Electricity Futures: A New Trading Opportunity

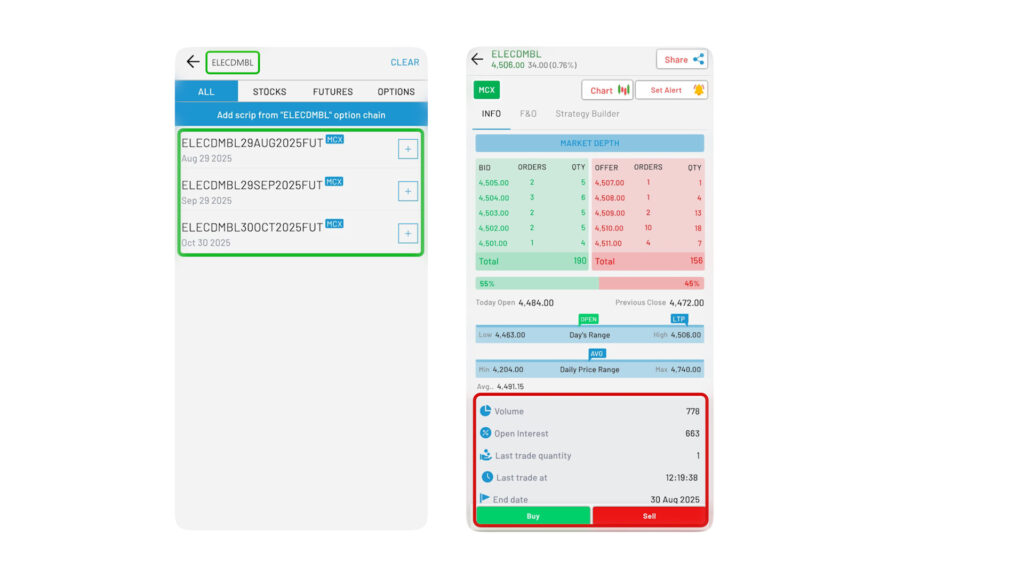

Electricity futures, recently launched on MCX (Multi Commodity Exchange), are the latest addition to the world of commodity trading. Much like trading gold, silver, or crude oil, you can now trade electricity as a financial instrument.

In this article, we’ll discuss how electricity is traded, the launch of electricity derivatives, and the opportunities this brings for traders.

Why is Electricity Traded on an Exchange?

Traditionally, power plants sell the electricity they generate to power distribution companies (discoms) through Power Purchase Agreements (PPAs). These agreements often lock in prices at fixed rates, making them rigid when electricity prices change.

However, with electricity futures, both power generators and discoms can now hedge against short-term price fluctuations. They can buy and sell electricity on exchanges like IEX (Indian Energy Exchange) to get better prices and reduce volatility.

Electricity Derivatives: What Are They?

Electricity derivatives (or futures) are contracts that allow traders to buy or sell electricity for future dates at predetermined prices. This works the same way as futures contracts on stocks, indices, or commodities.

For example, if you want to hedge against potential price fluctuations in electricity, you can buy or sell electricity futures contracts on the MCX, helping you manage risks and avoid price shocks.

How Do Electricity Futures Work?

Electricity futures contracts are cash-settled, which means there’s no physical delivery of electricity. The settlement happens based on the difference between the contract price and the actual market price at expiry.

🠖 Underlying Asset: IEX’s Day Ahead Market (DAM) electricity prices.

🠖 Contract Size: 50 MWh (Megawatt-hour).

🠖 Tick Size: ₹1 per MWh. So, if the price changes by ₹1, your position changes by ₹50 for one lot.

