Crypto vs Stocks: Where Should You Put Your Money?

- The Incumbent: A Look at the Stock Market

- The Challenger: Understanding Cryptocurrency

- Crypto vs. Stock Market: Key Differences

- Stock Market vs. Cryptocurrency: Where Should You Put Your Money?

- Final Words

- Frequently Asked Questions

We know that our financial landscape has evolved dramatically over the past two decades, and it introduced a new contender called cryptocurrency. The stock market has been the default destination for long-term wealth building, because it offers a path to financial growth. But after the rise of Bitcoin and thousands of altcoins, investors are increasingly asking a question: crypto vs stock market- where should I put my money?

Don’t think that it is a simple question, and we can’t give a one-size-fits-all answer. Knowledge about the fundamental differences, historical performance and future potential will help to make informed decisions.

The Incumbent: A Look at the Stock Market

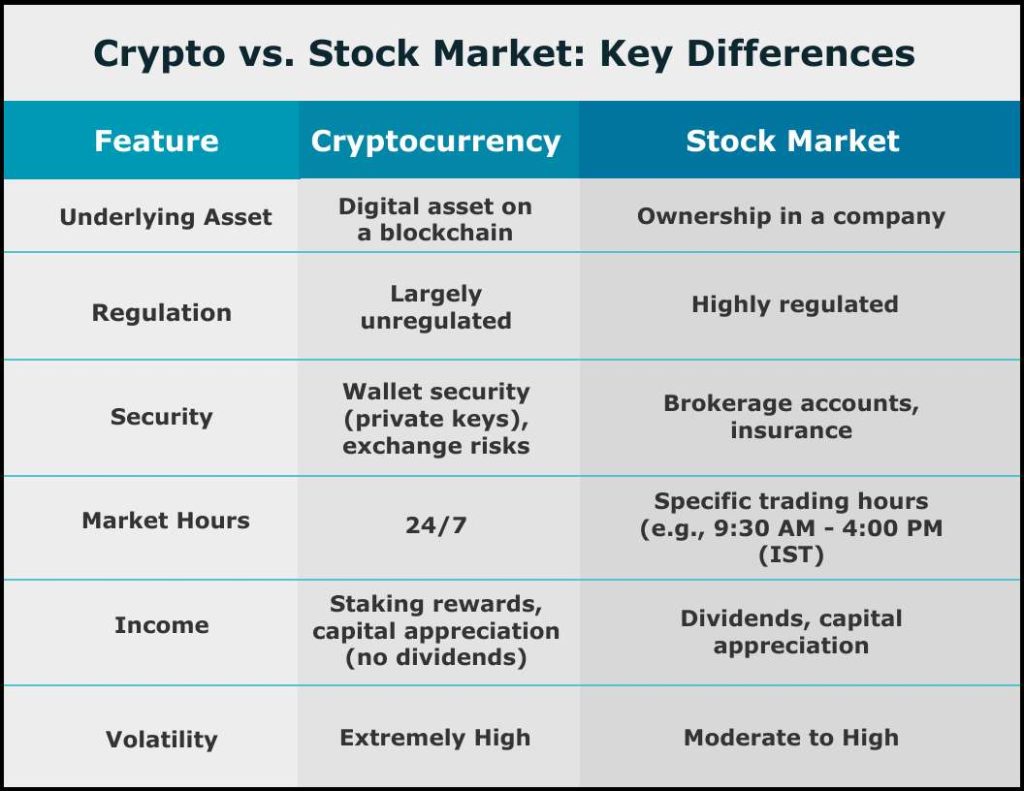

The stock market represents ownership in publicly traded companies. For example, if you buy a stock, it means you are buying a small piece of that business. It leads you to both investment gains and losses based on the company’s performance, trends, and overall economic conditions.

Advantages of Stock Market

Income Generation: Many companies distribute a portion of their profits to their shareholders, that is called dividends. It is a regular income for investors in addition to potential capital appreciation.

Long-Term Growth Potential: The Stock market provided consistent long-term returns, outperforming inflation and many other asset classes over extended periods.

Liquidity: Most stocks are highly liquid, which means they can buy and sell quickly without significantly impacting their price.

Tangible Value: Stocks are real-world assets so you can analyze a company’s balance sheet, income statements and management team to assess its value.

Established Regulation and Infrastructure: The stock market operations under regulatory frameworks, that offer investor protection and transparency.

