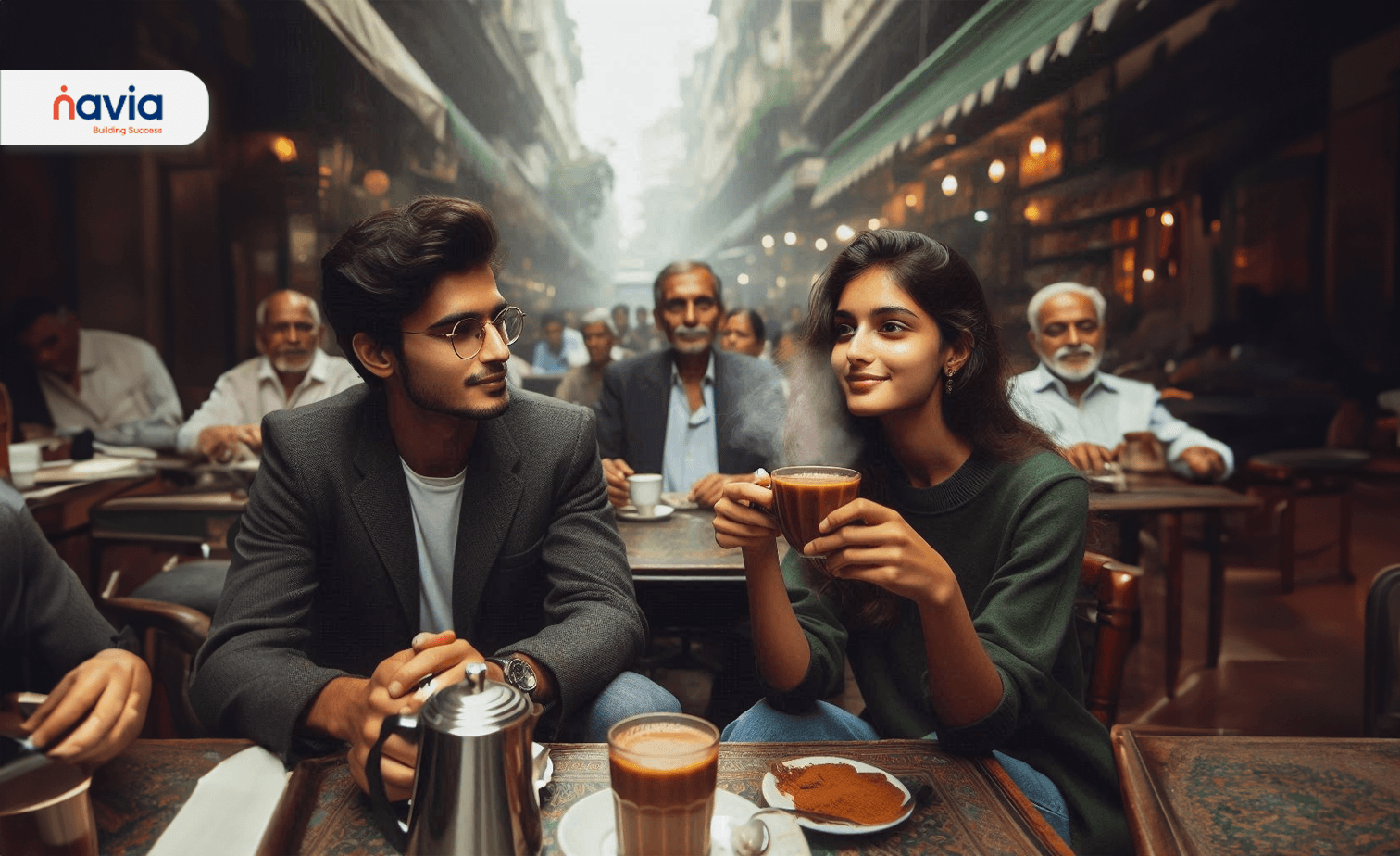

Dividend Dilemma: A Desi Cafe Chat

A steaming cup of chai in hand, Shreya, a young investment enthusiast, sat across from her experienced friend, Rohan, in a bustling Kolkata cafe. The aroma of freshly ground coffee and the chatter of the city outside provided the perfect backdrop for their financial discussion.

“Rohan, I’ve been hearing a lot about dividend stocks lately. They sound like a steady source of income,” Shreya began, her eyes sparkling with curiosity. “Can you break it down for me?”

Rohan took a sip of his chai, a thoughtful expression crossing his face. “Sure, Shreya. Dividend stocks are essentially shares of companies that share a portion of their profits with shareholders, like a regular paycheck.”

Intrigued, Shreya leaned forward. “So, any company can do this?”

“Not quite,” Rohan explained. “Companies that offer dividends are usually large, established players, like the Tatas or Reliance. They’re financially stable and have a consistent profit track record.”

“But why would they share their profits? Wouldn’t they rather reinvest it all?” Shreya questioned.

Rohan chuckled. “That’s a good point. While reinvesting is important for growth, dividends attract investors, build trust, and can be a tax-efficient way to distribute profits.”

“How does this benefit me?” Shreya asked, eager to understand the perks.

“Dividend stocks can be a steady income source, especially for those looking for stable returns,” Rohan replied. “They’re generally less risky than other stocks, and dividends can help protect your money from inflation.”

“Sounds good, but is there a catch?” Shreya inquired, a hint of skepticism in her voice.

“Of course,” Rohan admitted. “While they offer stability, dividend stocks might not give you the same high growth potential as other stocks. Plus, they tend to be pricier.”

“What about taxes?” Shreya asked, her eyebrows furrowing slightly.

“There are two main taxes: Dividend Distribution Tax (DDT), which the company pays on your behalf, and capital gains tax when you sell the stocks,” Rohan explained.

“So, who should invest in these?” Shreya asked, summarizing the conversation.

“Dividend stocks are ideal for investors seeking regular income, especially those with a long-term perspective. Think of retirees or those building a retirement fund. But it’s essential to diversify your portfolio,” Rohan advised.

“Got it. So, before I dive in, I should check the company’s dividend history, financial health, and how much they’re paying out?” Shreya concluded.

“Absolutely. A consistent dividend payout and strong financials are key indicators of a reliable dividend stock,” Rohan affirmed.

As they finished their chai, Shreya felt more confident about understanding dividend stocks. With Rohan’s guidance, she was one step closer to making informed investment decisions.

So, there you have it! Dividend stocks can be a valuable addition to your investment portfolio, offering a steady income stream and potential long-term growth. Remember, while they can be less risky than other investments, they might not offer the same high returns. It’s essential to do your research and understand the companies you’re investing in.

Now are you ready to start your dividend investing journey? Open a free Demat account with Navia today and explore the world of dividend stocks. With Navia’s user-friendly platform, you can easily track your investments and make informed decisions.

Don’t forget to check out our Stock SIP feature! Set aside a small amount each month to invest in your favorite stocks and watch your wealth grow steadily. It’s a simple, disciplined way to build a strong investment portfolio.

To learn how to set up your SIP, watch our step-by-step tutorial and get started effortlessly.

Start your investment journey with Navia today!

We’d Love to Hear From You