Experts Attribute Indian Stock Market Decline to Two Reasons

Market Correction Unfolds: Understanding the Reasons Behind Today’s Indian Share Market Decline

In today’s trading session, the Indian stock market witnessed a continued downturn, extending the sell-off from the previous day. Key benchmark indices, including the Nifty 50, Sensex, and Nifty Bank, experienced notable intraday losses. Let’s delve into the reasons behind this market decline as explained by expert analyses.

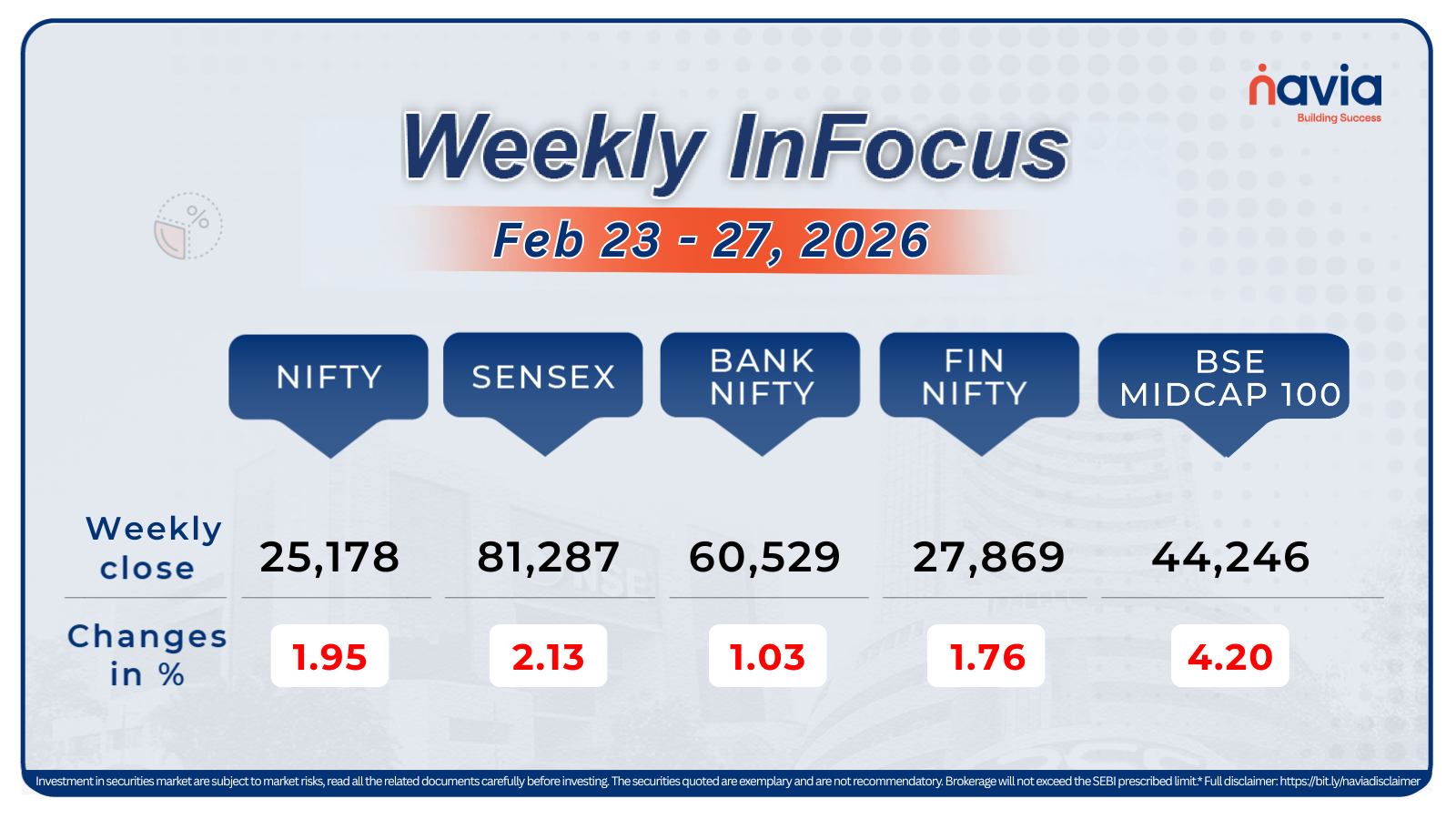

Overbought Market Conditions: Sandeep Pandey, Founder at Basav Capital, highlights the overbought condition of the Indian stock market. Over the last two months, the Nifty 50 index surged by nearly 3,000 points, BSE Sensex recorded a substantial gain of around 9,400 points, and Nifty Bank climbed approximately 6,350 points. This continuous upward trend created an overextended market scenario. Pandey suggests that the current correction, marked by an intraday loss of 186 points in Nifty 50, is a healthy adjustment. He attributes this correction to the overdue profit booking by both Domestic Institutional Investors (DIIs) and Foreign Institutional Investors (FIIs).

Anticipation of Q3FY24 Results Season: Saurabh Jain, Vice President — Research at SMC Global Securities, points to the upcoming Q3FY24 results season as another significant factor contributing to the market downturn. Jain notes that profit booking was overdue, given that FIIs and DIIs remained net buyers over the past two months. This correction aligns with historical trends, as the Indian market tends to rebalance ahead of the Q3 results season at the beginning of the new year. Jain emphasizes that the market is proactively preparing for the upcoming results season, making the observed profit-booking and rebalancing a natural and anticipated occurrence.

Conclusion:

In conclusion, the decline in the Indian stock market today can be attributed to a combination of factors, including an overbought market condition and the imminent Q3FY24 results season. Investors, both domestic and foreign, are strategically adjusting their positions through profit booking and portfolio rebalancing. Understanding these dynamics provides valuable insights into the current market correction and its alignment with broader market trends.

We’d Love to Hear from you-

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.