Disadvantages of Stock Market

Volatility: Generally, the stock market is less volatile than crypto, but the economic downturns and geopolitical events will make significant price swings.

Brokerage Fees and Taxes: Trade stocks include brokerage fees, and profits are subject to capital gains taxes.

Research Intensive: Before making informed decisions, you must research into companies, industries and economic indicators in detail.

The Challenger: Understanding Cryptocurrency

Cryptocurrency is a digital currency secured by cryptography, making it nearly impossible to counterfeit or double-spend. Most cryptocurrencies are decentralized; it means that they are not subject to government or financial institution control.

Advantages of Cryptocurrency

Accessibility: Crypto markets are available 24/7, it only needs an internet connection to participate.

Diversification: If someone adding crypto to a traditional portfolio will offer diversification, as its price movements often don’t directly correlate with the stock market.

High Growth Potential: The crypto market has seen unprecedented growth that can potentially offer high returns.

Decentralization: Cryptocurrencies operate on blockchain technology, a distributor of public ledger, so, there is no single entity that controls the network.

Technological Innovation: Blockchain technology underpins smart contracts, decentralized applications (dApps), and new internet paradigms, means is a glimpse into future technological shifts.

Disadvantages of Cryptocurrency

Volatility: It is considered the biggest disadvantage for new investors, because crypto prices will swing anytime.

Security Risks: Blockchain is secure but exchanges and individual wallets will face hacking and scams sometimes.

Complexity and Learning Curve: Understanding blockchain technology is difficult, because of its mechanisms, and various altcoins can be confusing for beginners.

Crypto vs. Stock Market: Key Differences

Stock Market vs. Cryptocurrency: Where Should You Put Your Money?

The decision to choose the stock market or cryptocurrency completely depends on your risk tolerance and investment goals.

For Conservative or Beginner Investor

The stock market is generally more stable and regulated, making it suitable for conservative or beginner investors. Begin with diversified index funds or ETFs that track broad markets. It provides exposure to a wide range of companies and historically stable long-term growth with less risk.

For the Growth-Oriented Investor with Moderate Risk Tolerance

Once you’re knowledgeable in stock market basics, after research you can explore individual stocks. After you’re curious about crypto, consider small, diversified allocation, keep in mind that a balanced approach is important.

For the Aggressive Investor with High Risk Tolerance

After you understand the significant risks and are comfortable with potentially losing your entire investment in crypto, you can allocate a higher portion. However, these investors are wise to maintain a diversified portfolio that includes traditional assets.

Final Words

The debate of crypto vs stock market isn’t about choosing the best one compared to other. That’s why we have already been told that both can offer many advantages and disadvantages. So, before making investment decisions, consult a financial advisor to make a strategy align with your individual financial goals and risk tolerance.

The journey to financial independence is like a marathon, not a sprint, and a thoughtful, informed approach is always the most rewarding path. So, always start your journey by choosing NSE registered broker.

Do You Find This Interesting?

Frequently Asked Questions

Which is better to invest, crypto or stocks?

Both crypto and stocks have their own advantages. Stocks are regulated, less volatile, and backed by company fundamentals, making them suitable for long-term wealth creation. Cryptocurrencies are highly volatile but offer the potential for high returns in a short amount of time.

Why is crypto riskier than stocks?

Crypto is riskier because it is largely unregulated, highly volatile, and influenced by factors like speculation, global regulations, and security risks.

Can you make more money in crypto or stocks?

Crypto prices have historically shown sharp moves, both upward and downward, while stocks tend to provide steadier, long-term returns.

What are the disadvantages of cryptocurrency?

➱ High volatility leading to unpredictable price swings

➱ Lack of regulation and legal protections

➱ Security risks

➱ Complexity and learning curve

What to Keep in Mind Before Choosing Cryptocurrencies?

➔ Do Your Own Research (DYOR): Never invest based on hype. Understand the technology, the project’s utility, the team behind it, and its market capitalization.

➔ Only invest what you can afford to lose: This cannot be stressed enough. The crypto market is still nascent and highly speculative.

➔ Security: Learn how to secure your crypto assets, whether on a reputable exchange with strong security measures or in a hardware wallet for long-term holdings.

➔ Long-Term vs. Short-Term: Are you looking to “get rich quick” (a dangerous mindset in crypto) or are you investing in projects you believe have long-term potential?

DISCLAIMER: Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.