at 7.0% to 7.3%, among the strongest globally

◉ Inflation is in benign territory, leaving room for further easing if required

◉ Government measures such as GST rationalisation, tax relief and infrastructure spending support consumption and investment

◉ Above normal monsoons, easing commodity prices, and improved rural demand add to the growth outlook

Historically, multi-year market phases have often followed periods of valuation adjustment and improving liquidity. 2026 has more of these ingredients than 2025 did.

Nifty 50 outlook for 2026

After breaking out of consolidation in late 2025, the Nifty 50 enters 2026 with a different structural context compared to early 2025. Street expectations broadly factor in double-digit returns, with Nifty targets in the 28,300 to 30,000 range and Sensex targets between 94,000 and 98,500.

🔸 Base case: range-bound first half amid global volatility and cautious foreign flows

🔸 Stronger second half if earnings momentum improves and foreign inflows return

🔸 Valuations are not cheap, but more reasonable than peak cycle levels seen earlier

🔸 With earnings growth expected around 13% to 16%, the market can compound without relying on aggressive multiple expansion

Key opportunities and risks in 2026

Opportunities

➜ Rate-sensitive sectors benefiting from easing policy

➜ Financials supported by credit growth and asset quality stability

➜ Consumption recovery aided by tax relief and lower borrowing costs

➜ Infrastructure-linked sectors driven by sustained capital expenditure

Risks

➜ Global bond market volatility and delayed Fed easing

➜ Sharp reversals in foreign flows

➜ Overvaluation pockets in small and mid caps

➜ Geopolitical flare-ups or trade-related shocks

Conclusion: 2025 resets the base, 2026 builds the trend

Calendar year 2025 was not about chasing returns. It was about resetting expectations, valuations and policy frameworks. Markets absorbed global shocks, digested heavy foreign selling and adjusted to a macro environment defined by low inflation and easing rates.

As India enters 2026, it does so from a position of strength. Growth remains resilient, policy credibility is intact, and domestic capital continues to act as a stabilising force. Volatility will not disappear, but the structural environment continues to be shaped by domestic growth, policy measures and liquidity conditions.

Do You Find This Interesting?

DISCLAIMER: Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.