CEO’s Annual Round-Up – 2025

- Rebuilding the Brand & Strengthening Trust

- Faster, Smoother, and More Reliable Onboarding

- Listening Closely: What Client Feedback Tells Us

- Making Support Simpler & More Accessible

- Improving the Trading Experience

- Governance, Compliance & Platform Ownership

- A Defining Milestone: Our In-House Trading Platform

- Introducing Navia Backup – Your Emergency Exit Safety Net

- Looking Ahead – 2026

- Important Advisory

Your Trust. Our Responsibility. A Stronger Navia.

The year 2025 marked a phase of meaningful transformation for global and Indian stock markets. Volatility remained elevated, regulatory frameworks continued to evolve, and technology increasingly shaped how investors participated in the markets.

Amid these changes, Indian markets stood resilient, supported by strong domestic participation and growing investor maturity.

For us at Navia, this environment reinforced a clear belief:

👉 In uncertain markets, clients value control, transparency, and reliability above all else.

Throughout the year, we focused on strengthening these very foundations.

Rebuilding the Brand & Strengthening Trust

One of our most visible milestones in 2025 was the re-establishment of the Navia brand, transitioning from Tradeplus, which had served its purpose as our online discount broking identity.

This transition was not merely cosmetic. It was driven by:

🔸 A structured on-site and off-site content strategy

🔸 Improved clarity in communication

🔸 A renewed emphasis on transparency and consistency

The response was encouraging.

🔹 Monthly new account openings doubled

🔹 New client activations consistently crossed 60%

🔹 Trading volume growth outpaced overall exchange month-on-month growth

These outcomes reaffirmed that clients value a platform that combines ease of use with robust systems and governance.

Faster, Smoother, and More Reliable Onboarding

We further strengthened our eKYC platform by integrating Account Aggregator (AA) infrastructure. This significantly improved onboarding efficiency and data accuracy.

In certain months, KYC rejection rates dropped to as low as 1%, reducing friction and helping clients get started faster—without compromising regulatory integrity.

Listening Closely: What Client Feedback Tells Us

At Navia, feedback is not treated as a formality—it is a critical input into how we improve our services. Throughout the year, we actively collected client feedback across multiple support touchpoints.

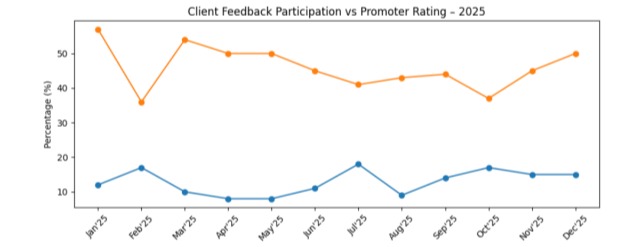

➔The blue line represents the percentage of clients who shared feedback (ranging between 12% and 17%).

➔ The orange line represents the Promoter Rating, reflecting client confidence (ranging between 36% and 57%).

What this tells us:

➤ Promoter ratings tend to soften during periods of trading disruptions, whether due to internal platform upgrades or external market and exchange-related events.

➤ These insights help us prioritise stability, communication, and faster resolution, especially during high-impact market phases.

We see this feedback as a partnership—with clients helping us build a better platform.

Making Support Simpler & More Accessible

To improve response times and empower self-service:

◉ Support content was enhanced with video-based explainers

◉ 70% of support emails were handled by online bot agents

◉ 25% of inbound queries were resolved via online chat

◉ Call centre dependency reduced by 40%, improving turnaround time and consistency

The objective remains simple:

👉 Resolve most queries faster, without requiring clients to wait or call.

Improving the Trading Experience

✔️ We enhanced the options trading experience at zero brokerage through the integration of Insta Options, making derivatives trading simpler and more intuitive—especially for active traders.

✔️ NRI clients can now seamlessly trade across Cash and F&O segments using a single base capital, with the added benefit of accessing the Margin Trade Funding (MTF) facility.

Governance, Compliance & Platform Ownership

✔️ Our commitment to compliance, transparency, and risk discipline remains non-negotiable.

✔️ No disciplinary actions were taken against Navia Markets Limited by any exchange during 2025, as reflected in publicly available exchange records.

A Defining Milestone: Our In-House Trading Platform

One of the most important achievements of the year was the launch of our in-house trading platform.

By bringing Order Management System (OMS) and Risk Management System (RMS) fully under our control, we materially reduced dependence on third-party platform vendors—who today handle nearly 70% of industry trading volumes.

This gives us:

★ Better operational risk control

★ Faster regulatory responsiveness

★ Direct oversight of order execution and risk limits

★ Improved business continuity and cost predictability

While the platform went through initial teething challenges, I sincerely thank our clients and internal teams for their patience and trust during this transition.

Introducing Navia Backup – Your Emergency Exit Safety Net

Over the years, we have invested heavily in redundancy and disaster-recovery systems, aligned with SEBI’s stringent resilience framework.

In addition, we introduced Navia Backup—a fully independent emergency trading mode, designed as a last-resort safety mechanism. Even in the unlikely event of a primary system outage, this facility enables clients to exit market positions independently.

Looking Ahead – 2026

Subject to regulatory and exchange approvals, we are working towards introducing:

➡️ Client APIs

➡️ Algo Trading facilities

➡️ Portfolio Health Check tools

➡️ Stock advisory services through SEBI-registered RAs

➡️ Digital Fixed Deposits

All enhancements will continue under our Zero Brokerage commitment for online RI clients.

Important Advisory

We caution the public and our clients against the unauthorised or fraudulent use of Navia’s name, logo, or brand identity. Navia Markets Limited does not authorise any third party to collect funds, promise guaranteed returns, or operate unofficial trading groups. Please verify all communications only through our official channels.

As part of our continued expansion, we will be relocating to a larger office premises in January 2026, reinforcing our commitment to serve you better.

Thank you for your continued trust and partnership.

Wishing you a Happy and Prosperous New Year 2026

Warm regards,

S K Hozefa

CEO

Do You Find This Interesting?

DISCLAIMER: Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.