ETF vs MF: Navigating Investment Choices with Navia

In the ever-evolving landscape of investment, two vehicles consistently capture the attention of savvy investors: Exchange-Traded Funds (ETFs) and Mutual Funds (MFs). Both offer unique advantages and can be integral components of a diversified investment strategy. At Navia Markets, we understand the importance of making informed investment choices. That’s why we offer an extensive platform that caters to both ETFs and MFs, empowering our clients to tailor their portfolios to their specific financial goals and risk tolerance.

What are ETFs?

Exchange-Traded Funds, or ETFs, are investment funds traded on stock exchanges, much like stocks. They hold assets such as stocks, commodities, or bonds and typically operate with an arbitrage mechanism designed to keep the trading close to its net asset value, though deviations can occasionally occur.

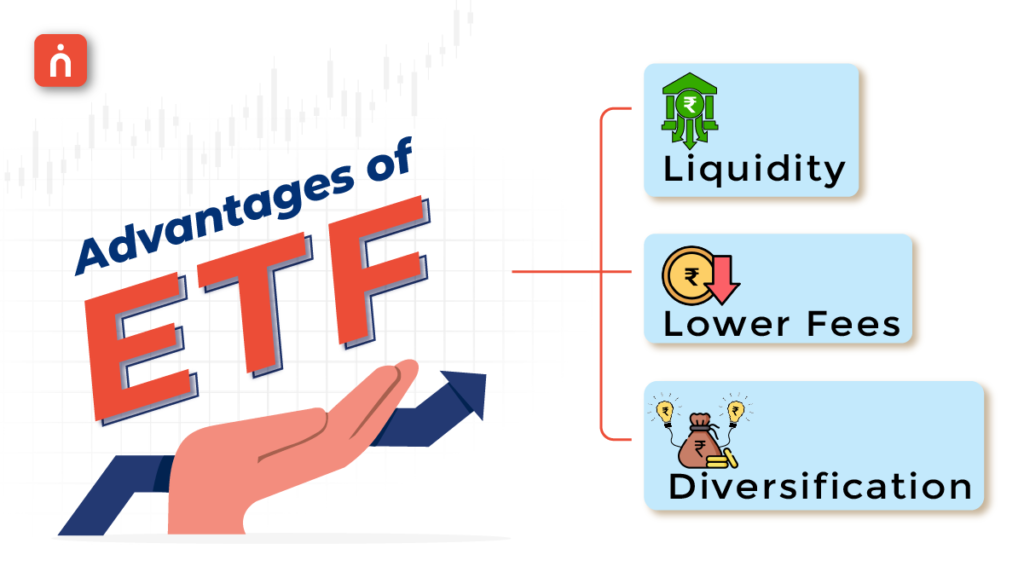

Advantages of Exchange Traded Funds:

🔸Liquidity- ETFs are traded throughout the trading day at market price, which can be more or less than their net asset value, providing flexibility and liquidity.

🔸Lower Fees- Generally, ETFs have lower expense ratios compared to mutual funds, making them an economical choice for cost-conscious investors.

🔸Diversification- ETFs offer access to a wide range of sectors, commodities, and international markets, helping investors diversify their portfolios.

What are Mutual Funds?

Mutual Funds are investment vehicles made up of a pool of funds collected from many investors for the purpose of investing in securities like stocks, bonds, money market instruments, and other assets. Managed by professional fund managers, mutual funds aim for growth over the long term and income through dividend or interest payments.

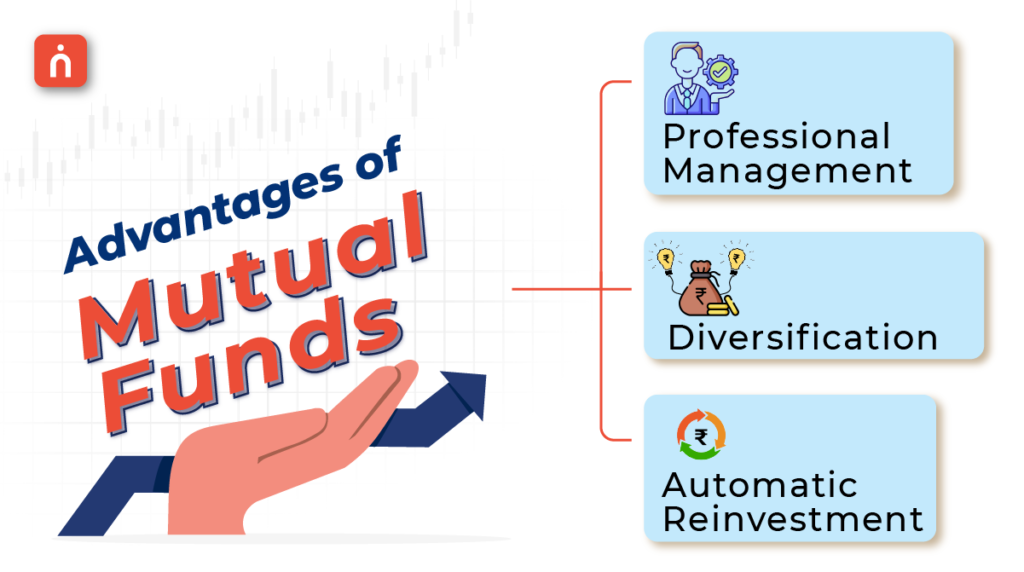

Advantages of Mutual Funds:

🔸Professional Management– Investors gain access to professional money managers who actively manage the portfolio, making decisions about buying and selling securities.