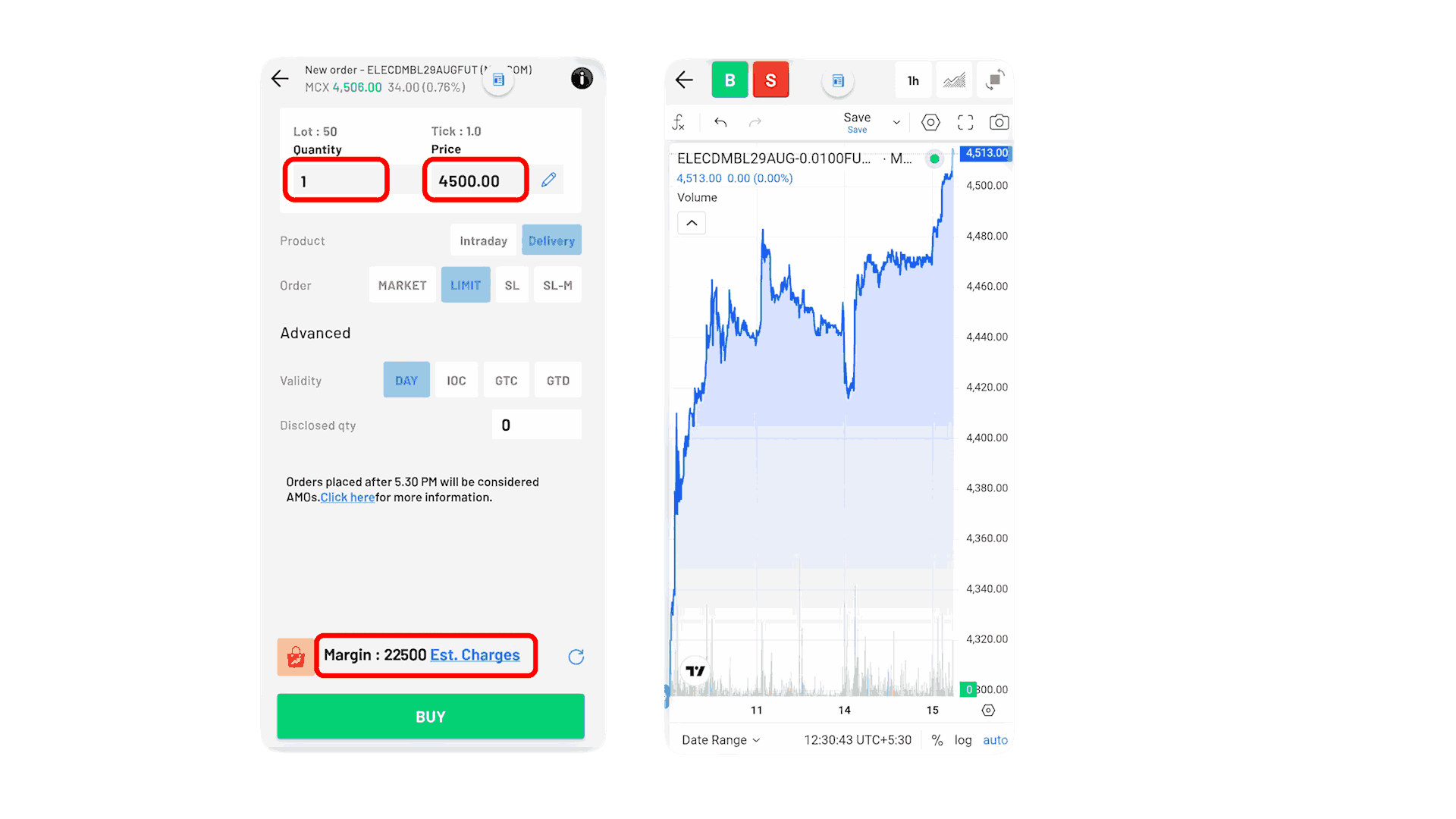

Example of Electricity Futures

Let’s say the current price of electricity is ₹4500 per MWh.

🠖 You decide to buy 1 contract of electricity futures at ₹4500/MWh.

🠖 The contract size is 50 MWh, so the contract value is ₹4500 × 50 = ₹2,25,000.

🠖 The margin requirement (10%) for this trade would be ₹22,500.

Now, if the price moves up by ₹10 to ₹4510/MWh:

🠖 Your profit would be 50 × ₹10 = ₹500.

If the price drops by ₹10 to ₹4490/MWh:

🠖Your loss would be 50 × ₹10 = ₹500.

Who Can Trade Electricity Futures?

The introduction of electricity futures opens the market to various participants, such as:

🠖 Power Generation Companies: To hedge against price drops.

🠖 Power Distribution Companies (Discoms): To manage costs when they sell electricity below market prices.

🠖 Institutional and Retail Investors: To profit from electricity price movements and diversify their portfolios.

Contract Specifications for Electricity Futures

Here’s a quick look at the specifications for electricity futures:

| Feature | Details |

| Contract Size | 50 MWh |

| Price Quotation | ₹ per MWh |

| Tick Size | ₹1 per MWh |

| Lot Size | Minimum: 1 lot, Maximum: 50 lots |

| Initial Margin | 10% of contract value |

| Settlement | Cash-settled |

| Trading Hours | 9:00 AM – 11:30 PM (Weekdays) |

Risks in Electricity Futures

Like any financial instrument, electricity futures carry risks. Some of the common risks include:

🠖 Price Risk: Electricity prices can be volatile, and excessive speculation could lead to losses.

🠖 Time Basis Risk: If your electricity consumption cycle doesn’t match the contract expiry, your exposure could be unhedged for a period.

🠖 Location Basis Risk: The price of electricity in your area might differ from the exchange price, affecting your hedging strategy.

It’s important to understand these risks and have strategies in place before trading.

Conclusion

Electricity futures offer a new way to hedge and trade electricity prices, just like you would with other commodities. With MCX now offering these contracts, brokers (including Navia) provide access to them via trading platforms. Investors may consider these contracts for hedging or diversification, depending on their risk profile.

Whether you’re a power generation company, a discom, or an investor, electricity derivatives open up a range of trading opportunities.

Key Takeaways:

🠖 Electricity futures help manage price volatility in electricity markets.

🠖 The contract size is 50 MWh with a ₹1 tick size.

🠖 They are cash-settled and have a 10% initial margin requirement.

🠖 Electricity futures are commonly used for hedging and speculative purposes by market participants.

Electricity futures are complex derivative instruments and may not be suitable for all investors. Participants should evaluate their risk tolerance before trading.

Do You Find This Interesting?

DISCLAIMER: Investments in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.