Investor’s Guide: Navigating Volatility in the Wake of Budget 2024

Introduction

As we approach Budget 2024, anticipation and speculation are rife in financial circles. The upcoming budget holds particular significance as it’s the last one before the general elections, adding an extra layer of complexity to an already dynamic economic landscape. In this comprehensive guide, we’ll delve into the intricacies of Budget 2024, with a keen focus on its potential impact on the stock market, trading, and investments.

Understanding the Buzz: Budget 2024 Overview

Scheduled for February 1, 2024, Budget 2024 is generating heightened interest among investors and market participants. The stock market, being a barometer of economic health, tends to respond vigorously to budgetary announcements. Traders and investors are closely monitoring various sectors for cues that could shape market trends in the aftermath of the budget.

Stock Market Dynamics: Pre-Budget Volatility

The Indian stock markets have experienced notable volatility leading up to Budget 2024. The BSE Sensex and Nifty50 have witnessed fluctuations, with market participants adopting a cautious stance. Analysts attribute this pre-budget volatility to uncertainties surrounding potential policy changes, fiscal measures, and the overall economic direction outlined by the government.

Strategic Safeguards Against Volatility:

🔸Caution on Trading Events: Experts underscore the need to steer clear of trading events, especially considering the elevated volatility in the market. Hedging positions or adopting strategies like the put ratio back spread is advisable.

🔸Expert Recommendation: Delve into iron butterflies, calendar spreads, or put ratio back spreads as your go-to safeguards against potential negative outcomes.

Investment Opportunities: Sectors in Focus

Budget 2024 is expected to shine a spotlight on specific sectors, presenting potential investment opportunities. Sectors such as railways, defense, infrastructure, renewable energy, manufacturing, and real estate are likely to be focal points. Investors keen on capitalizing on budget-induced trends should carefully evaluate the potential impacts on individual sectors.

Real estate, for instance, might see increased attention, especially with a potential focus on affordable housing. Banking and financial services could experience positive momentum if the budget outlines measures to stimulate credit growth and ease lending norms.

Taxation and Income Rules: What Investors Should Know

One of the critical aspects of Budget 2024 that investors are keenly watching is any potential changes in taxation and income rules. Speculations abound regarding a possible hike in standard deduction, basic exemption limit, and extended tax benefits to boost manufacturing. However, investors need to assess the impact on the fiscal deficit and the broader economic landscape.

Steer Clear of Over-Leveraged Positions

It is advisable for traders to avoid over-leveraged positions. Large-cap stocks are recommended for their resilience during volatile sessions. It is also suggested to enter the market during the last hour of trading to gain insights into the budget’s impact and to avoid being caught in uncertainties.

