Budget 2025: Big Tax Savings! See How Much You Can Save Under the New Slabs

The Indian government’s Union Budget 2025 has introduced significant changes to the income tax structure, aiming to reduce the tax burden for a broad range of taxpayers. Here’s a simplified breakdown of the new tax slabs and the potential savings:

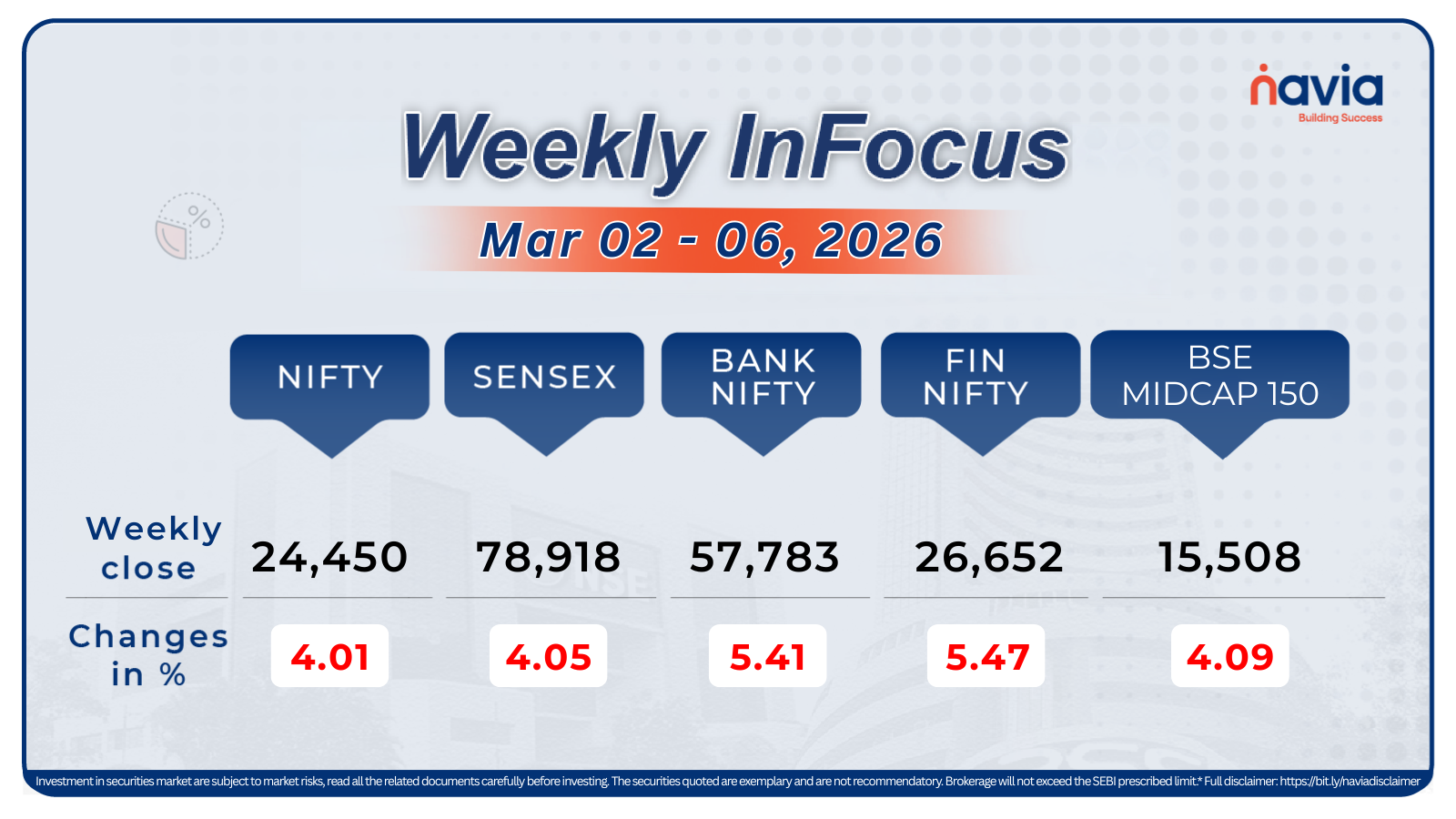

Revised Tax Slabs:

Who Benefits:

1. Income up to ₹12 lakh: No tax liability due to the revised structure and standard deductions.

2. Income between ₹12 lakh and ₹24 lakh: Tax reduction of approximately 25-31%.

3. Income above ₹24 lakh: Tax savings of up to ₹1.1 lakh.

Estimated Tax Savings:

| Total Income (₹) | Tax Under New Regime (₹) | Tax Under Old Regime (₹) | Savings (₹) |

| 5 lakh | 0 | 0 | 0 |

| 10 lakh | 0 | 50,000 | 50,000 |

| 12 lakh | 0 | 80,000 | 80,000 |

| 15 lakh | 1,05,000 | 1,40,000 | 35,000 |

| 20 lakh | 2,00,000 | 2,90,000 | 90,000 |

| 24 lakh | 3,00,000 | 4,10,000 | 1,10,000 |

| 30 lakh | 4,80,000 | 5,90,000 | 1,10,000 |

| 40 lakh | 7,80,000 | 8,90,000 | 1,10,000 |

Key Takeaway:

The updated tax regime offers substantial relief, especially for those earning up to ₹24 lakh annually. With zero tax for incomes up to ₹12 lakh and significant savings for higher earners, many may find the new structure more beneficial. It’s advisable to review your tax planning strategies to maximize benefits under these changes.

Do You Find This Interesting?

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.