Navia Weekly Roundup (SEP 09 – SEP 13, 2024)

Table of Contents

Week in the Review

Market hits new record high; Rupee edges up slightly

The Indian market rebounded from last week’s losses, rising 2 percent to reach a new record high in the volatile week ending September 13, driven by positive global and domestic data, along with strong support from both domestic and foreign investors.

Indices Analysis

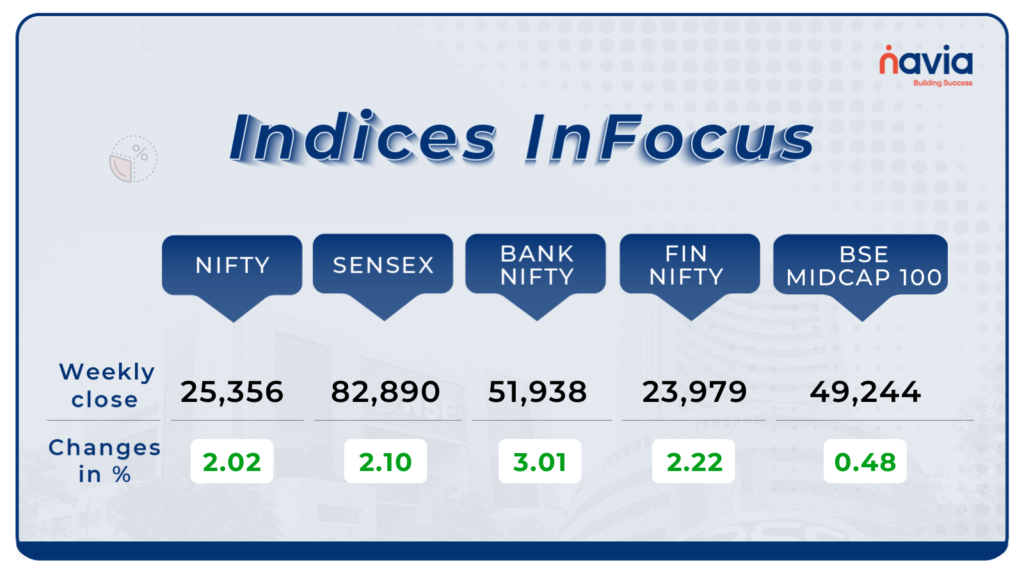

This week, BSE Sensex rose 2.10 percent to finish at 82,890.94, while the Nifty50 index added 2.02 percent to close at 25,356.50. On September 12, the Nifty50 and BSE Sensex touched a fresh record high of 25,433.35 and 83,116.19, respectively.

The BSE Mid-cap Index gained 0.48 percent, driven by stocks like Gujarat Fluorochemicals, Oracle Financial Services Software, Linde India, JSW Energy, and Jindal Steel & Power. On the downside, Power Finance Corporation, REC, Oil India, Aarti Industries, Petronet LNG, Whirlpool of India, Hindustan Petroleum Corporation, and Emami were the major losers.

Interactive Zone!

Last week’s poll:

Q) _________ is the National Securities Exchange’s promoter.

a) The Life Insurance Company (LIC) and the General Insurance Company (GIC)

b) State Bank of India (SBI).

c) Industrial Development Bank of India (IDBI)

d) All of the aforementioned.

Last week’s poll Answer: d) All of the aforementioned.

Poll for the week: The worth of a derivative contract ________ throughout the term of the contract.