Historical Daily Returns Analysis

Nifty Performance Analysis

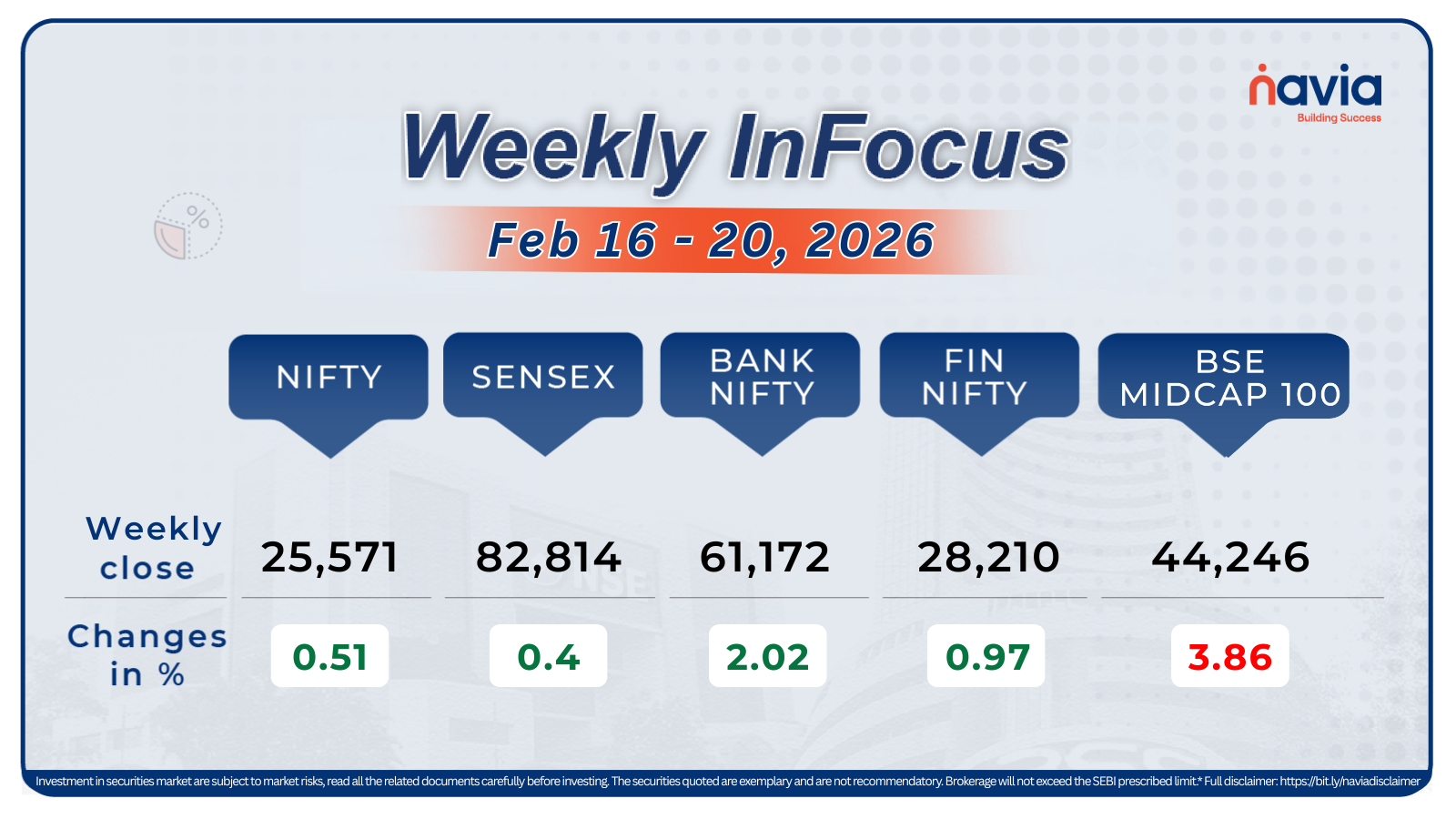

Examining data from 2010 to 2022 encompassing 15 Budgets (13 full and 2 interim), the average budget day returns for Nifty stand at 0.26%. Notably, Nifty tends to trade lower one week before the budget (-0.52%) due to prevailing fear and uncertainty. Post the budget, the market quickly discounts the event, resulting in an average return of 1.36% one week after the budget. The average trading range on the budget day is 2.65%.

Insights and Actions

The data highlights a consistent pattern: Nifty often trades lower in the lead-up to the budget, driven by apprehension. Traders, especially short-term options traders, are advised to seek opportunities on the long side post the budget. The market’s tendency to swiftly discount budget-related information implies potential gains for those adopting long positions after the event.

