Investing in Indian PSUs: A Blend of Stability and Growth

In the vibrant landscape of Indian investments, Public Sector Undertakings (PSUs) stand as towering beacons of stability and potential growth. These entities, backed by the Government of India, play a pivotal role in the country’s economic backbone, spanning across various sectors such as banking, energy, and manufacturing. For investors, PSUs offer a unique blend of security and the promise of growth, making them an attractive option for a diversified investment portfolio.

The Stability Quotient

PSUs are known for their stability. Being government-owned, they often enjoy monopoly or near-monopoly statuses in their respective sectors. This not only ensures a steady revenue stream but also provides a buffer against market volatilities. Furthermore, PSUs are pivotal in implementing government policies, which translates into stronger government support, including financial backing during downturns. For investors, this means a safer investment avenue, often accompanied by regular dividend payouts.

Growth Prospects

While stability is a key highlight, the growth prospects of PSUs cannot be underestimated. With India’s economy on an upward trajectory, PSUs in sectors like renewable energy, defense, and infrastructure are poised for significant growth. Strategic disinvestment and government initiatives aimed at bolstering these sectors further enhance their growth potential. For savvy investors, this means an opportunity to be part of India’s growth story.

Dividend Yields

One of the compelling reasons to invest in PSUs is their dividend yield. Historically, many Indian PSUs have offered generous dividends, making them an attractive option for income-seeking investors. In a world where fixed deposit rates are dwindling, PSUs can offer a better yield on investment, along with the added advantage of capital appreciation.