Sector Spotlight

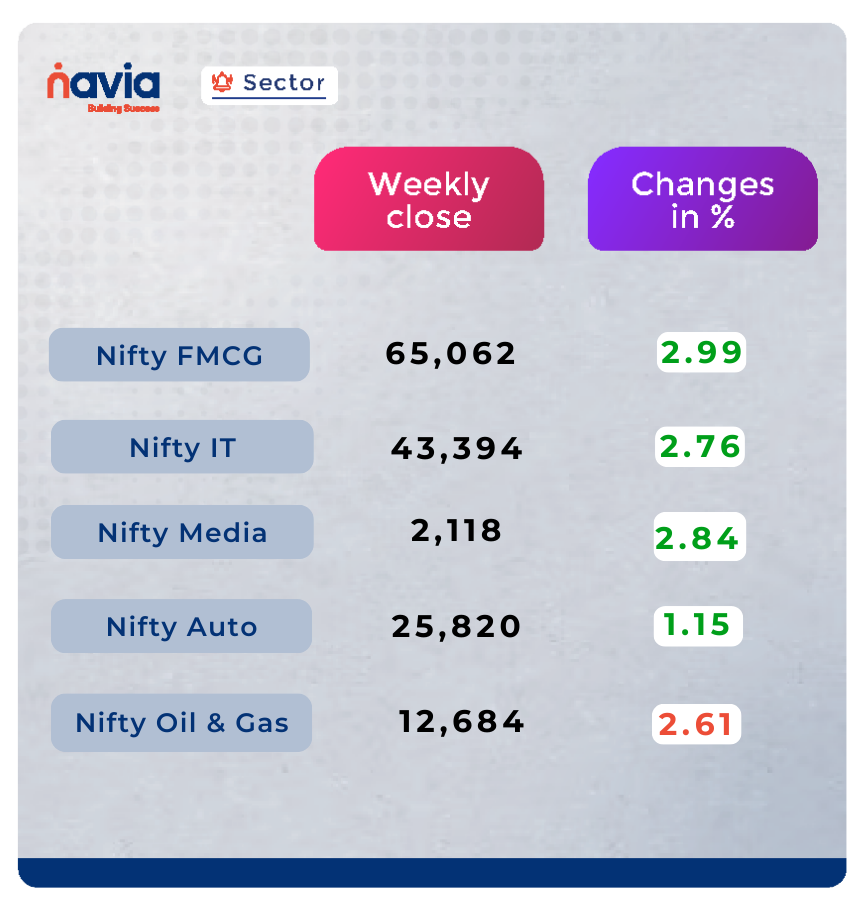

On the sectoral front, all indices closed in the green except Oil & Gas, which fell 2.61 percent. Nifty FMCG rose 2.99 percent, Nifty Information Technology gained 2.76 percent, and Nifty Media climbed 2.84 percent.

Explore Our Features!

Learn how to quickly shortlist the best stocks using the Navia app! Our step-by-step tutorial shows you how to leverage powerful features for efficient and effective stock selection.