| Year | Budget Day Return (%) | One Week Before (%) | One Week After (%) |

| 2010 | 0.45 | -0.68 | 1.05 |

| 2011 | 0.33 | -0.46 | 0.44 |

| 2012 | 0.09 | -0.53 | 0.72 |

| 2013 | 0.08 | -0.80 | 0.39 |

| 2014 | 0.27 | -0.62 | 0.85 |

| 2015 | -0.51 | -1.06 | 0.99 |

| 2016 | -0.17 | -0.66 | 1.17 |

| 2017 | 0.11 | -0.35 | 0.58 |

| 2018 | 0.06 | -1.18 | 1.45 |

| 2019 | 0.40 | -0.68 | 0.92 |

| 2020 | -2.42 | -3.53 | 4.70 |

| 2021 | 0.87 | -0.66 | 0.37 |

| 2022 | 0.18 | -0.64 | 1.44 |

| Avg | 0.26 | -0.52 | 1.36 |

Historical Data Overview

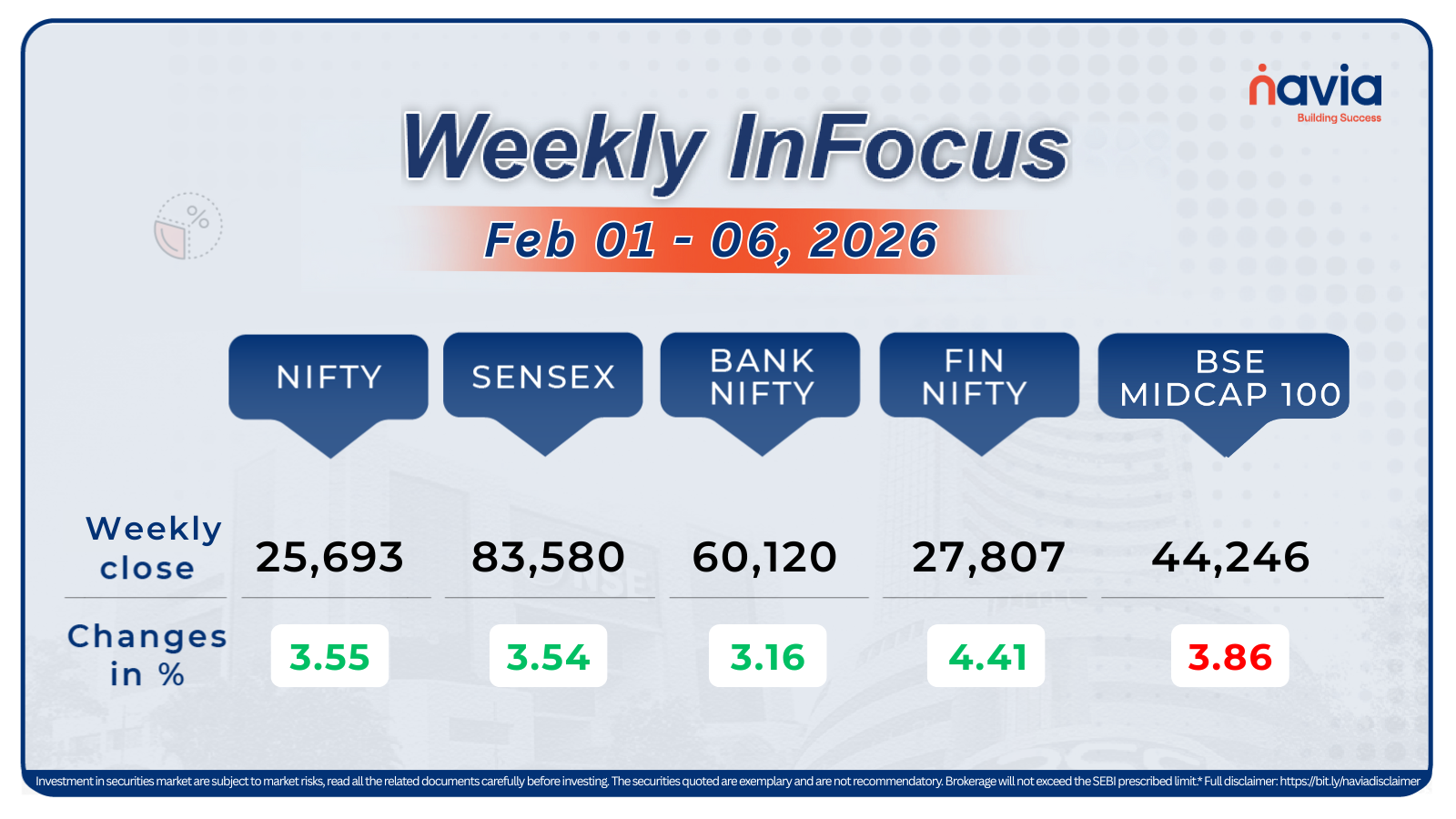

Bank Nifty exhibits a different dynamic, with an average budget day return of 0.60%. One week before the budget, Bank Nifty sees a marginal dip of -0.17%, while one week after witnesses an average return of 2.02%. The average trading range on the budget day is notably higher at 3.83%.

