Exploring Investor Psychology: Stocks vs Mutual Funds

Table of Contents

Introduction

The psychology of investors is a complex interplay of cognitive and emotional factors that significantly influence investment decisions and market behavior. Understanding this psychology is crucial for investors as it shapes financial markets and impacts investment outcomes. One significant aspect of investor psychology lies in the choice between investing in individual stocks or mutual funds.

Understanding Stocks

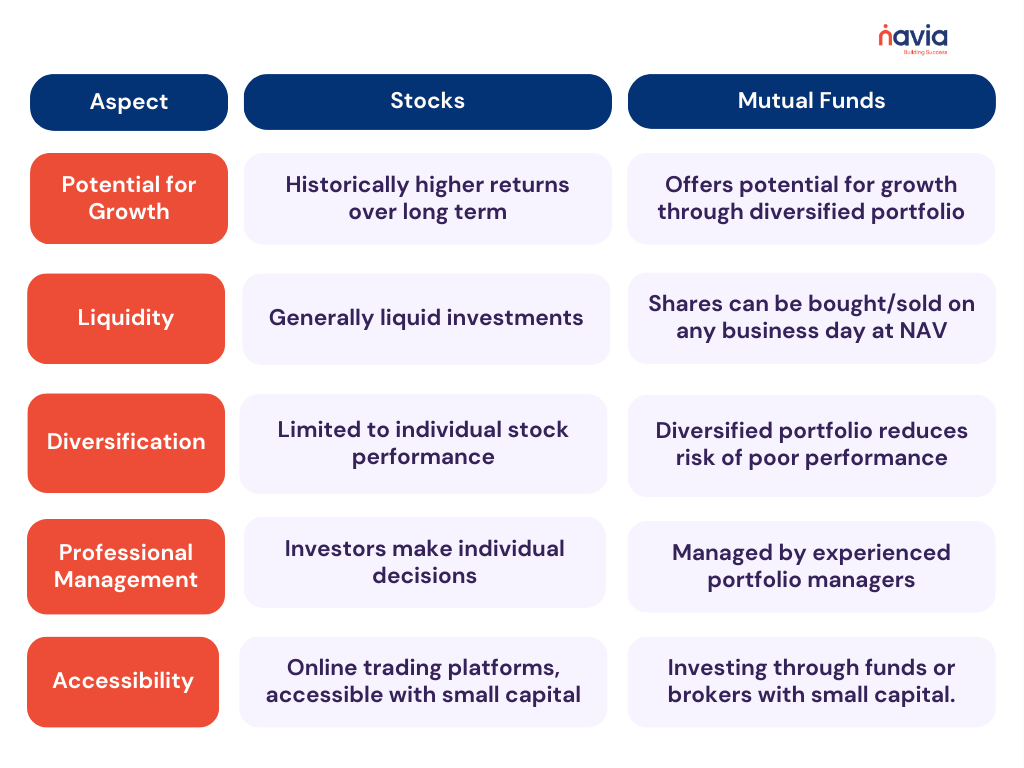

Stocks represent ownership in a company, offering investors the potential for long-term wealth growth. They are fundamental market instruments, providing benefits such as potential growth, dividend income, liquidity, and accessibility. Investors can buy and sell stocks easily on stock exchanges, making them a flexible investment option.

Exploring Mutual Funds

Mutual funds pool money from multiple investors to invest in diversified portfolios managed by professional portfolio managers. They offer benefits such as diversification, professional management, accessibility, liquidity, and transparency. Investors buy shares of Mutual funds, and their investment value fluctuates based on the fund’s performance.

Comparing Stocks and Mutual Funds: Key Factors to Consider

Factors Influencing Investment Decisions

Risk Tolerance and Time Horizon

Investors assess their risk tolerance and time horizon to determine their investment preferences. High-risk tolerant, long-term investors may opt for individual stocks, while low-risk tolerant, short-term investors may prefer mutual funds for stability.

Behavioral Finance Concepts

Behavioral biases like loss aversion and herding behavior influence investment decisions. Understanding these biases helps investors make more rational choices aligned with their financial goals.

Performance Comparison

Investors compare the historical performance of individual stocks and mutual funds. Stocks historically offer higher returns but require more research, while mutual funds provide instant diversification.

Tax Efficiency

Tax considerations significantly impact overall returns. Holding stocks for over a year may qualify for lower capital gains taxes, while mutual funds may distribute taxable capital gains and dividends.