🔸Diversification– Like ETFs, mutual funds offer diversification but usually require a lower minimum investment, making them accessible to a wider range of investors.

🔸Automatic Reinvestment– Dividends and interest can be automatically reinvested to purchase more shares of the fund, aiding in compounding growth over time.

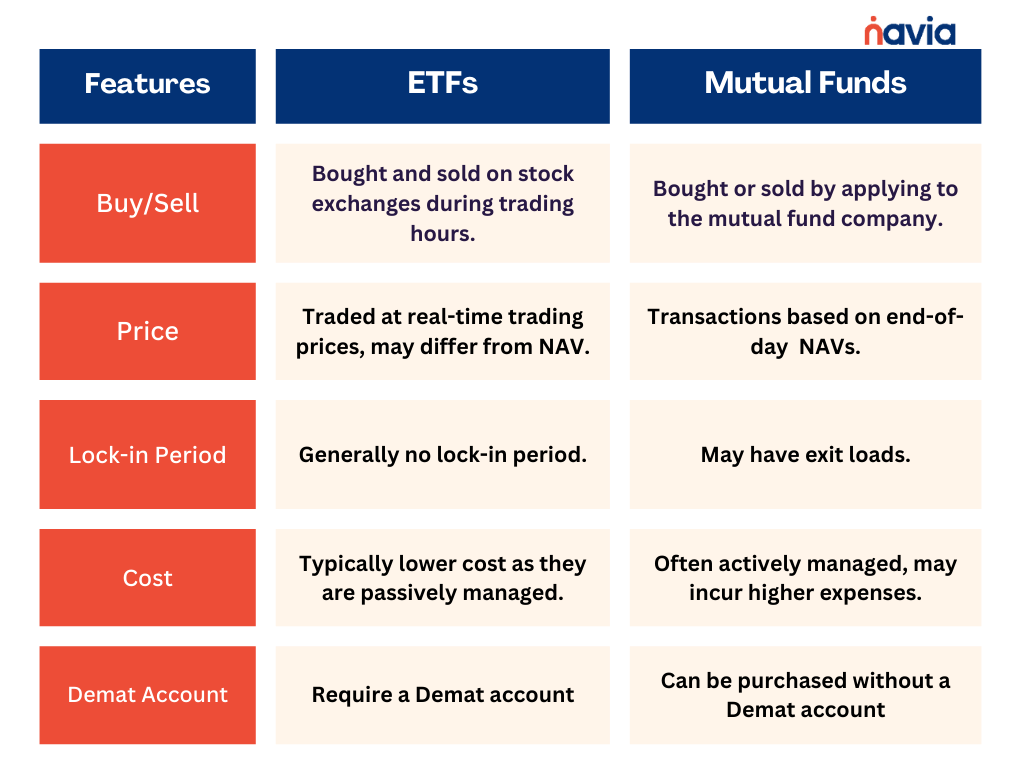

Difference between ETF and mutual funds?

Tax Considerations: Mutual Funds vs. ETFs

→ Capital Gains Distributions

Mutual Funds: Investors may face unexpected tax bills due to capital gains distributions, even if they haven’t sold any shares themselves, particularly in high turnover years.

ETFs: They are typically more tax-efficient since they minimize capital gains distributions by creating and redeeming shares “in-kind,” giving investors more control over their tax liabilities.

→ Tax Efficiency and Control

Mutual Funds: Investors have limited control over when capital gains are incurred since fund managers make decisions on selling securities within the portfolio.

ETFs: Investors have more control over timing as they can choose when to buy or sell, potentially optimizing capital gains taxes. The “in-kind” creation and redemption process can also reduce taxable events.

→ Tax Harvesting Opportunities

Mutual Funds: Tax-loss harvesting is challenging due to constant asset inflow and outflow.

ETFs: Tax-loss harvesting is easier as investors can sell losing positions and replace them with similar investments without triggering capital gains.

→ Cost Basis Reporting

Mutual Funds: Investors often bear the responsibility of tracking cost basis, which can lead to errors.

ETFs: ETFs generally offer more accurate and transparent cost basis reporting, simplifying tax-related record-keeping for investors.

ETFs vs MF: Which is Right for You?

Choosing between an ETF and a mutual fund depends on your investment strategy, goals, and preferences. If you value liquidity and lower fees, ETFs might be more appealing. On the other hand, if you prefer having a professional manage your investments and are looking for a more set-it-and-forget-it approach, mutual funds could be the better option.

How Navia Can Help

At Navia Markets, we’re dedicated to providing our clients with a robust platform that supports both ETFs and Mutual Funds. Our intuitive platform simplifies the investment process, offering tools and resources that help you make informed decisions. Whether you’re drawn to the hands-off approach of mutual funds or the flexibility of ETFs, Navia empowers you to navigate the investment landscape with confidence.

Tailored Solutions for Every Investor

Understanding that each investor’s journey is unique, we at Navia Markets pride ourselves on offering personalized investment solutions. Our team of experts is here to guide you through the nuances of ETFs and MFs, ensuring that your portfolio aligns with your financial objectives.

Embrace the Future with Navia

In the dynamic world of investments, having a partner like Navia Markets can make all the difference. By offering both ETFs and Mutual Funds on our platform, we provide the versatility and support needed to achieve your investment goals. Join us at Navia, and let’s build your financial future together.

We’d Love to Hear from you

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.