Hedging Wisdom: A Tale of Two Traders Battling the Storm

Risk vs. Caution: A Trader’s Debate

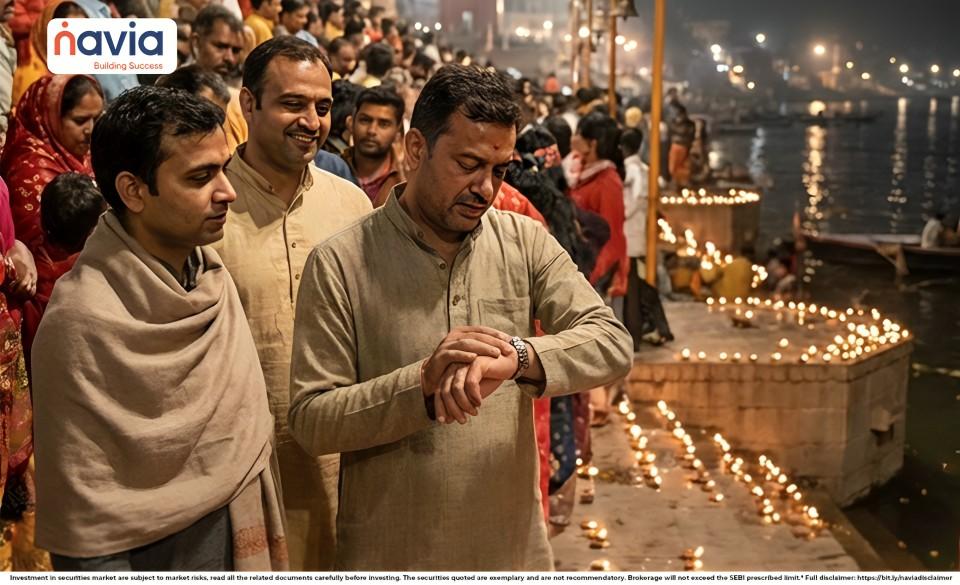

In the serene ambiance of a traditional Tamil church, Christopher and Xavier, two traders from Chennai, found themselves engaged in a spirited discussion during a brief break in a prayer meet. Christopher, known for his daring trades and aggressive strategies, couldn’t resist teasing Xavier about his cautious approach to investing.

“You’re so boring, Xavier,” Christopher laughed, “Always hedging your bets. Where’s the fun in that?”

Xavier, unfazed, took a sip of his water and replied, “It’s called risk management, Christopher. You can’t always win, and when you do lose, it’s better to lose a little than a lot.”

Christopher scoffed, “I’d rather live on the edge than play it safe.”

Just as they were about to delve deeper into their debate, their phones buzzed with breaking news: a major geopolitical event had occurred, sending shockwaves through the market. The indices plummeted, and panic ensued.

Christopher watched in horror as his portfolio dwindled. He had been heavily invested in a sector that was particularly vulnerable to the crisis. Xavier, however, remained calm. He had hedged his positions using options contracts, which had now become profitable.

The Power of Hedging

As the prayer meet resumed, Christopher approached Xavier. “I guess you were right,” he admitted. “Hedging isn’t so bad after all.”

Xavier smiled. “It’s about balance, Christopher. Taking calculated risks while protecting yourself from the unexpected. It’s like wearing a seatbelt while driving fast – you still enjoy the thrill, but you’re prepared for the worst.”

“So, what exactly is hedging?” Christopher asked, intrigued.

“Hedging is a risk management strategy used to minimize potential losses from adverse market movements,” Xavier explained. “It involves taking a position in a financial instrument that offsets the risk of another position. Think of it as buying insurance for your investments.”

Understanding Hedging Tools

Christopher nodded. “That makes sense. But are there any examples of it ?”

“There are several types of hedges, each with its own advantages and risks,” Xavier continued. “For example, forward contracts are agreements to buy or sell an asset at a predetermined price on a future date. Futures contracts are similar, but standardized and traded on exchanges. Options give the buyer the right, but not the obligation, to buy or sell an asset at a specified price. And swaps are agreements to exchange cash flows based on different underlying assets.”

“Wow, that’s a lot to take in,” Christopher said. “What are the benefits of hedging?”

“Hedging can reduce risk, increase liquidity, enhance returns, and provide peace of mind,” Xavier replied. “However, it’s important to remember that hedging can also be expensive, ineffective, complex, and limit your potential for gains.”

Christopher thought about it for a moment. “I see. So, it’s not a one-size-fits-all solution.”

“Exactly,” Xavier agreed. “The best approach depends on your individual circumstances and risk tolerance. But one thing is for sure: hedging can be a valuable tool for investors who want to protect their investments from market volatility.”

As Christopher and Xavier wrapped up their conversation, Christopher couldn’t help but reflect on Xavier’s approach. “You know, hedging is starting to make a lot of sense to me now,” he admitted. “But there’s still one thing I keep worrying about—those trading fees! With all this hedging and risk management, it feels like my profits just keep getting chipped away.”

Xavier grinned, “Well, if you want to keep more of your profits, you should consider trading with zero brokerage.”

Zero Brokerage: Keeping More of Your Profits

Christopher raised an eyebrow. “Zero brokerage? What’s the catch?”

Xavier chuckled. “No catch, my friend. With Navia’s Zero Brokerage, you’re not just hedging your risks, you’re increasing your profitability. Think about it—when you’re not paying brokerage fees, more of your profits stay in your pocket. It’s perfect for traders like you, who thrive on active trading. You can execute more trades without worrying about fees eating into your gains.”

Christopher’s interest piqued. “That does sound like a game-changer.”

“It absolutely is,” Xavier continued. “Not only does it encourage you to be more active in the market, but it also simplifies cost management. No more calculating extra trading costs or figuring out your net returns after fees. Plus, it’s especially great for beginners. Zero brokerage lets them experiment and learn without the stress of accumulating high costs.”

Trading Smarter, Not Harder

As they both stood up to leave, Xavier patted Christopher on the back with a knowing smile. “Exactly. It’s about finding the right balance—protecting yourself from the unexpected while still making the most of every opportunity. Looks like you’re finally stepping into the world of smart trading, Christopher.”

Christopher nodded, feeling a sense of clarity. “I guess it’s time to trade smarter, not just harder.”

As they left the church together, Christopher realized that success in trading, much like life, wasn’t just about taking risks—it was about managing them wisely. With Xavier’s advice and Navia’s zero brokerage, he felt ready to embrace this new approach, balancing risk with reward and making the most of every trade.

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.

We’d Love to Hear from you-