Cost Considerations

Investors weigh the costs associated with different investment options. Individual stocks may incur trading fees and research costs, while Mutual funds charge management fees. Understanding cost structures aids in evaluating investment choices.

Investment Strategies

Various investment strategies exist within both individual stocks and mutual funds. Tailoring strategies to align with objectives and risk preferences is crucial for investment success.

Long-Term vs. Short-Term Investment Mindsets

Investors often exhibit distinct psychological traits depending on whether they adopt a long-term or short-term investment mindset. Understanding these differences is essential for investors as they navigate the complexities of financial markets and strive to achieve their investment goals.

Long-Term Mindset

Investors with a long-term mindset prioritize patience and discipline in their investment approach. They typically focus on fundamental factors such as company performance, industry trends, and economic outlook rather than short-term market fluctuations. Long-term investors often have a broader perspective, aiming to build wealth gradually over an extended period.

Psychological Characteristics:

🔸 Patience: Long-term investors are willing to endure temporary fluctuations in the market with the confidence that their investments will deliver favorable returns over time. They understand that achieving significant wealth requires time and commitment.

🔸 Discipline: Long-term investors adhere to a well-defined investment strategy and resist the temptation to react impulsively to short-term market movements. They maintain a consistent approach even during periods of market volatility, avoiding knee-jerk reactions.

🔸 Emotional Stability: Long-term investors exhibit emotional resilience, remaining calm and rational during periods of market turbulence. They understand that market downturns are inevitable and view them as opportunities rather than setbacks.

Influence on Investment Decisions and Outcomes:

🔹 Strategic Asset Allocation: Long-term investors focus on strategic asset allocation tailored to their risk tolerance and financial goals. They prioritize asset classes with the potential for long-term growth, such as equities, and maintain a diversified portfolio to mitigate risk.

🔹 Staying Power: Long-term investors have the staying power to weather short-term market downturns without abandoning their investment strategy. They take a proactive approach to portfolio management, periodically rebalancing their holdings to ensure alignment with their long-term objectives.

🔹 Compound Growth: Long-term investors harness the power of compounding by reinvesting dividends and capital gains back into their portfolios. They understand that compounding accelerates wealth accumulation over time, contributing significantly to their investment success.

Short-Term Mindset

In contrast, investors with a short-term mindset prioritize immediate gains or losses, often driven by market sentiment and short-term trends. They may exhibit higher levels of risk aversion and react impulsively to market fluctuations, seeking to capitalize on short-term opportunities.

Psychological Characteristics:

🔸 Impulsivity: Short-term investors are more susceptible to impulsive decision-making, influenced by daily market movements and speculative trends. They may engage in frequent trading in pursuit of quick profits, often overlooking long-term fundamentals.

🔸Risk Aversion: Short-term investors may have a lower tolerance for risk, preferring investments with perceived stability and immediate returns. They prioritize capital preservation over long-term growth and may quickly exit positions at the first sign of volatility.

🔸Emotional Reactivity: Short-term investors are prone to emotional reactions to market fluctuations, experiencing heightened anxiety and stress during periods of volatility. Their investment decisions may be driven by fear or greed rather than rational analysis.

Influence on Investment Decisions and Outcomes:

🔹 Market Timing: Short-term investors may attempt to time the market, buying and selling securities based on short-term price movements. However, market timing is notoriously difficult to execute successfully and can lead to suboptimal investment outcomes.

🔹 Chasing Performance: Short-term investors may chase performance, allocating capital to assets that have recently experienced strong gains. This behavior often results in buying high and selling low, detracting from long-term wealth accumulation.

🔹 Lack of Discipline: Short-term investors may lack the discipline to adhere to a consistent investment strategy, frequently changing their approach in response to market conditions. This lack of discipline can lead to inconsistent returns and diminished portfolio performance over time.

Conclusion

Understanding investor psychology is essential for making informed investment decisions. Whether choosing between individual stocks or mutual funds, investors must consider their risk tolerance, time horizon, and psychological tendencies to align their investment strategies with their financial goals. By adopting a long-term mindset, prioritizing discipline and patience, investors can navigate market volatility and achieve long-term wealth accumulation. This is where Navia plays a crucial role, offering valuable insights, research, and guidance to help investors make well-informed decisions in line with their investment objectives.

Conversely, succumbing to short-term impulses and emotional reactions can undermine investment success. By recognizing the psychological factors at play, investors can cultivate a mindset conducive to long-term financial growth and stability.

We’d Love to Hear from you-

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.