Market Resilience

Flat Close, Yet Weekly Gains Prevail

Week in the Review

Nifty’s week close above 22,200 suggests a potential breakthrough after a month-long consolidation. The demand zone of 22,100 – 22,130, guided by industry insights, signals a retreat to 22,000 if breached. Globally, the U.S. dollar index pauses its rally, prompting reflection amid anticipated Fed rate delays. Wall Street’s momentum, fueled by Nvidia’s AI success, reflects in Dow Jones, S&P 500, and Nasdaq gains. Amid market shifts, oil prices dip on the U.S. central bank’s hints of delayed rate cuts. Stay tuned for global trends and market insights on Navia’s blog.

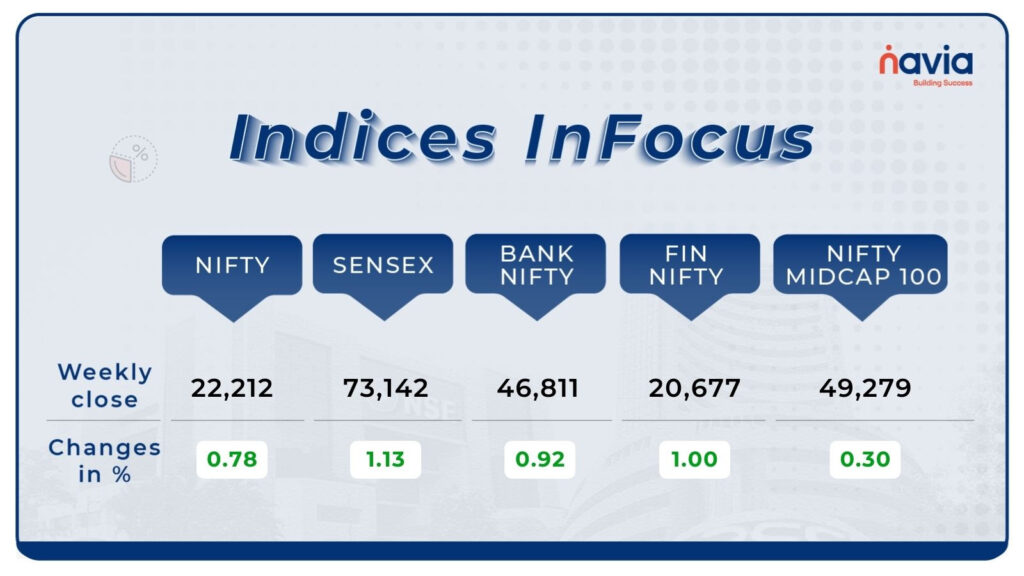

Indices Analysis

In a week marked by impressive resilience, Indian equity indices continued their upward trajectory, building on the gains from the previous week. The Nifty50 index reached new heights, soaring to a record high of 22,297.50 by the week ending February 23. This remarkable ascent was propelled by a combination of positive macro data, robust support from global markets, all while navigating through challenges such as escalating crude oil prices and US bond yields. The indices showcased an unwavering strength, demonstrating the market’s ability to withstand external pressures and capitalize on favorable factors.

For any further queries, you can now contact us on WhatsApp!

