Anatomy of a Bull Call and Bear Put Spread: A Comprehensive Guide for Options Traders

Table of Contents

Options trading offers a wide array of strategies that allow traders to tailor their risk and reward profiles according to market conditions. Among these strategies, the Bull Call Spread and Bear Put Spread are two popular methods for capitalizing on directional market moves while managing risk. These strategies involve using multiple options to create a more defined profit and loss structure. In this blog, we’ll explore the anatomy of a bull call spread and a bear put spread, explaining how they work, when to use them, and providing easy-to-understand examples. We’ll also discuss how you can use the Navia Mobile App to implement these strategies effectively.

What is a Bull Call Spread?

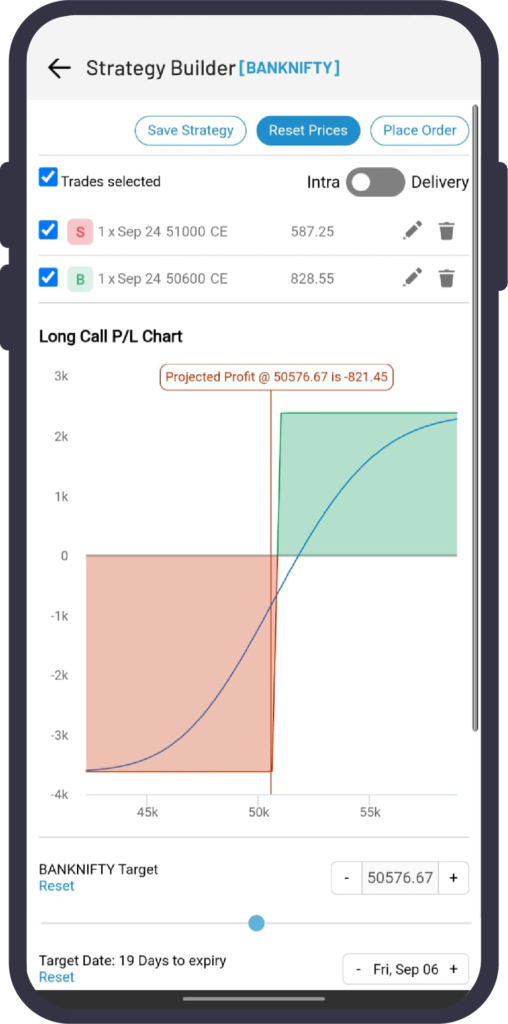

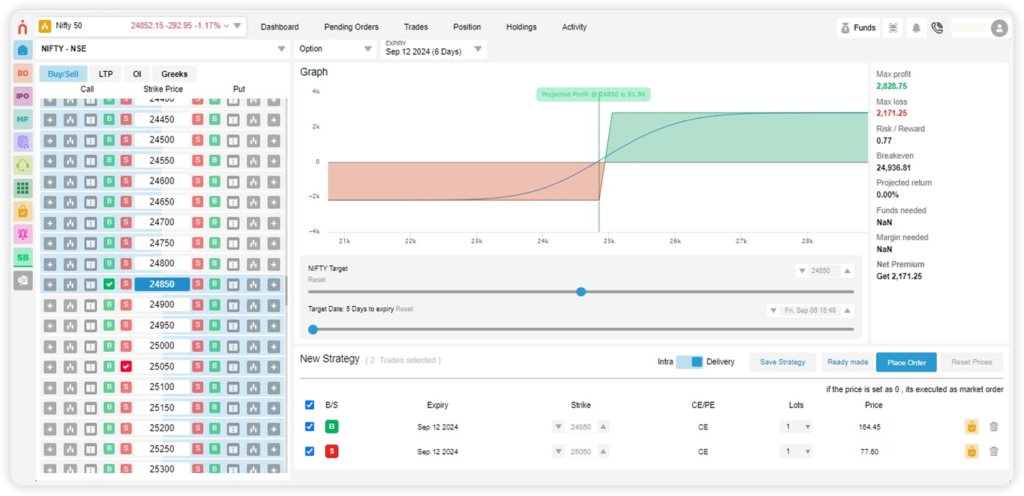

A bull call spread is a bullish options strategy that involves buying a call option with a lower strike price and selling another call option with a higher strike price, both with the same expiration date. This strategy is used when you expect the price of the underlying asset to increase moderately.

