Fedfina IPO: A Golden Opportunity in the Financial Horizon

Introduction

In the exciting world of money matters, there’s a chance for people to join in on the success of growing companies. One such opportunity is the Fedfina IPO, where Fedbank Financial Services Limited, a subsidiary of The Federal Bank Limited, is offering its shares to the public for the first time. Let’s take a closer look at what the Fedfina IPO is all about, get to know the company better, and see why it could be a good opportunity to invest your money.

Company overview:

Fedbank Financial Services, a company that helps people with their money. They focus on lending to small businesses and individuals who work for themselves. In 2023, they had one of the lowest costs for borrowing money in India. They offer different kinds of financial help, like Gold Loans, Home Loans, Loans Against Property, and Business Loans. Their main customers are small businesses and people who are just starting to work for themselves such as entrepreneurs.

PAN India Presence

As of March 31, 2023, Fedbank Financial Services is present in many places all over India. They have 575 branches in 191 districts across 16 states and union territories. Most of their offices are in the Southern and Western parts of India, like Andhra Pradesh (including Telangana) and Rajasthan. They’ve got a strong presence in these areas.

IPO Details

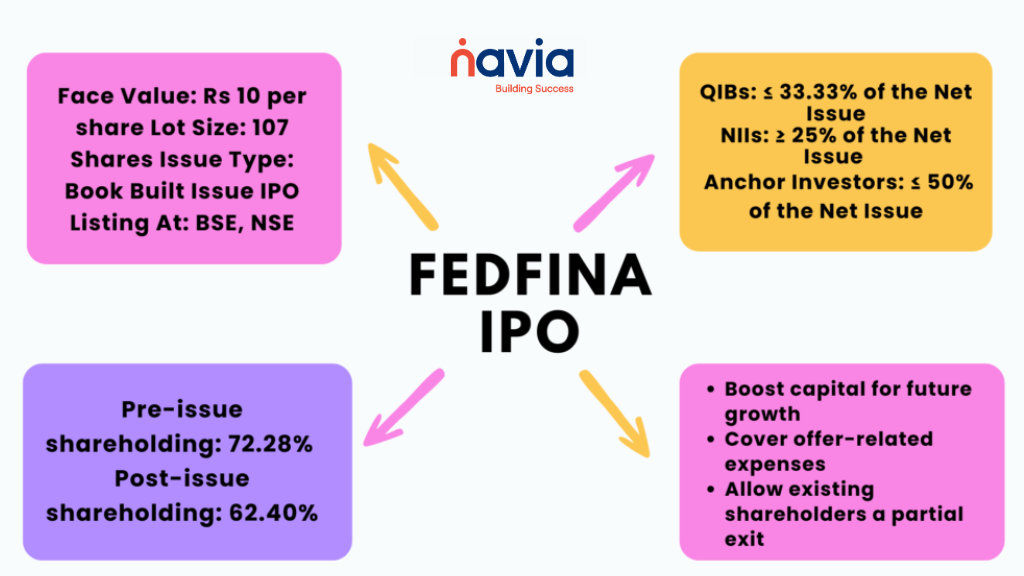

Fedbank Financial Services will sell some of its shares from November 22, 2023to November 24, 2023. People can buy these shares for ₹133 to ₹140 each. In total, they’re selling 78,073,810 shares, worth ₹1,092.26 Crores. Some are new shares (42,912,087 worth ₹600.77 Crores), and others are being sold by current owners (35,161,723 worth ₹492.26 Crores). If you work for the company, you get a ₹10 discount on each share.

Listing Details

After the Fedfina IPO, Fedbank Financial Services will be available for trading on both the BSE and NSE. This means investors can choose where they want to buy and sell the company’s shares.

Who Gets How Much

They have a plan for who gets how many shares. Big institutions get 33.33%, regular people get 58.33%, and employees get a little bit too. There are also special investors called Anchor Investors who get half of the shares.

Investment Scenario:

For people thinking about investing, there’s a careful plan for how much they can invest. If you’re a regular investor, the smallest amount is ₹14,980 for 1 lot (107 shares), and the biggest is ₹194,740 for 13 lots (1391 shares). If you have a lot of money to invest (Super High Net Worth Individuals), the smallest is ₹209,720 for 14 lots (1498 shares), and the most is ₹988,680 for 66 lots (7062 shares). For really big investors (Big High Net Worth Individuals), the smallest is ₹1,003,660 for 67 lots (7169 shares), and the most is ₹1,003,660 for 67 lots (7169 shares).

Objects of the Issue:

Understanding the purpose behind the IPO is crucial for investors. Fedbank Financial Services aims to utilize the net proceeds for:

(i) Augmenting the company’s Tier I capital base to meet future capital requirements.

(ii) Meeting offer expenses.

Conclusion

To sum it up, the Fedbank Financial Services IPO (Fedfina IPO) is a chance to join a well-known company that helps people with money. They have lots of different services, are present all over India, and have a good plan for how they’ll use the money from the IPO. It seems like a good opportunity for people who want to invest. The IPO starts on November 22, 2023, so if you’re interested, take a close look and think about being part of this financial journey. Happy investing!

We’d Love to Hear from you-

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.