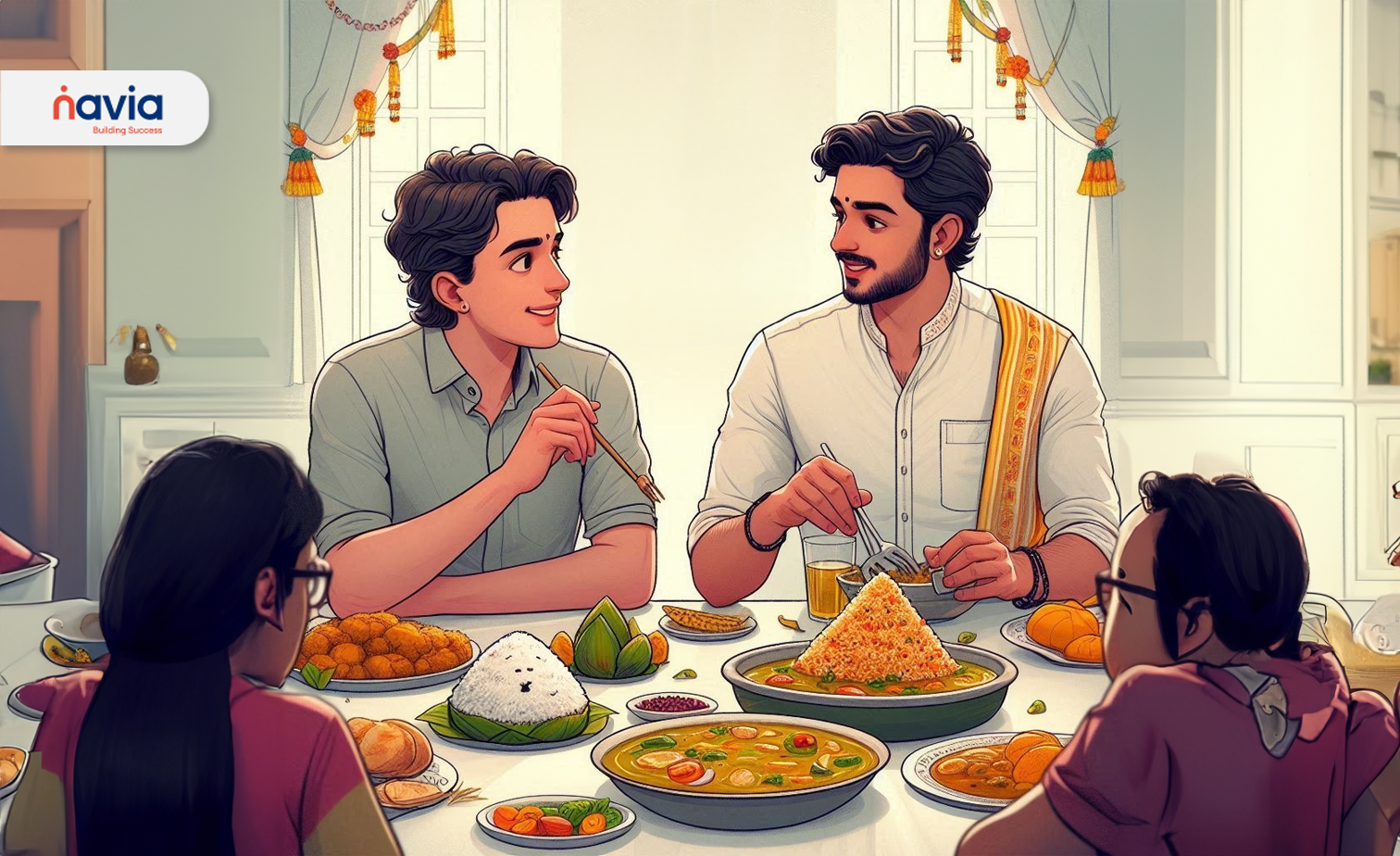

Arbitrage Explained Over Onam’s Sadhya: A Navia-Fueled Feast!

