Bonding Over Bonds: A Market Chat Amid Chennai’s Vibrance

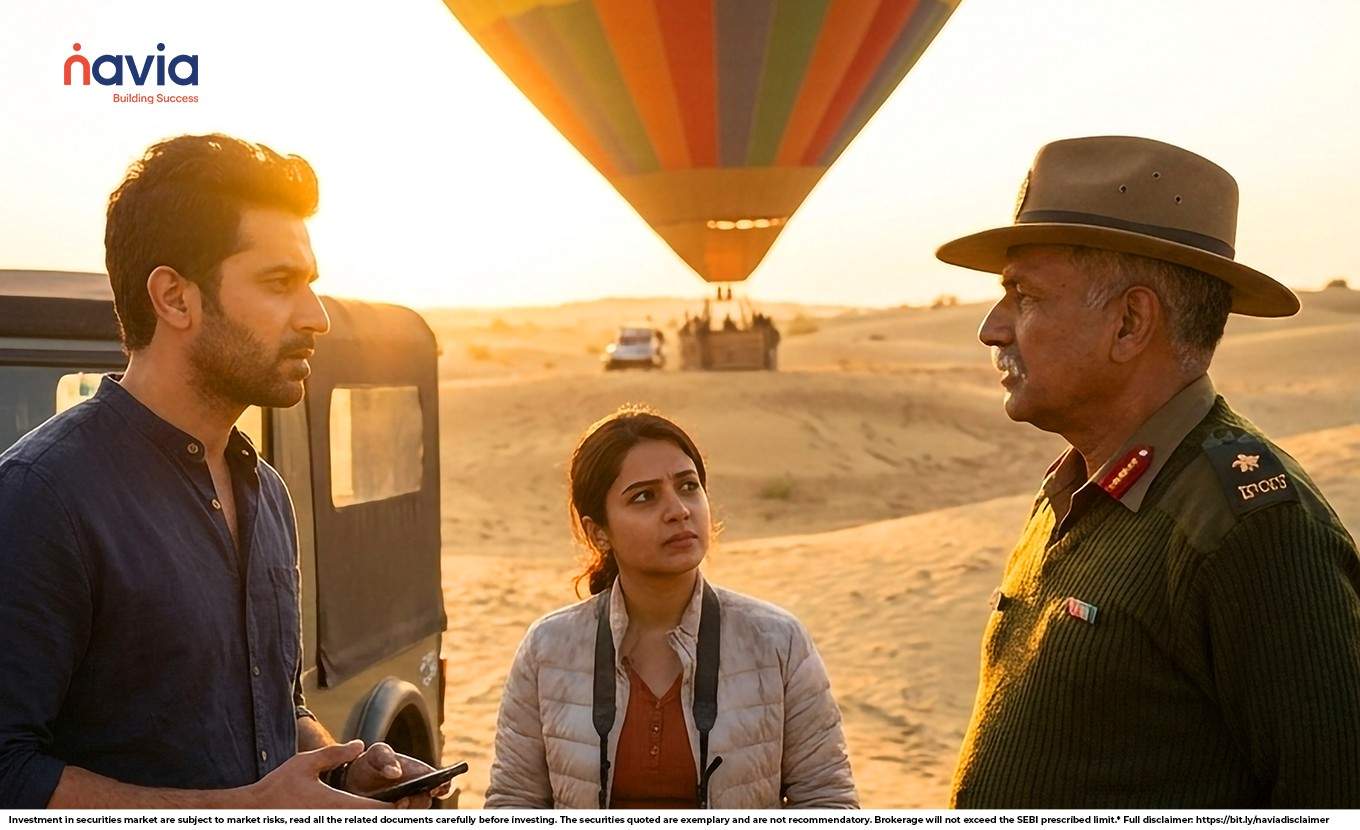

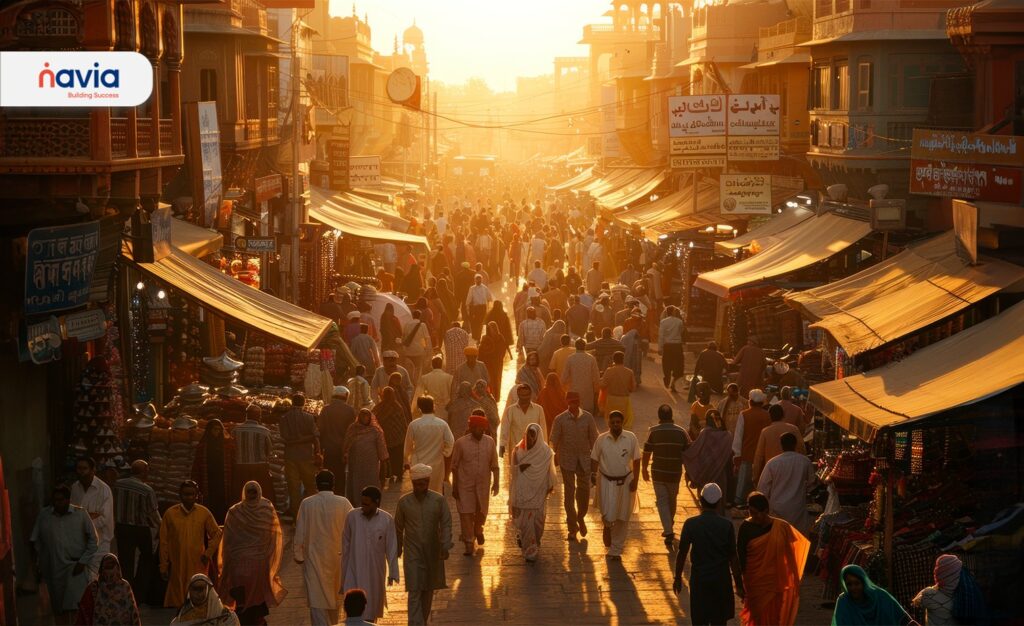

As the sun dipped below the horizon, casting a warm glow over the bustling streets of Chennai, Meghna and Mithun strolled through the local market, bags of fresh produce in hand. Amid the vibrant chaos of vendors shouting and the scent of spices lingering in the air, their conversation took a turn toward something more serious—finances.

Meghna, a financial expert, was eager to share her knowledge with Mithun, a young professional with a budding interest in investing. “Let me explain bonds to you,” she began, adjusting the lemons in her bag. “Think of bonds as loans. When governments or companies need funds, they issue bonds. We, as investors, buy those bonds, essentially lending them money. In return, we get regular interest payments and our investment back when the bond matures.”

“So, they’re like loans I give to companies or the government?” Mithun asked, intrigued.

“Exactly,” Meghna nodded. “And they’re generally safer than stocks because bonds offer more stability and predictable returns.”

Market Strolls to Financial Insights: Meghna and Mithun’s Chat

Mithun’s curiosity was piqued. “What kinds of bonds are out there?”

“Well, let’s start with Fixed-Interest Bonds,” Meghna said, holding up a bunch of spinach. “These bonds offer a steady, fixed interest rate throughout their term. No matter what happens in the market, you’ll know exactly how much you’re earning.”

“That sounds like a safe bet,” Mithun mused. “But what if I want something with more risk?”

Meghna smiled. “Then you have Floating-Interest Bonds, where the interest rate varies based on the market conditions. If the economy is doing well, you could earn more. But the downside is that in slower times, your returns could decrease.”

Mithun raised an eyebrow. “Okay, that does sound riskier. What else?”

“There are Inflation-Linked Bonds, which protect your returns from inflation. As prices rise, your interest payments adjust to ensure your earnings aren’t devalued by inflation,” Meghna explained.

“And what if I don’t want my money back at all?” Mithun joked.

Meghna chuckled. “In that case, you’d go for Perpetual Bonds. These bonds never mature, so you keep getting interest payments indefinitely, but you’ll never see your initial investment again.”

Stability and Safety: Why Bonds are Worth Considering

Mithun’s eyes widened in surprise. “That’s wild! Do people really invest in those?”

“Some do,” Meghna replied. “Especially those who like the idea of passive income flowing in forever.”

As they continued navigating through the crowd, Meghna shifted the conversation. “Now, let’s talk about why bonds are worth considering. For one, they offer stability. Stocks can be unpredictable, but bonds provide more consistent returns, which is great for risk-averse investors.”