Insights and Actions

Bank Nifty displays higher gains compared to Nifty, closing positively in 11 out of the last 15 budgets. This trend signals an opportunity for traders to explore long positions. However, the heightened volatility in Bank Nifty suggests that option traders should opt for hedged long strategies, such as Bull Call Spread or Call Ratio Backspread. Implementing stop losses is crucial to mitigate risks in case of unfavorable movements.

| Year | Budget Day Return (%) | One Week Before (%) | One Week After (%) |

| 2010 | 0.55 | -0.15 | 1.79 |

| 2011 | 0.47 | -0.22 | 0.69 |

| 2012 | 0.73 | -0.15 | 1.76 |

| 2013 | 0.08 | -0.32 | 0.19 |

| 2014 | 0.37 | -0.51 | 2.11 |

| 2015 | 0.67 | -0.42 | 1.32 |

| 2016 | -2.69 | -3.19 | 5.33 |

| 2017 | 0.24 | -0.16 | 1.31 |

| 2018 | 0.37 | -1.04 | 2.11 |

| 2019 | 0.67 | -0.42 | 1.32 |

| 2020 | -2.69 | -3.19 | 5.33 |

| 2021 | 1.07 | -0.54 | 0.34 |

| 2022 | 0.32 | -0.17 | 1.85 |

| Avg | 0.60 | -0.17 | 2.02 |

India VIX Performance Analysis

Historical Data Overview

A surprising revelation emerges when examining India VIX, which measures the volatility of Nifty options. Contrary to expectations, India VIX has fallen on all 14 Budget sessions since 2011, with an average change of -9.02%.

Insights and Actions

The consistent decline in India VIX before and during budget sessions implies limited profits for traders employing long straddles or strangles. To capitalize on falling VIX, option traders are advised to consider adopting an intraday short straddle or short strangle strategy. As volatility recedes, a sharp fall in option prices may ensue, presenting an opportunity for traders.

| Year | India VIX Change |

| 2011 | -5.18 |

| 2012 | -12.43 |

| 2013 | -11.23 |

| 2014 | -2.32 |

| 2015 | -14.29 |

| 2016 | -7.89 |

| 2017 | -12.26 |

| 2018 | -5.74 |

| 2019 | -22.05 |

| 2020 | -44.48 |

| 2021 | -24.42 |

| 2022 | -10.32 |

Fiscal Deficit Target: Implications for Investors

The fiscal deficit target set by the government is a crucial metric with far-reaching implications for investors. As the government aims to narrow the fiscal deficit, investors should be prepared for potential policy shifts. Schemes directed towards the agricultural sector, if introduced, could impact the performance of agro-based industries and related stocks.

Crafting a Resilient Portfolio: A Guide for Investors

In the midst of budget-related uncertainties, crafting a resilient investment portfolio becomes paramount. Investors are advised to focus on the fundamentals of the companies in their portfolios, considering factors such as earnings growth, debt levels, and management quality. A diversified portfolio that spans different sectors can help cushion the impact of any adverse market movements.

The Road Ahead: Post-Budget Market Dynamics

While the market may experience short-term fluctuations in response to budgetary announcements, the road ahead post-Budget 2024 could be more stable. Investors are encouraged to adopt a long-term perspective, aligning their investments with their financial goals. Historical patterns suggest that post-budget reactions might not always align with pre-budget expectations, highlighting the importance of informed decision-making.

Conclusion

As we navigate the intricacies of Budget 2024, investors find themselves at a crucial juncture. The stock market, trading strategies, and investment opportunities are all intertwined with the government’s fiscal policies. By staying informed, adopting prudent trading strategies, and maintaining diversified portfolios, investors can position themselves to navigate the volatility and capitalize on opportunities that may arise in the wake of Budget 2024. The road ahead may hold challenges, but with strategic foresight, investors can chart a course towards financial resilience and success.

We’d Love to Hear from you-

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.