How to Read the Annual Report of a Company?

Whether you are a seasoned investor or just starting out in the world of stocks, understanding a company’s annual report is one of the smartest ways to make informed investment decisions. It will provide a comprehensive overview of the company’s financial health, growth strategy, and business outlook. And it is considered a company’s way of communicating with its shareholders and investors.

In this blog, we will break down how to read a company’s yearly report, that will help you to use it to evaluate investment opportunities smartly.

What is an Annual Report?

An annual report of a company is a formal document that is published publicly to disclose their financial performance, operational highlights and plans over the past fiscal year. The report aims to provide transparency and build trust from investors by summarizing both qualitative and quantitative aspects of the business.

Investors should always rely on official sources such as stock exchange filings or company websites to avoid misinformation. Being a retail investor, reading the annual report of a company is an essential part of analyzing a company before investing in it.

What are the Components of Annual Report?

Here you can see the major components commonly found in a company financial report.

| Components | Definition |

|---|---|

| Table of Contents | The table of contents is an essential part that will help readers to navigate the annual report easily. It has a quick view of the sections that are included in the report. |

| Business/Company Overview | The Business/Company Overview of an annual report provides a clear picture of what the company does and their future. It includes the history and core activities of the company with their mission and vision statements. |

| Chairman’s Letter | The chairman’s letter gives you an insight into the company’s plans and highlights significant milestones of past performance. It will give a deeper understanding about the company’s strategic direction from a leadership perspective. |

| Board of Directors | It has the people’s details they are supporting the company to make top-level decisions. The information includes their backgrounds and other critical factors that have contributed to the company’s past successes and may influence its future achievements. |

| Management, Discussion and Analysis (MD&A) | This section offers insights into the company’s operations, strategies, and challenges faced during the year. This analysis is necessary to understand the company’s management of both business and financial performance for the particular year. |

| Corporate Governance Report | It describes how the company complies with governance standards and board structure. The report includes the company’s governance practices, policies and compliance, so they are aiming to showcase their commitment to ethical practices through this report. |

| Financial Statement | Financial statements include various reports like; Balance Sheet: It shows the company’s assets, liability, and equity that maintain its financial health. Income Statement: It includes the expenses, revenues, and profits of the company that will easily show its annual performance. Cash Flow Statement: It has the information about the use of cash for company needs that is necessary to understand their financial stability. Statement to Shareholders: It’s like a summary of the financial performance of the company that includes dividends or other major financial decisions. |

| Auditor’s Report | It includes the unbiased opinion of the auditor about the financial statement of the company. That’s why it is considered a crucial insight into the company’s financial practices and transparency. |

| Notes to Account | By analyzing it we can get an idea of how the company records their financial activities, that includes the management of assets, and how it reports on different parts of their business. |

| Other Information | It has disclaimers, additional details, and predictions of the company that we can’t add to other sections. The information will be presented through visual elements like infographics and photographs to make the section more engaging. |

What to Look for in the Annual Report of any Company?

An annual report has many sections that include critical information about the company. If you are looking to an annual report, you must focus on some major sections that are given below;

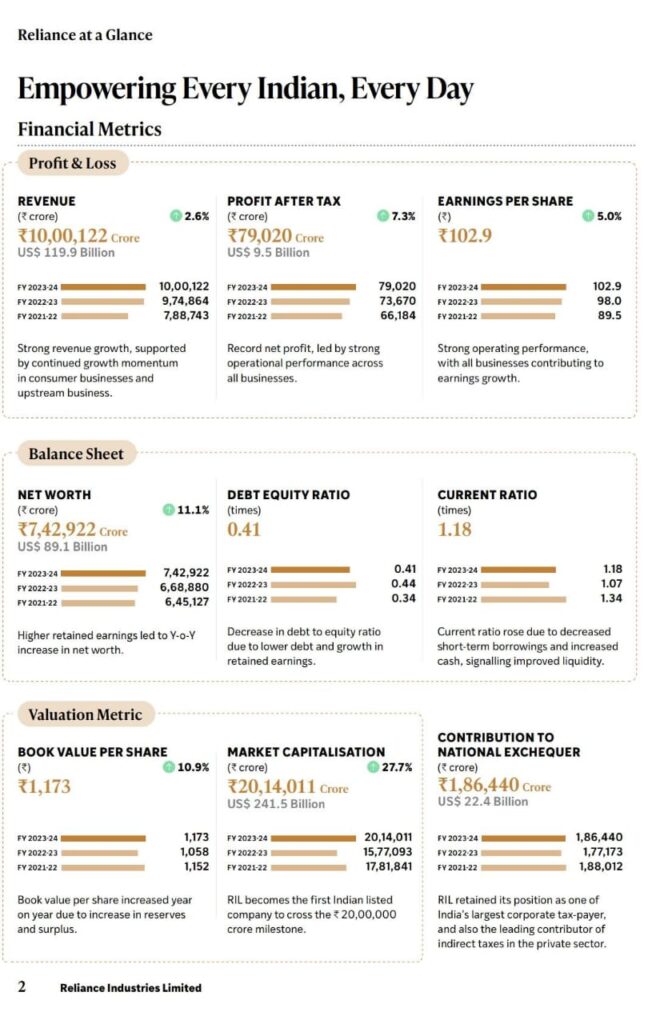

Revenue and Profit Growth

Check if the company has shown consistent growth in revenue and net profits over the years. It is very important to understand the company’s growth.

Debt Levels

You can check the debt-to-equity ratio that will help you to understand how much debt the company has compared to their assets. And also check how they manage their liabilities.

Cash Flow

If the company gets positive cash flow from operations, it is a healthy sign. Be wary if most cash are coming from financial activities.

Margins

Study about operating margin and net profit margin that will evaluate how efficiently the company is managing their costs.

Future

The MD&A (Management, Discussion and Analysis) section will deliver how the company plans to deal with market challenges and leverage new opportunities.

Example – Annual Report of Reliance

Let’s take the annual report of Reliance Industries as an example to understand the structure of the document.

Reliance’s company yearly report always begins with table of contents and financial metrics that highlights the milestones of their business.

Source: Reliance Industries Limited

Conclusion

Reading a company’s annual report is a valuable tool for making smarter investing decisions, but without the right focus you can’t achieve it. If you are interested in understanding company financial statements, evaluating risks, and spotting growth opportunities, annual reports are the best resource for you.

By developing this habit, you can gain the power to go beyond stock tips and make better investment decisions that will lead you to success. To achieve that, Navia provides tools that help you access company reports and analyze data more efficiently.

Do You Find This Interesting?

Frequently Asked Questions

How annual reports are important for traders and investors?

Annual reports help traders and investors to analyze the fundamental strength of a company, and they provide data on earnings, debt, cash flow, and management’s strategic direction.

How to read an annual income statement?

Look at the top line (revenue), operating income, and bottom line (net profit). Compare year-over-year figures and examine margins to evaluate profitability.

What are the main sections of an annual report?

The major sections include the Chairman’s letter, MD&A, financial statements, auditor’s report and notes to accounts.

How can I understand a company’s health or growth from the company’s annual report?

Analyze revenue growth, net profit trends, debt levels, free cash flows, and management commentary on future.

How often should I review the annual reports of a company?

You should review the company’s yearly report at least once a year, ideally soon after it is published, to stay informed about any fundamental changes.

DISCLAIMER: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.