Return is Easy, But What About Risk? A Simple Guide to Risk-Adjusted Returns (with a 7% Risk-Free Rate)

What is Risk in Investing?

Risk is the volatility or uncertainty in your investment’s returns. Even if two stocks give the same average return, one might be much bumpier than the other. The bumpier one is riskier.

We use Standard Deviation to measure how much returns fluctuate. The more it jumps around, the higher the risk.

Example: Stock A vs Stock B (with Risk-Free Rate = 7%)

| Investments | Avg Annual Returns | Std. Dev (Risk) | Sharpe Ratio |

| Stock A | 12% | 10% | (12%-7%) ÷ 10% = 0.50 |

| Stock B | 15% | 20% | (15%-7%) ÷ 20% = 0.40 |

Even though Stock B gave a higher return, Stock A is more efficient — it generated more return per unit of risk.

Mutual Fund Comparison (Risk-Free Rate = 7%)

| Mutual Funds | 5Y CAGR | Std Dev | Sharpe Ratio |

| Fund X | 10% | 8% | (10%-7%) ÷ 8% = 0.375 |

| Fund Y | 12% | 15% | (12%-7%) ÷ 15% = 0.33 |

Fund X might be more “boring,” but it’s better adjusted for risk.

Options Vs ETFs (Using Sharpe with 7% Risk-Free)

Let’s say:

🠖 Nifty ETF gives a 10% return, risk (std dev) 7%

🠖 Nifty Call Option gives a 30% return, risk (std dev) 35%

| Investments | Returns | Std Dev | Sharpe Ratio |

| Nifty ETF | 10% | 7% | (10%-7%) ÷ 7% = 0.43 |

| Nifty Option | 30% | 35% | (30%-7%) ÷ 35% = 0.66 |

This time, the option appears better on a risk-adjusted basis — but it comes with higher capital loss risk and requires skill. That’s why Sharpe ratio must be interpreted carefully, especially in derivatives.

Why Risk-Adjusted Return Matters?

Imagine these two funds:

🠖 Fund A: 15% return with low volatility → more peace of mind

🠖 Fund B: 17% return with wild swings → stressful and riskier

Sharpe Ratio helps you pick quality over flash — consistent, predictable performers over wild returns.

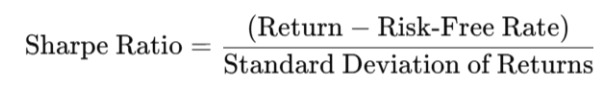

Sharpe Ratio Formula Refresher

In our examples, we used 7% as the risk-free rate — similar to an Indian 1-year FD.

Bottom Line

🠖 A high return means little unless you know how much risk was taken to earn it

🠖 Use Sharpe Ratio to compare investments more meaningfully

🠖 Look at this metric for mutual funds, stocks, and even derivatives

Do You Find This Interesting?

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.