Decoding Penny Stocks: Factors to Consider While Selecting Penny Stocks for Investment

Investing in penny stocks can be likened to navigating a minefield. If you tread carefully, you might find treasure, but one wrong step could have dire consequences. For the uninitiated, penny stocks are shares of companies that trade at very low prices. Despite their name, they’re not just stocks that trade for pennies; in the U.S., they’re typically defined as stocks trading below $5 per share. While they offer the allure of substantial returns, they come with higher risks and volatility. In this guide, we’ll explore key factors to consider when selecting penny stocks to potentially add to your investment portfolio.

1. Understand the Business Model

Before diving into penny stocks investments, it’s crucial to comprehend the underlying business models of the companies you’re considering. A solid business model that is scalable and understandable suggests that the company has a clear path to growth and profitability. Remember, the complexity of a business should not deter its potential, but a red flag is raised when the model is incomprehensible or based on unstable foundations.

2. Scrutinize Financial Health

Assessing a company’s financial health is paramount. This involves looking at their balance sheets, income statements, and cash flow statements. Key metrics to examine include revenue trends, profit margins, debt levels, and cash reserves. Companies with strong financials are more likely to weather economic downturns and emerge as winners in their sectors.

3. Analyze the Market Potential

For a penny stock to become a worthy investment, the company should operate in a market with significant growth potential. Investigate the industry trends, demand drivers, and competitive landscape. A company that offers innovative solutions or targets emerging markets might have a brighter future than one in a stagnant or overly saturated market.

4. Management Team Evaluation

The caliber of a company’s management team can be a make-or-break factor. Look for experienced leaders with proven track records of success in related fields. A strong management team is often indicative of a company’s ability to execute its business plan and navigate challenges.

5. Regulatory and Competitive Landscape

Understanding the regulatory environment is crucial, especially for companies in sectors like biotechnology, pharmaceuticals, or finance. Stringent regulations can impact a company’s ability to operate or scale. Similarly, consider the competitive landscape. A company that offers a unique product or service that is difficult for competitors to replicate may have a competitive edge.

6. Trading Volume and Liquidity

Penny stocks with low trading volumes can be challenging to sell without impacting the stock price significantly. Look for stocks with higher trading volumes, which indicate better liquidity and the ability to execute trades more efficiently.

7. Beware of Fraud and Scams

Unfortunately, the penny stock market is ripe for manipulation and scams. Conduct thorough due diligence and be wary of stocks promoted through unsolicited emails or high-pressure sales tactics. Reputable sources and regulatory filings should be your go-to for research.

8. Set Realistic Expectations

Finally, it’s crucial to have realistic expectations. Not every penny stock will become the next Amazon or Apple. Diversify your investments to mitigate risks, and never invest money you can’t afford to lose.

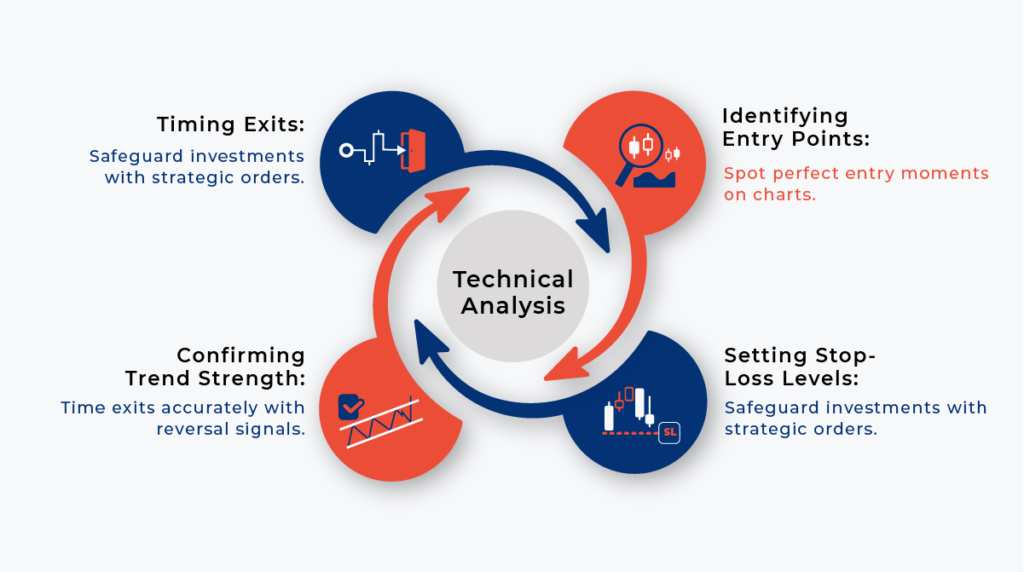

9. Incorporating Technical Analysis

Incorporating technical analysis into penny stock evaluation can provide valuable insights into trading decisions. Here’s how you can utilize technical analysis for various aspects of penny stock evaluation:

Identifying Entry Points:

Support/Resistance Levels: Look for key support and resistance levels on the price chart. These levels can indicate potential entry points. Buying near support levels or breakouts above resistance can be considered favorable entry points.

Chart Patterns: Identify chart patterns such as triangles, flags, or double bottoms. These patterns often signal potential entry points when they break out or confirm.

Setting Stop-Loss Levels:

Technical Indicators: Use technical indicators like moving averages, Bollinger Bands, or Average True Range (ATR) to determine volatility and set appropriate stop-loss levels. For instance, placing a stop-loss below a significant moving average or outside of Bollinger Bands can help manage risk.

Confirming Trend Strength:

Trendlines: Draw trendlines on the price chart to confirm the direction of the trend. A series of higher highs and higher lows indicate an uptrend, while lower highs and lower lows indicate a downtrend.

Technical Indicators: Utilize indicators like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), or stochastic oscillator to confirm the strength of trends identified through fundamental analysis. Strong bullish/bearish signals from these indicators can confirm the trend’s strength.

Timing Exits:

Reversal Patterns: Keep an eye out for reversal patterns such as head and shoulders, double tops, or triple tops for potential exit signals. These patterns suggest a potential trend reversal, indicating it might be time to exit the position.

Divergence: Pay attention to divergence between price and momentum oscillators like the RSI or MACD. Divergence can signal weakening momentum and potential trend reversals, providing a cue to exit positions.

Additionally, it’s crucial to combine technical analysis with fundamental analysis for comprehensive penny stock evaluation. Technical analysis can provide timing and risk management insights, while fundamental analysis helps assess the underlying value and growth potential of the penny stock. Always remember to manage risk by using appropriate position sizing and adhering to disciplined trading strategies.

Conclusion

Investing in penny stocks requires a blend of diligence, patience, and a bit of courage. By considering these factors and incorporating technical analysis into your evaluation process, you’re better equipped to sift through the noise and identify potential gems. Remember, the goal is not to find a stock that will make you rich overnight but to make informed decisions that contribute to a well-rounded, profitable investment portfolio over time.

We’d Love to Hear from you-

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.