In the heart of Chennai, during the vibrant Onam celebrations, Ashish visited his friend Madhav’s house. The festive atmosphere was alive with the aroma of traditional sadhya dishes, and the room buzzed with laughter and conversation. Sitting down at the beautifully laid banana leaf, Ashish, always curious to learn more about finance, turned to Madhav, who was busy serving a generous portion of avial.

“Madhav, I’ve been hearing a lot about something called arbitrage,” Ashish began, breaking the conversation about the feast. “Can you explain it to me?”

What is Arbitrage? A Sadhya Analogy

Madhav paused with a smile, the sparkle of Onam festivities reflecting in his eyes. “Of course, Ashish. Think of arbitrage like discovering a rare ingredient for our sadhya at a local market, much cheaper than its usual price. It’s about finding price differences in different markets and using them to your advantage.”

Ashish leaned in, intrigued. “How does it work?”

“Imagine two different markets,” Madhav said, as he handed over a ladle of sambar. “The same stock is priced differently in both markets. An arbitrageur buys the stock where it’s cheaper and sells it where it’s more expensive—just like you’d buy a spice for less at one shop and sell it at a higher price at another.”

Spicing Up Arbitrage: Pure, Risk, and Dividend

Ashish, savoring the sadhya flavors, asked, “Is it like making money without any risk?”

“Not exactly,” Madhav said thoughtfully. “While it can be profitable, it’s not risk-free. As markets become more efficient, finding these opportunities becomes harder. Plus, you have to consider transaction costs and market fluctuations, just like you would account for the quality and cost of ingredients while preparing a feast.”

Ashish nodded, his interest growing. “Are there different types of it?”

“Yes,” Madhav replied, his eyes lighting up. “There’s pure arbitrage, where you buy and sell immediately, like grabbing a discounted item before anyone else. Risk arbitrage is when you bet on stock price changes due to events like mergers, much like predicting which ingredients will rise in price during a festival. Then there’s dividend arbitrage, where you buy stocks just before they go ex-dividend to earn the dividend, similar to planning your shopping around a seasonal sale.”

The Sweet and Sour of Arbitrage: Risk and Reward

Ashish was fascinated. “It sounds complex, but exciting! It must take a lot of expertise.”

“Indeed,” Madhav agreed, offering a bowl of payasam. “Arbitrage requires speed and precision, much like perfecting a sadhya. Arbitrageurs often use sophisticated tools and strategies to act quickly on these opportunities.”

“So, to sum it up,” Ashish said with a smile, “arbitrage is all about spotting price differences in markets, with types like pure, risk, and dividend arbitrage. It takes skill and knowledge to do it successfully.”

Madhav nodded approvingly. “Exactly. It can be rewarding, but it’s no shortcut to wealth. Like mastering a sadhya, it requires understanding, practice, and awareness of the risks involved.”

Trading Bliss: Navia’s Zero Brokerage Flavor

As the conversation shifted back to the Onam celebrations, Madhav transitioned the topic to trading platforms. “Just like this sadhya gives us a complete experience without hidden surprises, Navia’s zero brokerage model enhances the trading experience.”

“Zero brokerage means more of your profits stay with you,” Madhav explained. “Active traders can trade without worrying about fees, and beginners can explore the market with less financial pressure.”

Navia: Your One-Stop Feast for Seamless Trading

Ashish, connecting the dots, said, “So, while arbitrage is about using price differences with skill, Navia’s zero brokerage and advanced features offer traders a seamless, cost-effective way to engage with the market.”

Madhav nodded in agreement. “Exactly! Just like a well-prepared sadhya brings together the best flavors, Navia brings together the best tools for trading. It lets you focus on your financial goals without the burden of extra fees.”

A Festival of Wisdom: From Arbitrage to Trading Tools

As they enjoyed the last of the festive meal, Ashish left with not only a deeper understanding of arbitrage but also a newfound appreciation for how Navia could make his trading journey smoother and more rewarding. It was a day of celebration, knowledge, and new opportunities.

We’d Love to Hear from you