Weekly Wrap-Up (DEC 25 – DEC 29, 2023)

The Indian market closed 2023 and its last week on a strong note, buoyed by expectations of 2024 rate cuts. It also marked a fresh record high during the week, fueled by FII buying and positive global cues.

The market bounced back from the losses of the previous week and ended the year 2023 on a positive note. In the last week of December, it hit new milestones thanks to a number of positive factors, including falling US bond yields, decreasing crude oil prices, increased buying from foreign investors, and expectations of rate cuts by major central banks in the early part of 2024.

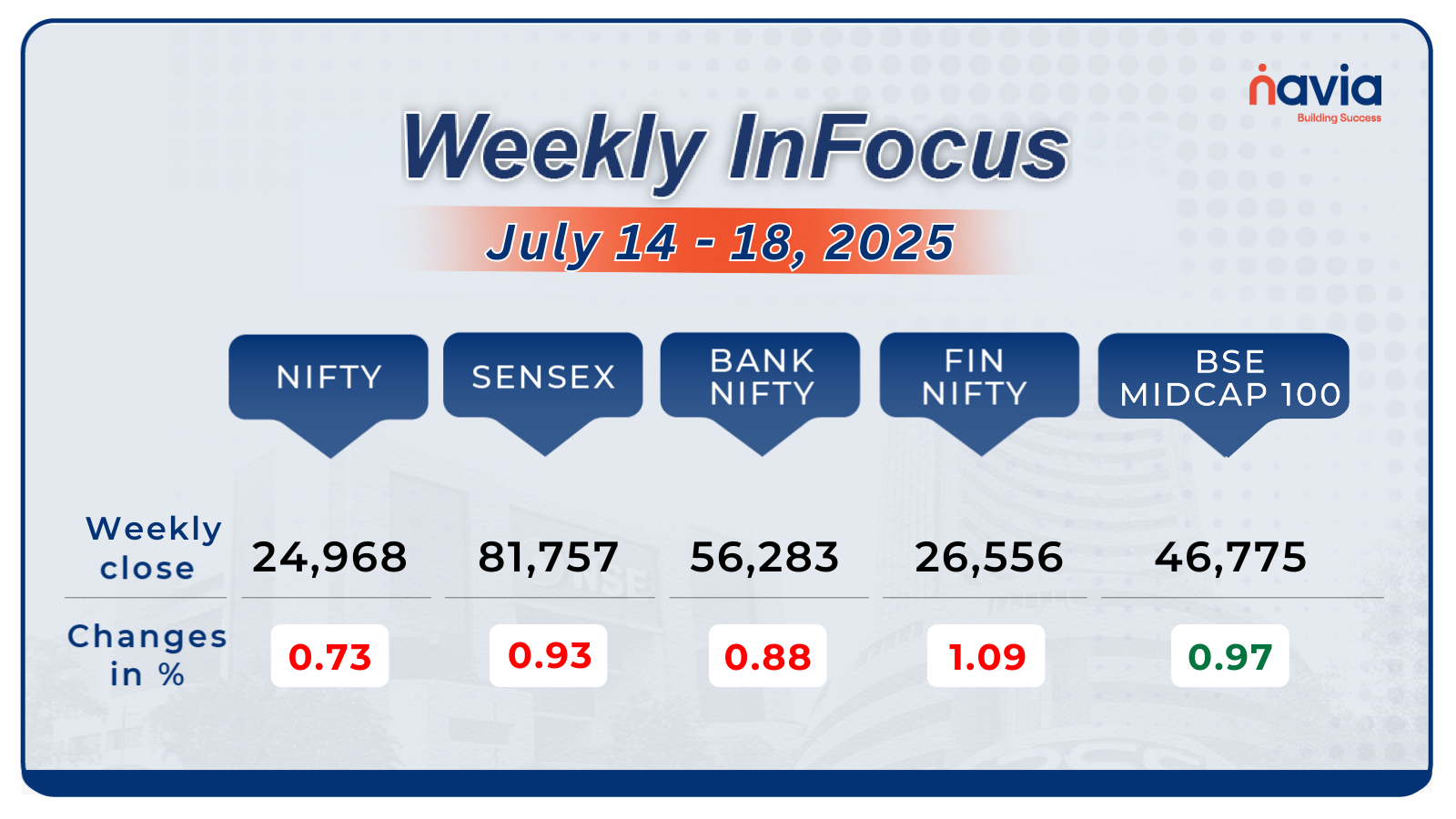

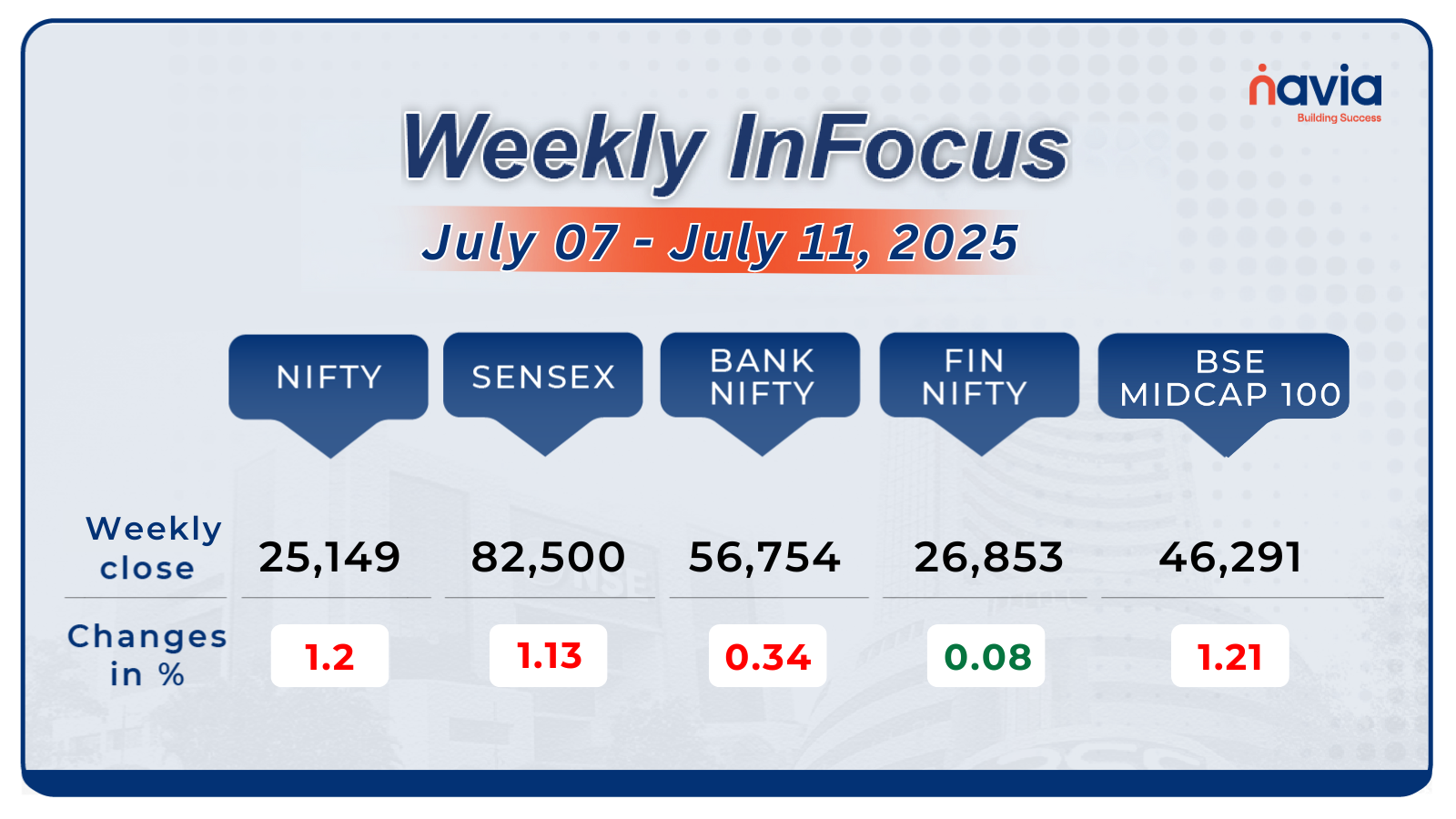

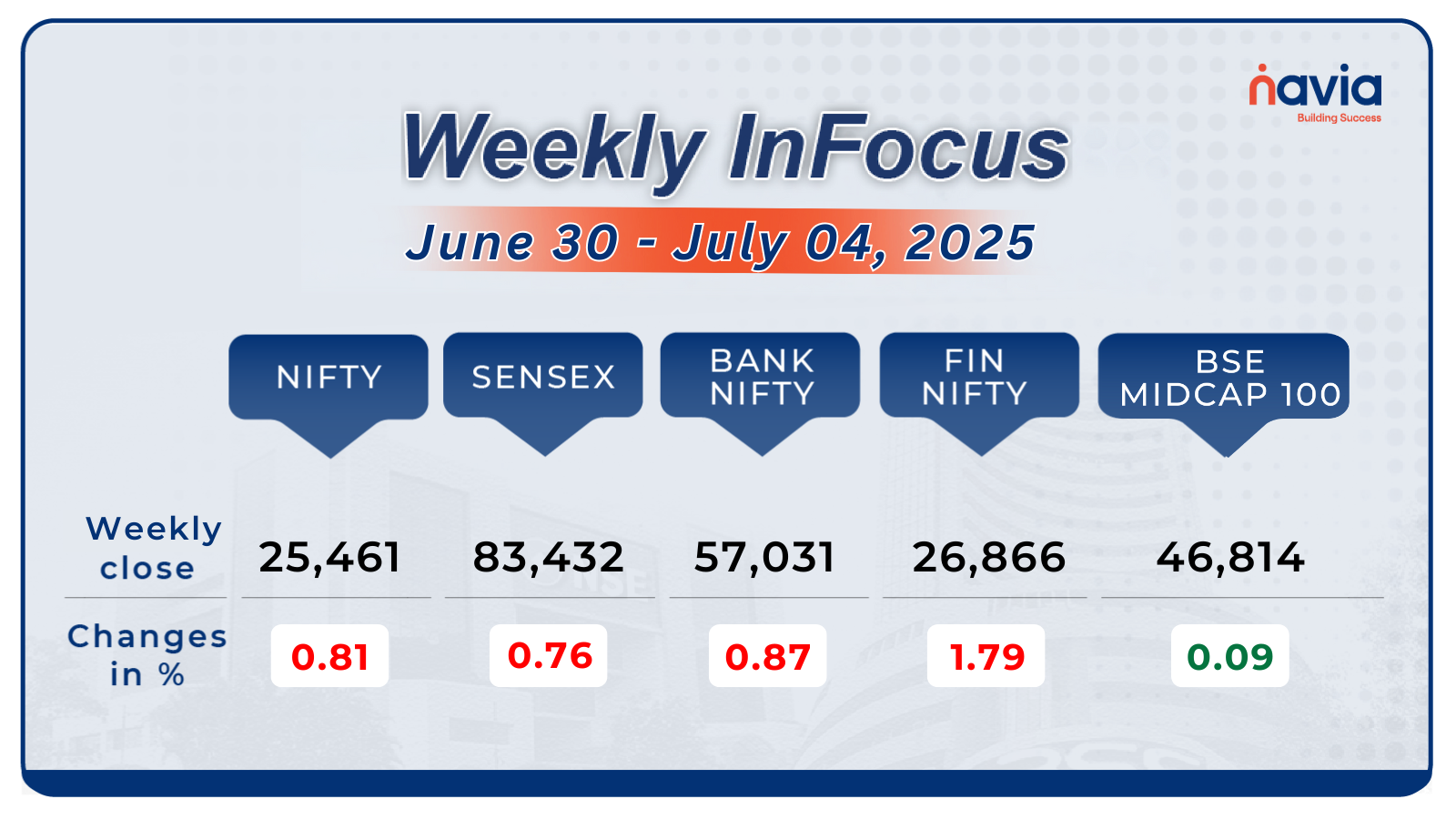

Indices Weekly Performance

During the week, the BSE Sensex climbed 1.59 percent, closing at 72,240, while the Nifty50 gained 1.79 percent, concluding at 21,731. On December 28, both the Sensex and Nifty reached new record highs of 72,484.34 and 21,801.45. For the entirety of 2023, they experienced respective increases of 18.7 and 20 percent.

Indices Analysis

NIFTY 50

Nifty remained sideways during the session, fluctuating within the range of 21650-21750. A doji pattern has formed on the daily chart, indicating indecisiveness in the market. This sentiment requires confirmation through a decisive breakout above 21750 or a breakdown below 21650. If it falls below 21650, the Nifty could potentially decline towards 21500. Conversely, if there’s sustained trading above 21750, the index might aim for 22000.

BANK NIFTY

Bank Nifty resistance is situated at 48300 on the higher end. As long as the index stays below 48300, the trend could lean towards favouring the bears. Moreover, a decisive drop below 48000 might drive the index below 47500. Conversely, a decisive move above 48300 could propel the index towards 48800-49000 on the higher end.