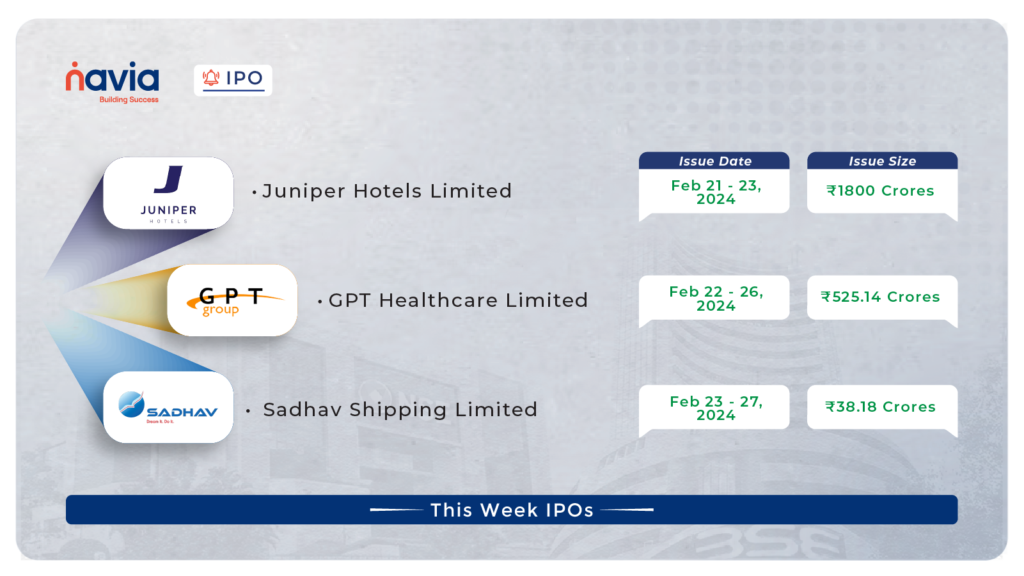

IPO Corner

Juniper Hotels IPO: Excitement Brews as Subscription Rate Hits 1.85 Times!

Subscription Soars to 1.85 Times! Despite a lukewarm start, Juniper Hotels’ IPO gained momentum, reaching 1.85 times subscription by February 23, signaling a promising turn as the retail portion hit full subscription.

GPT Healthcare IPO: Analysts Bullish as Subscription Nears 61%!

Bullish Momentum as Subscription Nears 61%! Analysts are optimistic about GPT Healthcare’s IPO, with subscription levels approaching 61% on the second day of bidding. Fueled by reasonable valuation and strong Eastern India presence, it’s a ‘subscribe’ contender.

Sadhav Shipping SME IPO: Setting Sail with 59% Subscription on Day One!

Sadhav Shipping’s SME IPO opens strong, aiming to raise Rs 38.18 crore with a 59% subscription rate on its debut day. Stay tuned for the journey of this ambitious seascape changer!

Now with N Coins, Navia customers can #Trade4Free.

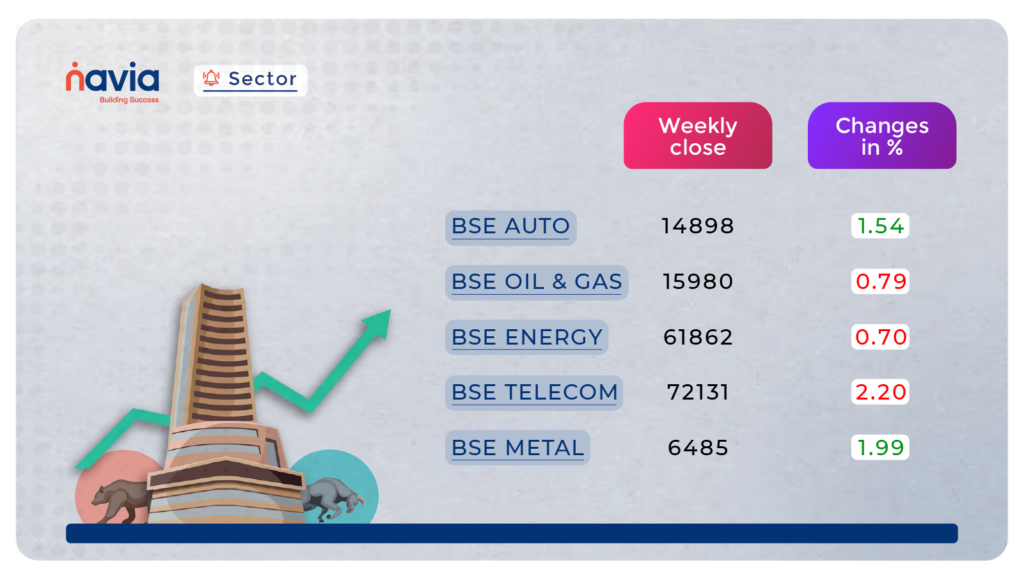

Sector Spotlight

In a week of dynamic market shifts, the BSE Realty index led with a strong 4 percent gain, followed by the resilient BSE Telecom index at 3.8 percent. FMCG and Power sectors showed steady progress, each gaining 1.5 percent. Conversely, the BSE Oil & Gas index faced a 2 percent dip, and the BSE Information Technology index saw a 1 percent decline. This week’s sectoral performance highlighted the intricate balance of ascents and descents, offering investors a nuanced view of market dynamics. Stay tuned for ongoing insights into the sectoral ebb and flow.

