“Cracking the Code of Bonus Shares: A Simple Guide for Investors”

Introduction to Bonus Shares

The sun dappled through the leaves, casting playful shadows on the balcony as Amit, a seasoned investor, nursed his tea. A contented sigh escaped his lips as he basked in the tranquil Sunday afternoon. His reverie was interrupted by the enthusiastic voice of his nephew, Rohit.

Understanding Bonus Shares with Amit and Rohit

“Uncle, I’ve been scratching my head over bonus shares,” Rohit began, his eyes wide with curiosity. “Everyone’s talking about it, but I’m lost.”

Amit chuckled, setting down his teacup. “Ah, the mysteries of the market, eh? Let’s unravel this together.”

Rohit nodded eagerly. “So, like, what exactly are bonus shares?”

Why Companies Issue Bonus Shares

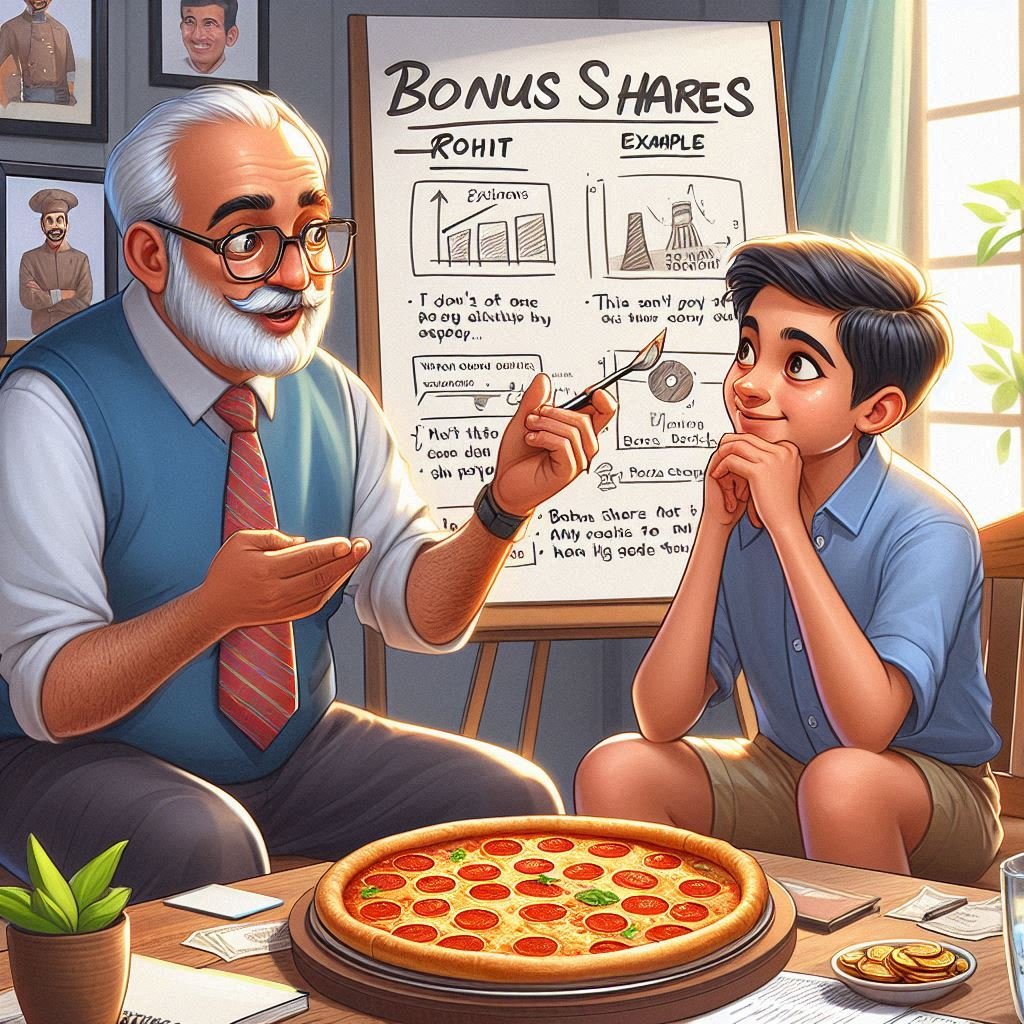

“Imagine owning a pizza,” Amit began, using a simple analogy. “The pizza is your company, and each slice is a share. Now, if the pizzeria is doing well, they might decide to bake a whole new pizza and give you an extra slice for every slice you already own. That’s a bonus share.”