Nifty Chart

Nifty to hold the 21,300-21,500 zone in case of a dip during consolidation and reiterate our positional target of 22,150 level. Participants should stay focused on the selection of stocks and prefer index majors.

Now with N Coins, Navia customers can actually #Trade4Free.

INDIA VIX

The India VIX value of 14.50 increased by 5.80%. showing market volatility increased

Refer your Friends and family and GET 500 N Coins.

Use N Coins to Redeem all Charges. #Trade4Free.

Sectoral Performance

On the sectoral front, BSE Telecommunication witnessed a 4.82 percent increase, BSE Auto also saw a 4.33 percent rise, and BSE Metal similarly added 4.07 percent. Additionally, the BSE FMCG index recorded a 3.18 percent gain. Conversely, the BSE Information Technology index was down by 0.53 percent.

FII & DII Weekly Activity

Throughout the week, Foreign Institutional Investors (FIIs) acquired equities amounting to Rs 8,648.96 crore, and Domestic Institutional Investors (DIIs) also made equity purchases totaling Rs 666.06 crore. However, for the month of December, FIIs invested Rs 31,959.78 crore in equities, while DIIs bought equities worth Rs 12,942.25 crore.

Global Market

US stocks closed modestly lower on Friday, the last trading day of 2023, capping a robust year-end rally as investors eyed easier monetary policy in the year ahead. The stock market has seen remarkable upward momentum in the closing months of the year, powering all three major indexes to monthly, quarterly, and annual gains.

The Dow Jones Industrial Average rose 0.81%, to 37,689.54, the S&P 500 gained 0.33%, to 4,769.83 and the Nasdaq Composite rose 0.12%, to 15,011.35.

Currency Indices

The Indian rupee posted marginal losses against the US dollar, as the domestic unit closed at 83.20 in the week ended December 29 against the December 22 closing of 83.15.

Poll of the week

Last week’s poll:

Q) On which date is the stock’s price reduced?

a) Ex-dividend date

b) Record date

c) Payment date

Last week’s poll answer: a) Ex-dividend date

Commodity Market

Over the past 6 trading sessions, natural gas has shown an uptrend movement, and in the previous session, natural gas closed up by 1.93%, forming a bullish candle. Natural gas futures extended gains as the EIA reported a bigger-than-expected draw on inventories. The current R1 is placed at 219.40, and S1 is placed at 203.3.

Over the past three weeks, crude oil has exhibited an uptrend in movements. However, in the previous weekThe India VIX value of 14.50 increased by 5.80%., crude oil opened with a gap down and throughout the session showed selling pressure. This was attributed to weaker oil prices stemming from easing concerns about shipping disruptions in the Red Sea. The market further extended losses after the EIA report, which dragged the crude oil price down and erased the gains made over the past five trading days. The current resistance level (R1) is placed at 6250, while the support level (S1) is placed at 6047.

Blogs of the week

Get TP Coins

Did you Know?

“NSE-BSE Price Variations = Profitable Arbitrage!”

Did you know that the difference in stock prices on NSE and BSE can create opportunities for professional traders to engage in profitable arbitrage? Buying shares from NSE and selling them on BSE at high speeds using extremely fast supercomputers is a strategy, but it’s challenging for regular retail investors to execute successfully. Interestingly, you can indeed buy shares from both NSE and BSE simultaneously.

The National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) are two major stock exchanges in India. The prices of stocks on these exchanges can sometimes differ due to various factors such as market demand, liquidity, and trading volumes.

Professional traders, especially those with access to high-frequency trading and extremely fast supercomputers, may exploit these price differences through a strategy known as arbitrage. In arbitrage, they buy a stock at a lower price on one exchange and simultaneously sell it at a higher price on another, thereby making a profit from the price gap.

This strategy requires swift execution and advanced technology to capitalize on the fleeting price differences. However, it’s crucial to note that this practice is intricate and not easily achievable for regular retail investors. The high-speed nature of arbitrage, along with transaction costs and potential risks, makes it a realm largely dominated by institutional or sophisticated traders.

So, while the concept of buying shares from NSE and BSE simultaneously is feasible, successfully implementing arbitrage strategies demands a level of expertise and infrastructure that might be beyond the reach of the average retail investor.

Refer your Friends & Family and GET 500 N Coins.

Use N Coins to Redeem all Charges. #Trade4Free.

Happy Learning,

Team Navia

We’d Love to Hear from you-