Unlock the Power: Explore Our Features!

Strategy Builder

Tailor your options strategy based on market sentiment – bullish, bearish, or neutral, ensuring precision in every trade

Payoff Chart

Visualize potential profits and losses with an intuitive chart, empowering you to adjust and predict outcomes effortlessly.

Square of All Option

Streamline your trading process. With a single tap, square off all open positions, optimizing efficiency in managing your options portfolio.

Multiple Charts on Rocket Web

Elevate your trading experience by viewing spot and strike charts simultaneously, enabling quick decisions and seamless order execution.

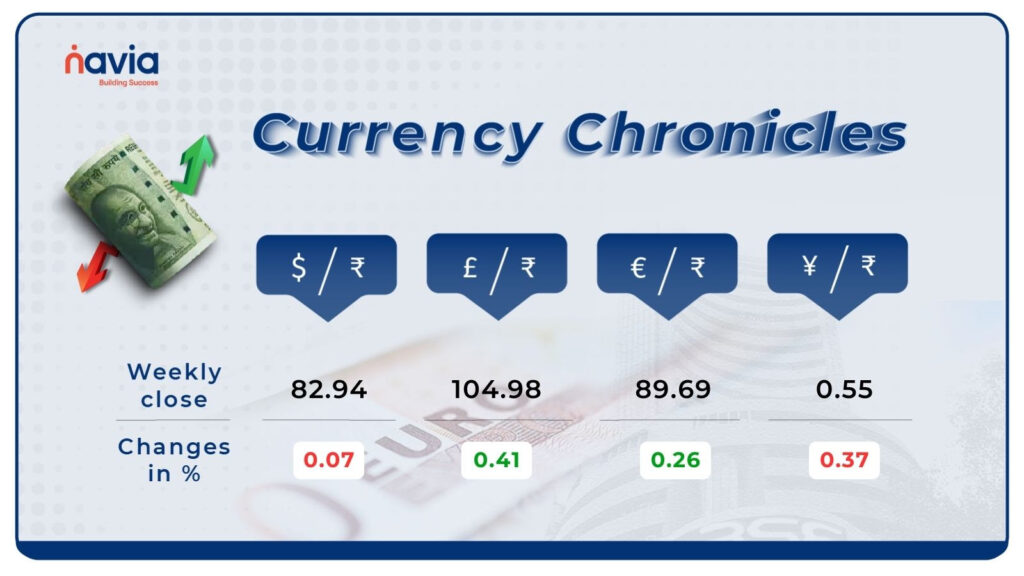

Currency Chronicles

EUR/USD:

The Euro initially reached a three-week high near $1.09 but retreated as the dollar regained strength, currently quoted at $1.0829. Despite a marginal daily decline, it marks a weekly gain of approximately 0.36%

USD/INR:

The Indian rupee consolidated within a narrow range, closing at 82.93 against the US dollar, influenced by the dollar’s strength and subdued domestic equities. The dollar index displayed renewed strength after a stable week.

JPY/INR:

The JPY/INR segment showed signs of an uptrend, reaching ₹0.551014 by the week’s end, reflecting a 0.37% increase. Bullish market sentiment favored the Japanese yen against the Indian rupee throughout the week.

Commodity Corner

Gold:

Despite a 0.13% weekly decline, gold maintains positive sentiment driven by a weakening dollar. Technical levels reveal Resistance 1 at 62,209 and Support 1 at 61,751.

Crude Oil:

Resilient above 6480 levels, crude oil showcases stability amid market fluctuations. Investors exercise caution, with technical indicators pointing to Resistance 1 at 6,605 and Support 1 at 6,447. Vigilance in monitoring technical and fundamental factors is key for informed decisions in the commodity sector.

Blog of the Week

Choosing between mutual funds and individual stocks is like mapping out routes to your financial destination. Read more for insights tailored to your investment journey.

