The Four Pillars of Wealth: Redefining Success

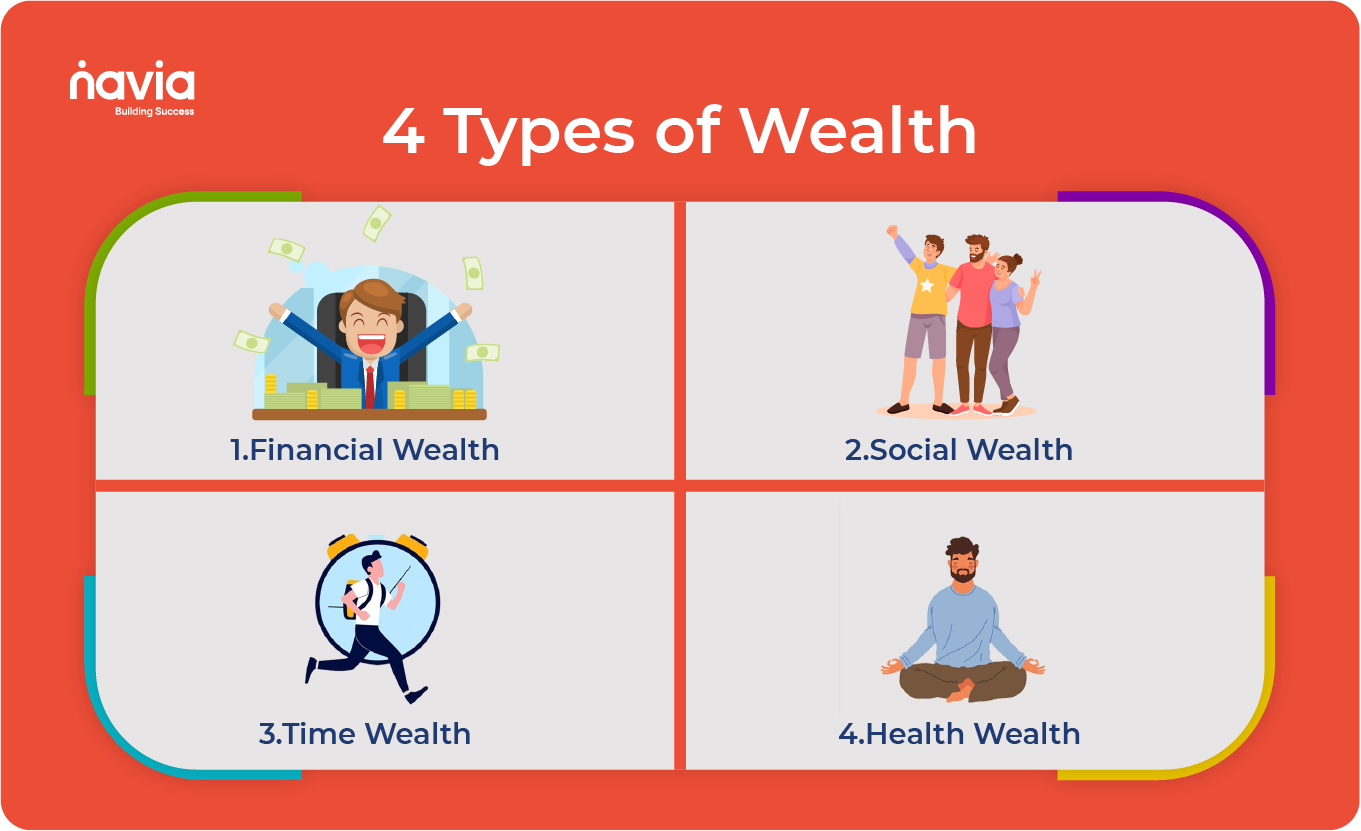

When we hear the word “wealth,” most of us immediately think of financial prosperity – money in the bank, investments, or material possessions. But what if wealth was more than just money? What if true wealth included time, social connections, and your health as well? In today’s world, redefining wealth to encompass multiple dimensions is crucial for leading a more fulfilling and balanced life.

Let’s dive into the four types of wealth: Financial Wealth, Social Wealth, Time Wealth, and Health Wealth, and explore why each is essential to your overall success and well-being.

1. Financial Wealth: The Classic Measure of Success

Financial wealth is the type of wealth that most people think of first. It’s the money you’ve accumulated through your career, investments, and assets. Having financial stability allows you to meet basic needs, pursue experiences, and invest in your future.

Why Financial Wealth Matters

🔷 Security: It provides the peace of mind that comes with knowing you can meet your basic needs, both now and in the future.

🔷 Opportunities: Having money enables you to take risks, like starting a new business or investing in personal development.

🔷 Freedom: Financial wealth gives you the freedom to make choices – whether it’s to retire early, pursue a passion, or support loved ones.

Building Financial Wealth:

Save more than you spend: Budgeting and mindful spending are the first steps to growing financial wealth.

Invest wisely: Diversified investments, including stocks, bonds, and real estate, can grow your wealth over time.

Plan for emergencies: Having an emergency fund ensures that unexpected life events don’t derail your financial security.

