From Rusty Bike to Smart Investor: Diya’s Journey with PEG

Diya was flipping through the newspaper, bored out of her mind. Stock prices, interest rates – it all looked like gibberish. “Why can’t investing be more like, I don’t know, buying a cool bike at a garage sale?” she sighed.

Suddenly, a headline caught her eye: “Local Bike Shop Announces Huge Growth Plans!” Her mind raced. The beat-up Hercules in her garage could be her ticket to a summer of cycling adventures. But was it worth fixing up? Just then, her grandpa, a retired investor, walked in, noticing her frown. “Garage sale troubles?” he chuckled, taking a seat. Diya explained her dilemma, wishing there was a way to know if the bike was a good investment. Intrigued, her grandpa smiled. “Well, Diya,” he began, “let me tell you a story about a magic formula that can help you value anything, even a rusty old bike…”

Diya’s eyes widened. “A magic formula for bikes? Really?” she asked, scooting closer.

Her grandpa chuckled. “Not exactly magic,” he corrected, “but a clever way to think about value. Imagine that Hercules in your garage is like a company you’re thinking of investing in.”

Diya’s brows furrowed. “A bike company? But it’s just one bike.”

“Exactly,” her grandpa said. “The ‘company’ is the bike, and its ‘value’ depends on two things: how much fun you’ll get out of it (its earnings) and how much that fun might grow (its growth potential).”

“Earnings?” Diya repeated, picturing herself riding the bike along scenic trails. “That makes sense. But growth?”

“That’s where the magic comes in,” her grandpa winked. “Think about how much more enjoyment you might get from that bike in the future. Maybe you’ll join a cycling group, explore new trails, or even participate in races. That potential for increased fun is the bike’s growth.”

Diya nodded, a smile creeping across her face. “So, the more fun I think I’ll have, and the more that fun could grow, the more valuable the bike becomes?”

“Absolutely,” her grandpa said. “But there’s one more piece to the puzzle: the price. Just like you wouldn’t pay an outrageous amount for a rusty bike, investors wouldn’t pay a crazy high price for a stock with low growth potential, no matter how profitable the company is right now.”

“That’s where the magic formula comes in, right?” Diya prompted, leaning forward.

Her grandpa grinned. “Right you are! This formula is called PEG, which stands for Price/Earnings to Growth. It basically takes the price of the bike (how much you have to pay to fix it) and divides it by the potential for increased fun (the bike’s growth). A low PEG score means you’re getting a good deal – the price is low compared to how much fun you’ll get and how much that fun might grow.”

Diya’s eyes sparkled. “So, a low PEG for my bike means it’s worth fixing up because the cost of repairs is low compared to all the fun adventures I could have on it?”

“Exactly!” her grandpa exclaimed, raising a fist. “PEG helps you see the bigger picture, just like with stocks. It’s not just about the current value, but also the potential for that value to grow.”

Diya couldn’t wait to grab her toolbox and assess her rusty Hercules through the lens of PEG. With a newfound understanding of value and potential, that dusty bike in the garage suddenly seemed like a gateway to endless summer adventures.

Just like Diya figuring out if her bike was a good investment, investors use a concept called PEG to value companies. Here’s the breakdown:

⮞ PE Ratio (Price to Earnings): This is like looking at the price of Diya’s bike (how much to fix it) compared to how much fun it provides now (company’s current earnings). A low PE might seem good, but it doesn’t tell the whole story.

⮞ Growth: This is where PEG comes in! It considers how much fun Diya might get in the future (company’s expected growth). Maybe she joins a cycling group (increased earnings!).

⮞ PEG Ratio (PE / Growth): This is the magic formula. It takes the price of the bike (PE) and divides it by the potential for increased fun (growth). A low PEG suggests a good deal – the price is low compared to the potential for future fun (company’s future earnings growth).

Why is PEG better than PE?

PE is like a snapshot – it only considers current earnings. But companies grow (or shrink!). PEG is like a movie trailer – it shows the current picture (PE) and adds a glimpse of the exciting future (growth). So, PEG gives a more complete picture of a company’s potential value.

Diya was hooked on PEG. She could see how it helped value a company, but how did she figure out a company’s growth potential? Her grandpa chuckled, “There are detective skills involved, Diya. We look at a company’s ‘fundamentals’ to guess its future.”

Fundamentals: The Company’s Crystal Ball

Imagine a company’s financials like a treasure map. The “fundamentals” are the hidden clues that tell you where the buried treasure (future growth) might be. Here’s how to dig for them:

🔸 Revenue Growth: See how much money the company has been making over time. Is it increasing steadily? A steadily rising revenue suggests the company might be on an upward growth path.

🔸 Profit Margins: This shows how much profit the company makes on every dollar of revenue. A healthy profit margin indicates efficient operations and potential for future growth through reinvestment.