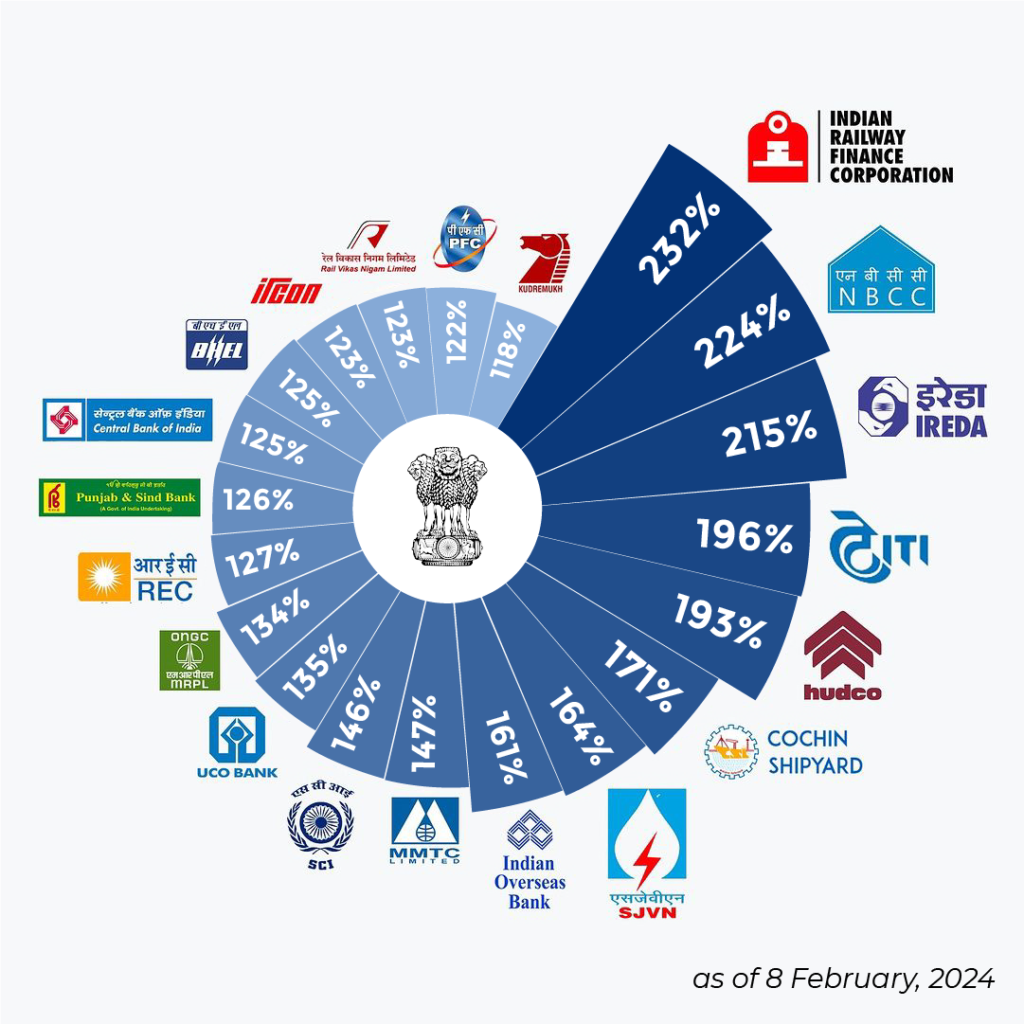

Top Performing PSU stocks:

ESG and Sustainability

Environmental, Social, and Governance (ESG) criteria are becoming increasingly important for investors. PSUs are often at the forefront of adopting sustainable practices, driven by government mandates to achieve various environmental and social objectives. Investing in PSUs can thus align with the growing trend of responsible investing, allowing investors to contribute to a sustainable future while seeking returns on their investment.

Sectoral Analysis

Maharatna, Navaratna, and Miniratna PSU Stocks: Pillars of India’s Economy

Public Sector Undertakings (PSUs) in India are categorized into Maharatna, Navaratna, and Miniratna based on their size, performance, and strategic importance to the nation’s economy. These classifications highlight the significance and contributions of these companies to various sectors and industries. Here’s an overview of Maharatna, Navaratna, and Miniratna PSU stocks in general:

The Power of Indian PSU stocks:

Maharatna PSUs:

🔸 Maharatna PSUs are the top-tier government-owned companies in India, recognized for their exceptional performance, extensive operations, and significant contributions to the economy.

🔸 These companies typically have a diverse portfolio spanning critical sectors such as energy, infrastructure, banking, manufacturing, and more.

🔸 Examples of Maharatna PSU stocks include Oil and Natural Gas Corporation (ONGC), Indian Oil Corporation (IOC), and State Bank of India (SBI).

Navaratna PSUs:

🔸 Navaratna PSUs are a notch below Maharatna PSUs and are also distinguished for their outstanding performance, strategic importance, and potential for growth.

🔸 These companies demonstrate excellence in their respective sectors and play a significant role in driving economic development and industrial growth.

🔸 Examples of Navaratna PSU stocks include Power Grid Corporation of India Limited (POWERGRID), Bharat Heavy Electricals Limited (BHEL), and Hindustan Aeronautics Limited (HAL).

Miniratna PSUs:

🔸 Miniratna PSUs are smaller in size compared to Maharatna and Navaratna PSUs but still play a crucial role in India’s economy and infrastructure development.

🔸 These companies are characterized by their agility, innovation, and potential for growth, despite their relatively smaller scale of operations.

🔸 Examples of Miniratna PSU stocks include Coal India Limited (CIL), National Aluminium Company Limited (NALCO), and Engineers India Limited (EIL).

These companies embody excellence, resilience, and innovation, driving India’s progress and prosperity on both domestic and international fronts.

Navigating the Challenges

Investing in PSUs also comes with its set of challenges. Bureaucratic inefficiencies and policy changes can impact performance. Hence, a thorough analysis and a keen eye on government policies become essential for investors. At Navia Markets, we leverage our expertise to guide our clients through these nuances, ensuring they make informed decisions that align with their investment goals.

Conclusion

Investing in Indian PSUs offers a balanced mix of stability, growth, and income generation, along with the opportunity to invest responsibly. As the Indian economy continues to grow, PSUs in strategic sectors are well-positioned to benefit, making them a worthwhile consideration for your investment portfolio.

At Navia Markets, we’re here to help you navigate this investment landscape, combining our deep market insights with a strategic approach to maximize your investment potential.

Invest wisely, and let’s grow together with the strength of Indian PSUs.

We’d Love to Hear from you

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.