Interactive Zone

Last week’s poll:

Q) Bombay stock exchange became the first stock exchange in india to launch commodity derivatives contract in gold and ____?

a) Diamond

b) Silver

c) Platinum

Last week’s poll answer: b) Silver

N Coins Rewards

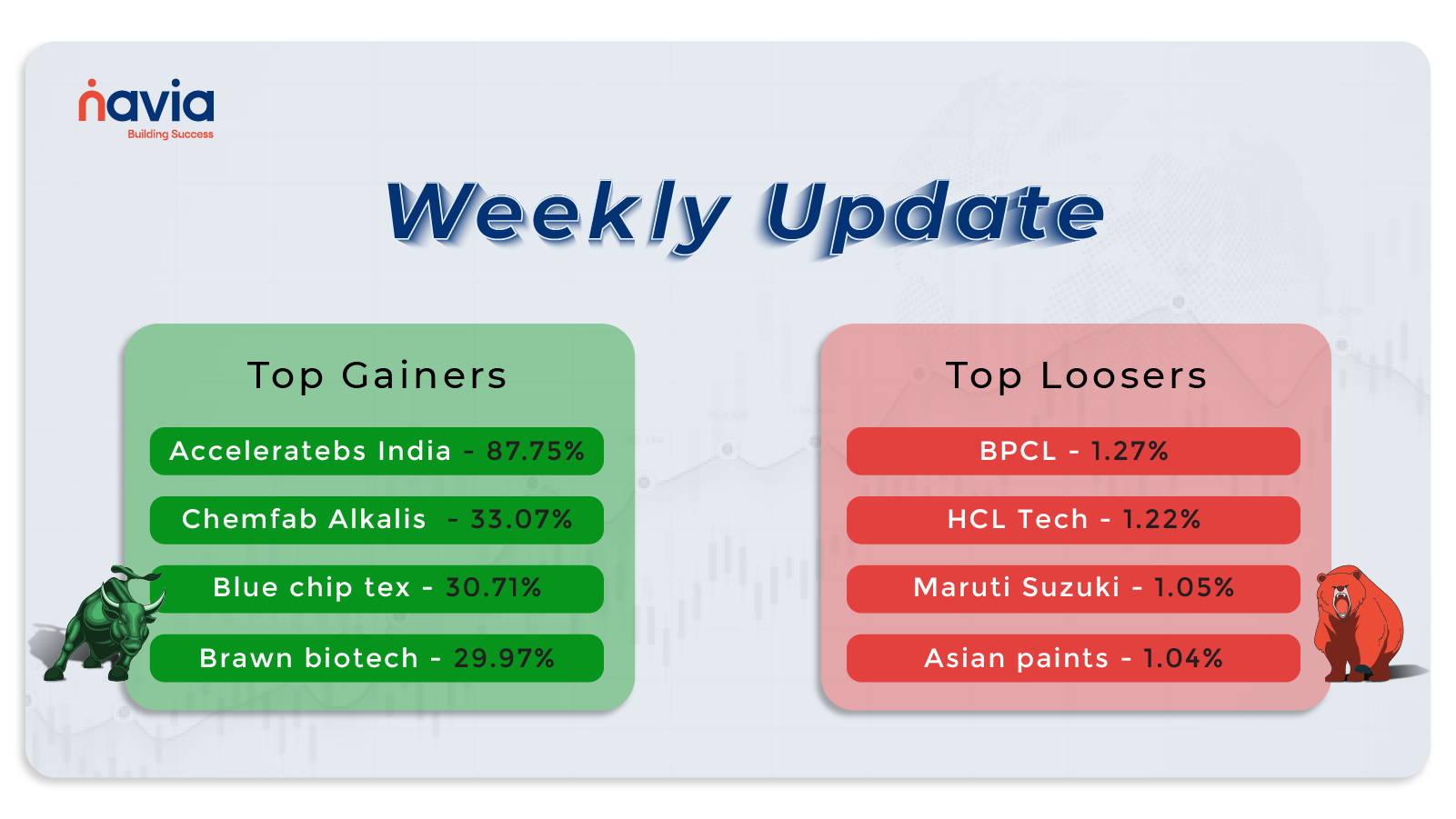

Top Gainers and Losers

Join Navia and trade like a pro!

Explore how our Navia and Rocket duo is working wonders for our client’s investment journey in the video below!

Refer your Friends & Family and GET 500 N Coins.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Do You Find This Interesting?

Happy Learning,

Team Navia