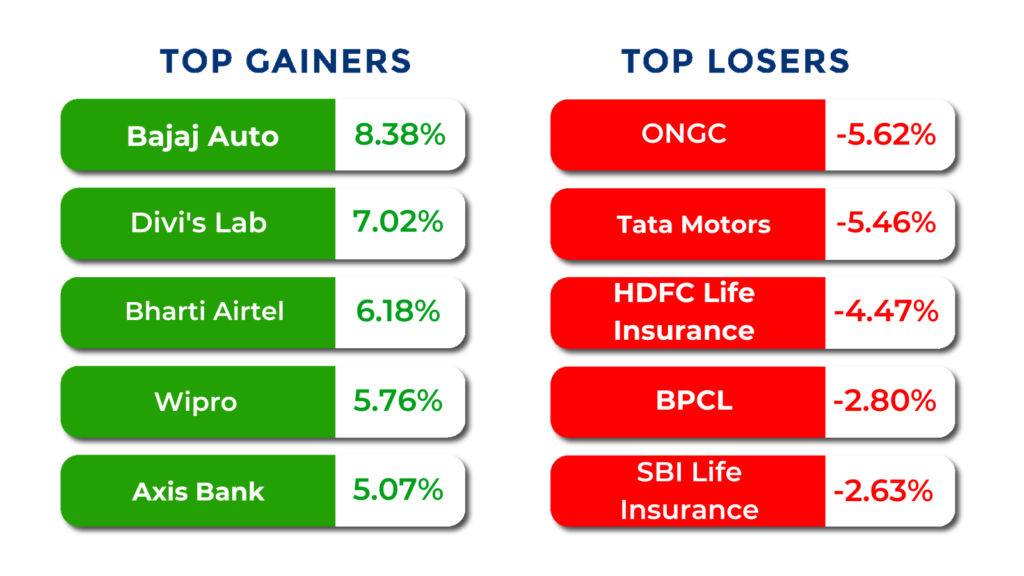

Top Gainers and Losers

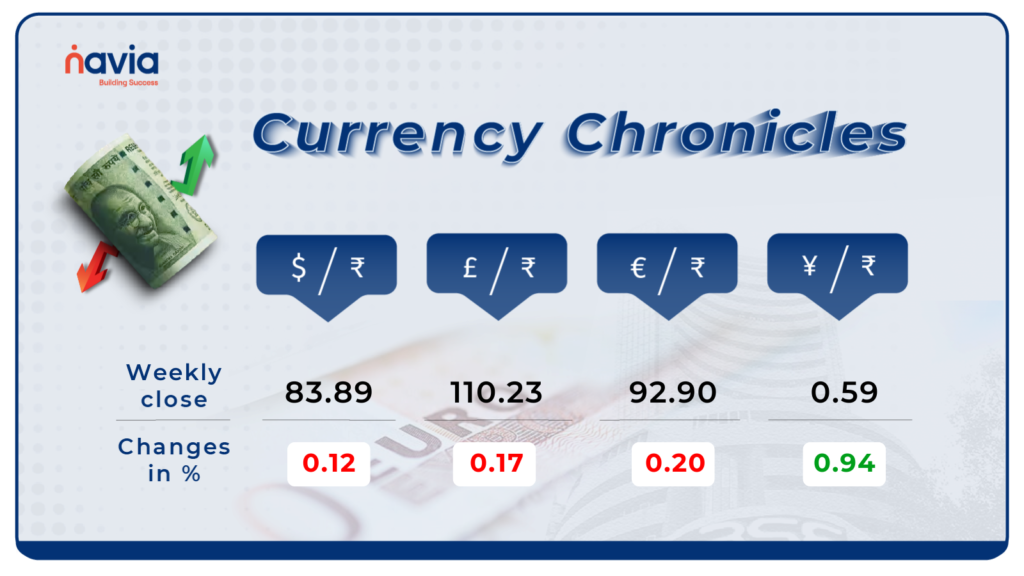

Currency Chronicles

USD/INR:

This week, the Indian rupee managed to recover from last week’s losses, closing marginally higher against the US dollar. The rupee ended at ₹83.89 on September 13, improving slightly from its September 6 close of ₹83.94. This subtle gain reflects cautious optimism in the market, though volatility remains a concern.

EUR/INR:

The EUR/INR exchange rate witnessed a slight dip of -0.20% for the week, with the euro closing at ₹92.90. Despite the minor decline, market sentiment remains bullish, pointing to positive expectations for the euro’s performance in the coming weeks.

JPY/INR:

The JPY/INR exchange rate saw a notable increase of 0.94% over the week, ending at ₹0.595502. This rise highlights the yen’s strength against the rupee, supported by a bullish market sentiment that suggests continued upward momentum in the short term.

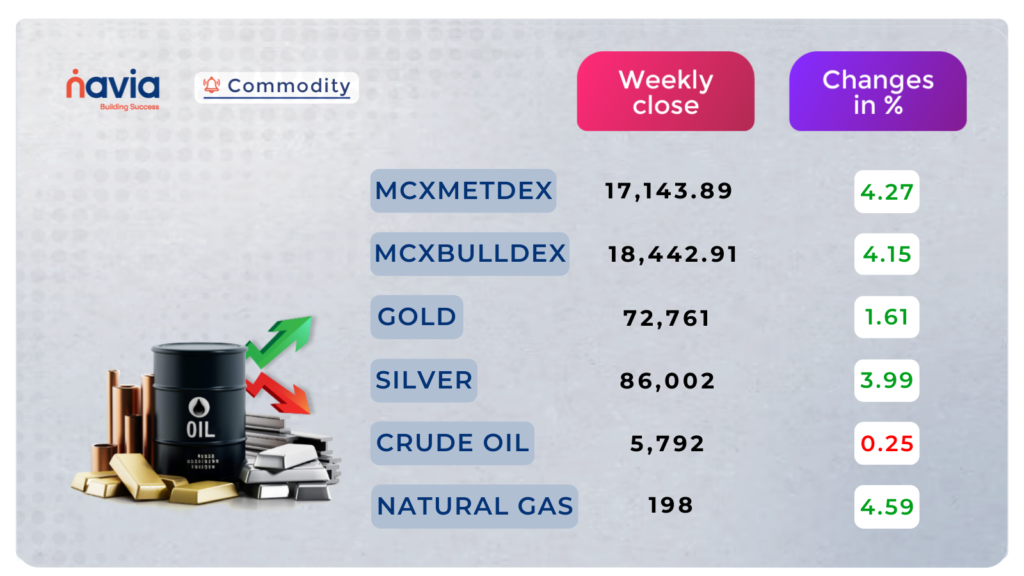

Commodity Corner

Gold has broken out of the consolidation range, showing a strong uptrend in the previous session and closing 1.61% positive. The dollar weakened amid the prospect of a reduction in U.S. interest rates, while palladium has gained 15% so far this week. The current resistance level (R1) is at 73811, and the support level (S1) is at 72279

Currently, natural gas is experiencing an uptrend rally. it closed 4.59% positive, and it is experiencing buying interest, buoyed by a below-estimate storage build and expectations of limited impact on demand The current resistance level (R1) is at 209 while the support level (S1) is at 187

Over the last 4 trading sessions, silver has experienced a strong uptrend rally, closing 3.99% positive. This was underpinned by speculations that the US Federal Reserve will deliver a supersized 50 basis point rate cut next week. The current resistance level (R1) is at 87,192, and the support level (S1) is at 83,834

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blogs of the Week!

Anatomy of a Bull Call and Bear Put Spread: A Comprehensive Guide for Options Traders

Master Bull Call & Bear Put Spreads! Discover key strategies and tips to boost your trading game with our quick guide. Dive in now!

Alex’s Short Selling Adventure: A Tale of Profit and Peril

Explore how Alex’s Risky Bet on InnovateX Could Have Been a Win with Navia! Read more to find out!

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?