🔸 Debt Levels: Too much debt can slow down a company. Look for companies with manageable debt levels, freeing up resources for growth initiatives.

🔸 Market Trends: Is the company operating in a growing industry? A strong tailwind from the market can propel the company forward.

🔸 Management Team: A company is only as good as the people who run it. A track record of success and a clear vision for the future are good signs for growth potential.

Remember: These are just some clues. Financial reports, news articles, and industry analysis can all be helpful tools for piecing together the growth story.

Diya grabbed her notebook, ready to become a financial detective. “So, by looking at these fundamentals, I can get a sense of how much fun a company might bring investors in the future, right?”

“Exactly, Diya!” her grandpa beamed. “PEG considers both the current ‘earnings’ (company’s profit) and the potential for increased ‘fun’ (future growth) – making it a powerful tool to assess a company’s true value.”

Remember: Just like Diya’s bike adventure, PEG helps investors see if a company’s stock price reflects not just its current earnings, but also its exciting possibilities for future growth!

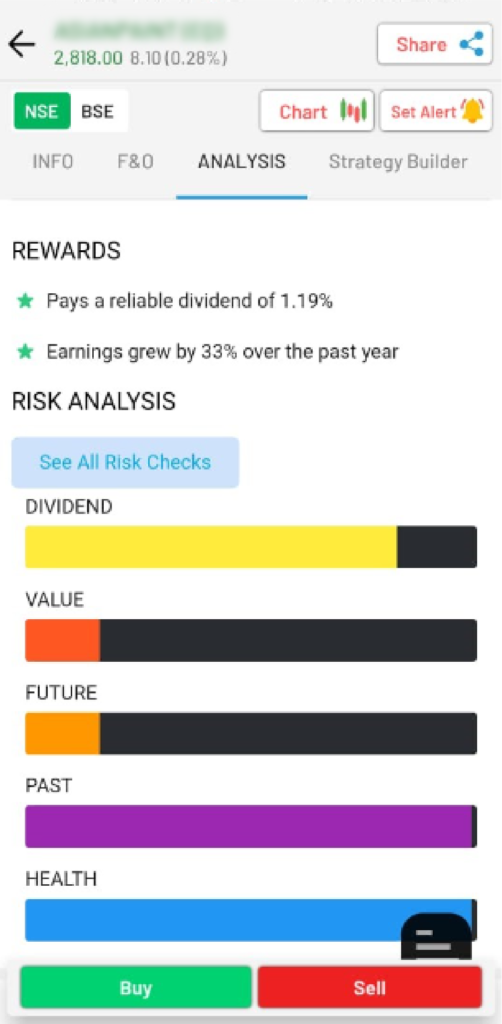

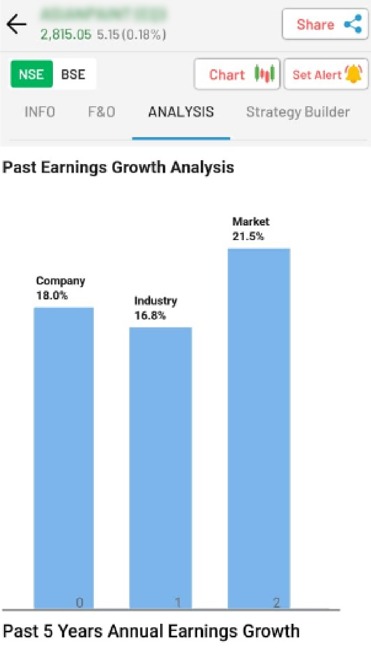

How to Get all this info in the Navia App ?

Step 1: Open the Navia App on your device.

Step 2: Navigate to the “Watchlist” section within the app.

Step 3: Locate the stock of interest and click on the “i” (information) icon adjacent to it.

Step 4: Explore the comprehensive information available for the selected stock.

Step 5: Proceed to the “Analysis” section within the stock details.

Step 6: Within the “Analysis” section, you will find the following past earning growth analyses:

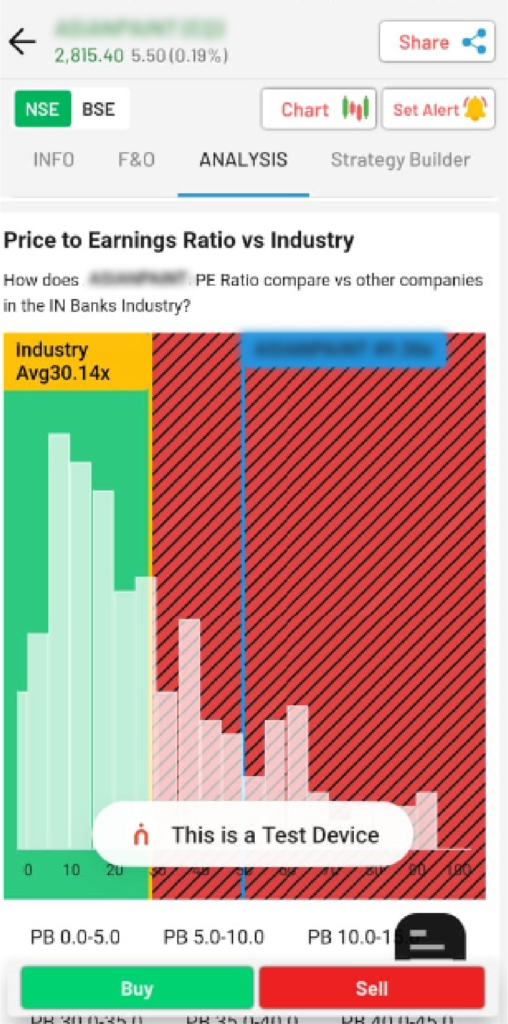

🔹 Price to Earnings Ratio (P/E) compared to the industry average.

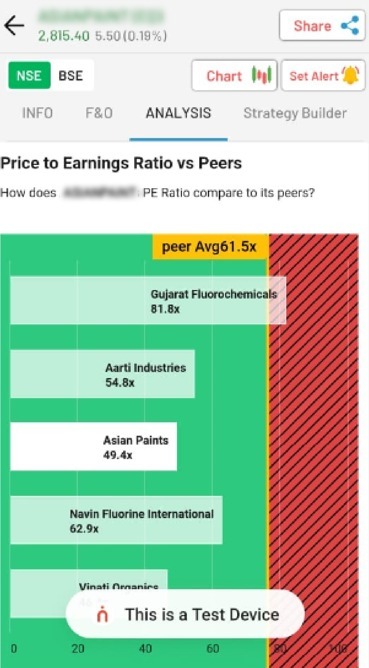

🔹 Price to Earnings Ratio (P/E) compared to peers in the same industry.

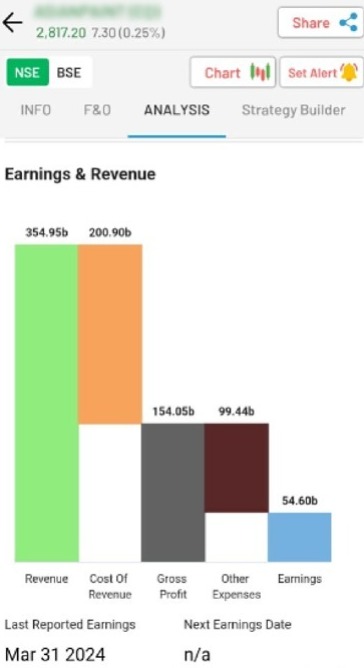

🔹 Historical trends in earnings and revenue.

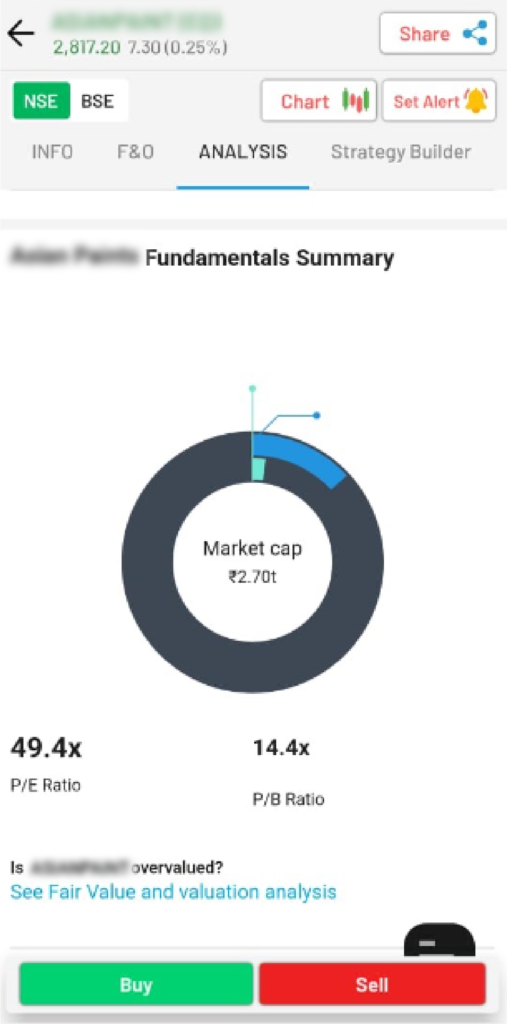

🔹 A summary of fundamental indicators.

We’d Love to Hear from you –