➝ How Navia Helps You Build Financial Wealth

At Navia Markets, we make financial growth accessible for everyone. Whether you’re exploring the stock market, ETFs like Goldbees and Pharmabees, or leveraging our Margin Trading Facility (MTF), we’ve got tools and products that can help you expand your wealth. With our zero brokerage model, you keep more of what you earn while investing across multiple segments.

Additionally, with Navia’s nCoins program, you can earn rewards for your trades and redeem them to further enhance your financial journey by waiving off interest or charges. Our app-first approach makes it easy to track and grow your wealth, with an intuitive experience designed to make investing straightforward and rewarding.

2. Social Wealth: The Power of Relationships

While money can provide comfort, it’s relationships that often provide true happiness. Social wealth refers to the connections we cultivate – with family, friends, and communities. These relationships support us in times of need and provide a sense of belonging.

Why Social Wealth Matters:

🔷 Mental Health: Strong social ties are closely linked to lower rates of depression and anxiety.

🔷 Support Systems: Close relationships help you navigate life’s challenges – whether it’s personal or professional.

🔷 Belonging: Humans are wired for connection. A rich social network can give you a sense of purpose and community.

Building Social Wealth:

Stay connected: Regularly check in with friends and family. Deep, meaningful relationships take effort.

Join communities: Whether through work, hobbies, or volunteering, being part of a group can foster new friendships and networks.

Digital detox: Spending device-free time with loved ones deepens bonds.

➝ How Navia Helps You Build Social Wealth

Beyond financial transactions, Navia fosters a sense of community with initiatives like the Navia Torchbearers Club (NTC). NTC is more than just a rewards club – it’s a way for investors to connect, share insights, and grow together in their financial journeys. By joining, you also gain access to exclusive webinars and discussions that help you build both financial and social wealth through shared knowledge.

3. Time Wealth: The Most Precious Resource

If there’s one thing money can’t buy, it’s time. Time wealth is about the freedom to control how you spend your hours – whether it’s pursuing your passions, spending time with loved ones, or simply enjoying life.

Why Time Wealth Matters:

🔷 Finite Resource: Time is the one resource you can’t replenish. How you spend it determines your quality of life.

🔷 Life Satisfaction: Having control over your schedule leads to greater happiness and life satisfaction.

🔷 Balance: Those with time wealth have the flexibility to balance work, family, and leisure.

Building Time Wealth:

Delegate: Spend financial wealth to gain time wealth. Whether it’s outsourcing tasks or automating routines, every bit helps.

Set boundaries: Saying “no” to non-essential commitments frees up time for what truly matters.

Flexible work: Opt for roles that offer time flexibility. This allows you to spend time on other important aspects of life.

➝ How Navia Helps You Build Time Wealth

Managing your investments should never be a time-consuming process. With the Navia app, you can invest, track your portfolio, and manage your trades all in one place, saving you hours of manual work. Our push notifications, daily updates, and user-friendly interface keep you informed without overwhelming your schedule. Now, you can focus on what truly matters, while letting Navia handle your investment needs.

4. Health Wealth: The Foundation of It All

No matter how much money, time, or social wealth you accumulate, without your health, it’s hard to enjoy any of it. Health wealth is about prioritizing your physical and mental well-being. It’s the pillar that supports all others.

Why Health Wealth Matters:

🔷 Foundation for Everything: You can’t enjoy time or financial wealth if your health is compromised.

🔷 Prevention: Ignoring your health leads to costly and painful consequences in the long run.

🔷 Productivity: When you’re in good health, you’re more productive, energetic, and able to tackle your goals.

Building Health Wealth:

Exercise regularly: Physical activity is key to maintaining both mental and physical health.

Sleep well: Getting 7+ hours of quality sleep each night is crucial for energy and mental clarity.

Eat mindfully: A balanced diet nourishes your body and fuels you for the day.

Mental health practices: Incorporate mindfulness, gratitude, and meditation into your routine to maintain mental well-being.

➝ How Navia Helps You Maintain Health Wealth

Financial stress can take a toll on your mental and physical health. By offering seamless, low-stress investing solutions, Navia helps alleviate the burden of managing your finances. With our innovative tools and personalized services, you can invest with confidence, knowing that your financial health is in good hands, which frees up more mental bandwidth to focus on your well-being.

Balancing All Four Types of Wealth

In an ideal world, we would all be rich in every type of wealth, but the reality is that most of us are stronger in one or two areas. The key to leading a fulfilling life is balance. By paying attention to these four types of wealth and actively investing in each, you can create a well-rounded and satisfying life.

At Navia, we understand the importance of balancing these aspects. That’s why we’re committed to making your financial journey smoother, more rewarding, and less time-consuming, so you can invest more in your relationships, health, and time freedom.

Ask yourself: What kind of wealth am I prioritizing? Are you too focused on financial wealth at the expense of your relationships or health? Are you neglecting time freedom to chase career goals?

Start making small changes today to nurture these four pillars of wealth, and you’ll find yourself living a richer, more balanced life.

Which type of wealth are you focusing on right now? Share your thoughts here!

We’d Love to Hear from you-

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.