Rohit’s eyes widened. “Free pizza!” he exclaimed.

Amit chuckled. “Well, not exactly free. The total value of your pizza, or your investment, remains the same. If your slice was worth Rs. 1000 before, after the bonus, you’ll have two slices, but each will be worth around Rs. 500. So, you have more slices, but the overall value is still the same.”

Just then, Sara, Amit’s friend and a financial advisor, stepped onto the balcony, her laughter echoing the warmth of the afternoon.

“What’s brewing, boys?” she asked, her eyes sparkling with amusement.

“Bonus shares,” Rohit replied, his voice filled with newfound knowledge. “Uncle Amit was just explaining it to me.”

Sara nodded. “Ah, the magic of corporate finance. It’s more than just freebies, Rohit. Companies issue bonus shares for various reasons. It can make the shares more affordable for small investors, signaling confidence in the company’s future, or even be a way to reward shareholders without dipping into cash reserves.”

Rohit’s eyebrows furrowed in thought. “So, if a company issues bonus shares, does it mean they’re doing really well?”

Amit took a sip of his tea. “Usually, yes. It’s often a sign of financial strength. But, like any investment, it’s essential to look at the bigger picture. Other financial indicators are equally important.”

Sara chimed in, “And let’s not forget the tax benefits. Bonus shares are generally tax-free until you sell them. That’s a sweet deal!”

Rohit’s eyes lit up. “That’s awesome!”

Amit continued, “However, there’s a slight catch. The share price often drops before the bonus shares are credited to your account. It might look like a loss initially, but it balances out once you get the extra shares.”

“So, it’s like a magic trick?” Rohit asked, his eyes wide with wonder.

Sara laughed. “Sort of. But remember, not every profitable company issues bonus shares. Some prefer to pay dividends or reinvest profits.”

Rohit leaned forward, his curiosity piqued. “How do I make sure I get the bonus shares?”

Amit explained, “You need to own the shares before the record date set by the company. Buying shares after the ex-date, which is a couple of days before the record date, won’t make you eligible.”

Rohit nodded, absorbing the information. “Uncle, Aunt Sara, thank you! This was super helpful. I feel like I can tackle the stock market with more confidence now.”

Sara smiled warmly. “That’s what we’re here for. Remember, investing is a journey, not a sprint. Do your research, and don’t hesitate to ask questions.”

As the sun began its descent, casting long shadows across the balcony, Rohit felt a sense of accomplishment. Armed with a clearer understanding of bonus shares, Rohit felt more confident in his investment journey. This newfound knowledge empowered him to make informed decisions in the dynamic world of stocks.

Beyond the initial excitement, bonus shares offer tangible advantages to investors. By increasing the number of shares, they enhance the stock’s liquidity, making it easier to buy and sell. Moreover, the tax-free nature of bonus shares is a significant perk. For long-term investors, bonus shares can amplify returns over time. Increased shareholding also translates to larger dividend payouts. Ultimately, the issuance of bonus shares often reflects a company’s financial health and growth prospects, fostering investor confidence.

As Rohit discovered, understanding the nuances of financial instruments like bonus shares is crucial for making sound investment choices.

Investing in the stock market just got easier and more affordable with Navia. Open a free Demat account online in minutes with hassle-free digital KYC. Enjoy lifetime free AMC, meaning no annual charges to maintain your account. Take advantage of zero brokerage on all equity delivery trades, making your investments even more cost-effective. Start your investment journey today with Navia and watch your portfolio grow.