“So, they’re like the safety net in a roller-coaster market?” Mithun quipped, adding some spices to his basket.

“Exactly! Plus, bonds help with diversifying your portfolio,” Meghna explained. “You don’t want all your investments in one place. Bonds spread the risk and give you a balanced approach.”

“That makes sense,” Mithun agreed, pausing to adjust his bag. “But are they completely safe?”

“Well, no investment is completely without risk,” Meghna admitted. “But bonds are generally lower-risk than stocks. And if the company or government that issued the bond goes bankrupt, bondholders get paid before shareholders, which adds an extra layer of security.”

Passive Income: Exploring Perpetual Bonds

“So, bonds are good if I want something more secure?” Mithun asked, his curiosity now in full bloom.

“Absolutely! They’re especially great for beginners who want a safer entry point into the world of investing,” Meghna said. “You may not see the same dramatic returns as stocks, but the steadier income makes them ideal for long-term planning.”

Mithun grinned. “You make a convincing case! Maybe I should start investing in bonds right away.”

Meghna laughed. “Not a bad idea, but don’t rush into anything. Just remember, bonds are a smart way to diversify and add stability to your portfolio.”

Diversifying Your Portfolio: The Role of Bonds in Investing

As their conversation wrapped up, Mithun realized how much he had learned in just a short walk through the market. The world of bonds was more nuanced than he’d ever imagined, and now, with a clearer understanding, he was ready to take the next step.

Kickstart Your Investment Journey: Open a Demat Account with Navia

And just like that, if you’re thinking about starting your investment journey, why not consider opening a Demat account with Navia? Navia offers unique advantages that make investing easier, whether you’re new to the market or an experienced trader.

● Zero Brokerage: Say goodbye to brokerage fees and keep more of your profits. This feature is perfect for active traders and beginners alike, giving you the freedom to trade without worrying about hidden costs.

● Superior Support: Navia provides round-the-clock assistance through WhatsApp and live chat, ensuring you get the help you need, whenever you need it.

● Exclusive Features: With Margin Trade Funding starting from 14.99% and access to US stocks, Navia lets you expand your portfolio globally, offering unique features not available elsewhere.

So, why wait? Open your Demat account with Navia today, and start trading with confidence, knowing you have the tools and support to succeed in your financial journey!

We’d Love to Hear from you