How US Inflation Impacts the World of Trading & Investing

In the interconnected web of global finance, the flutter of a butterfly’s wings can indeed cause a hurricane halfway across the world. Such is the case with US inflation—a seemingly domestic indicator that wields the power to sway international trading and investment decisions. As we delve into this phenomenon, we explore the mechanisms through which US inflation impacts global markets, offering strategic insights for traders and investors looking to navigate these turbulent waters.

The Ripple Effect of US Inflation

Exchange Rates and Competitiveness

When inflation rises in the US, it often leads to a depreciation of the dollar. This, in turn, affects global exchange rates, influencing the competitiveness of countries’ exports and imports. For international traders and investors, understanding these shifts is crucial for making informed decisions about currency trading and international investments.

Commodity Prices

The US dollar is the de facto global currency for commodity trading. An inflation surge can lead to higher commodity prices, affecting everything from oil to gold. Investors in these markets need to be vigilant, as US inflation indicators can signal shifts in commodity prices even before they happen.

Interest Rates and Monetary Policy

The Federal Reserve’s response to inflation—typically through adjusting interest rates—has profound implications worldwide. Higher interest rates can attract global capital to US assets, offering higher returns. However, this can also drain resources from emerging markets, making it imperative for investors to anticipate and react to these policy shifts.

Market Volatility

Inflation uncertainty can lead to increased volatility in global markets. For traders, especially those involved in short-term strategies, volatility can be both a risk and an opportunity. By analyzing how US inflation impacts market sentiments, traders can better position themselves in both equities and bonds.

Strategic Insights for Navigating Inflation-Induced Turbulence

Diversification: One of the most effective strategies against the uncertainties of inflation is diversification. By spreading investments across various asset classes and geographies, investors can mitigate risks associated with US inflation.

Hedge Against Inflation: Investors might consider assets traditionally seen as hedges against inflation, such as gold, real estate, or inflation-linked bonds. Such assets can provide a buffer during times of rising inflation.

Stay Informed and Agile: The landscape of trading and investing is ever-evolving, more so in the face of inflationary pressures. Staying informed about US economic indicators and being ready to pivot strategies accordingly can make a significant difference.

Leverage Technology: Modern trading platforms and analytical tools offer unprecedented insights and agility. Leveraging these technologies can provide traders and investors with the edge needed to navigate the complexities of inflation-impacted markets.

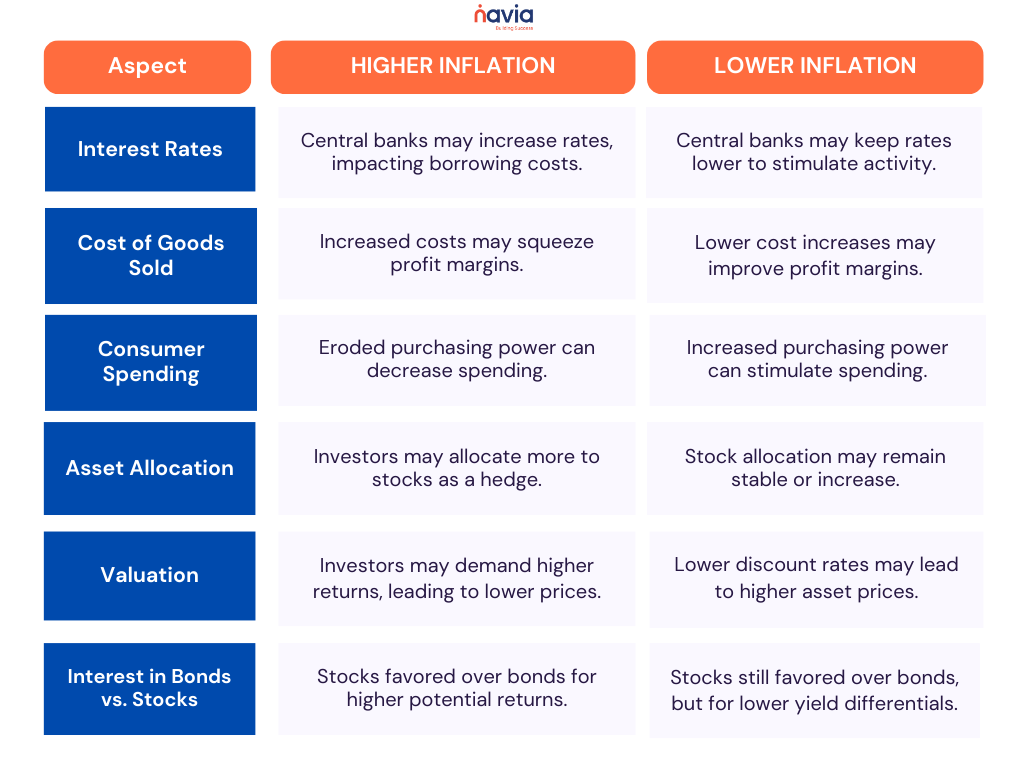

The Impact of Inflation on Stocks

To understand the impact of inflation on stocks, let’s differentiate the contrasting aspects of higher and lower inflation.

What happens to stocks when inflation goes up?

It’s not easy to figure out how stocks react when inflation rises. Each stock is different, so there’s no one-size-fits-all answer. To make smart decisions about investing or trading, you need to look closely at each stock.

Stocks to Watch When Inflation is High!

When inflation is high, certain kinds of stocks tend to do better than others. For example, “value” stocks often do well in the short term. These stocks are usually selling for less than they’re really worth, so they might hold up better during times of inflation.

What you do about higher inflation depends on how long you plan to keep your investments. If you’re in it for the long haul, you might stick with stocks that can raise prices over time to keep up with inflation. But if you’re more of a short-term trader, you might take advantage of the ups and downs in the stock market caused by inflation.

What happens to stocks when inflation goes down?

When inflation drops, interest rates usually go down too. People tend to spend more money in this situation, which is good for businesses. So, demand for stocks often goes up, and their prices rise.

Stocks that pay dividends might become more attractive when inflation is low. This is because even though the dividends might be small, they’ll be worth more in real terms when there’s less inflation. And stocks that are considered riskier might also become more popular, leading to higher prices.

Additionally, lower inflation can be favorable for stocks with lower, but reliable, dividend payouts. This is because lower inflation rates result in higher real interest earned per dividend payment. For instance, if the dividend yield is 5% and inflation is 3%, the real interest earned is 2%. However, if inflation drops to 1%, the real interest increases to 4%. Similarly, stocks with higher risk levels may also experience increased demand and higher prices during periods of lower inflation.

Conclusion

US inflation’s impact extends far beyond American borders, influencing global trading and investment strategies. By understanding these dynamics and adapting strategies accordingly, traders and investors can not only safeguard their assets but also uncover new opportunities in the evolving landscape of global finance.

In a world where change is the only constant, the ability to adapt and respond to the economic indicators of powerhouse economies like the US is invaluable. As we continue to witness the unfolding impact of US inflation, let us approach trading and investing with a keen eye, a strategic mind, and an adaptable strategy. Let’s embrace the journey of simplifying stock market participation and making it rewarding for everyone. Experience the ease of investing and trading with our user-friendly app, Visit Navia to kickstart your journey towards financial success. Happy investing!

Disclaimer: This blog is solely for educational purposes. The securities/investments quoted here are not recommendatory.

We’d Love to Hear from you-

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.