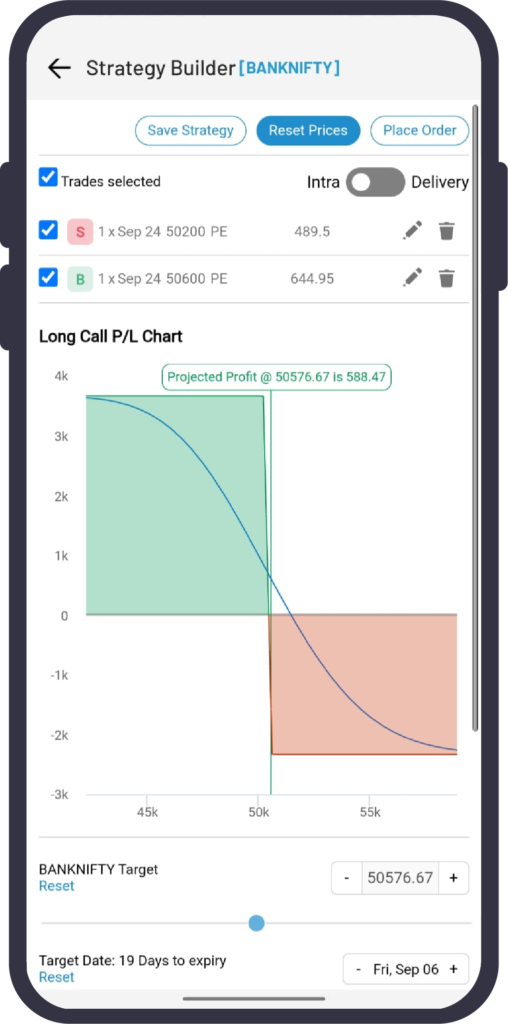

Snapshot of Bull Call Spread via Navia Mobile App

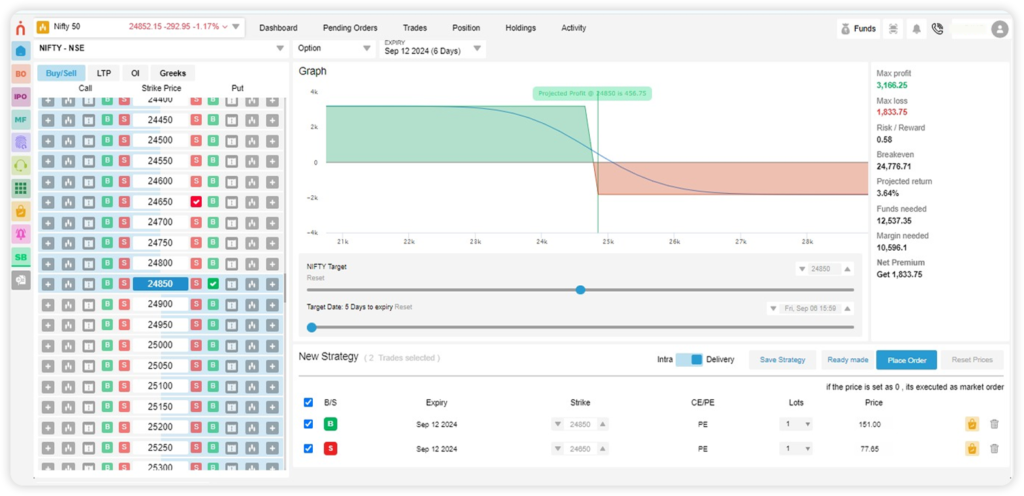

Snapshot of Bull Call Spread via Web Platform

How Does a Bull Call Spread Work?

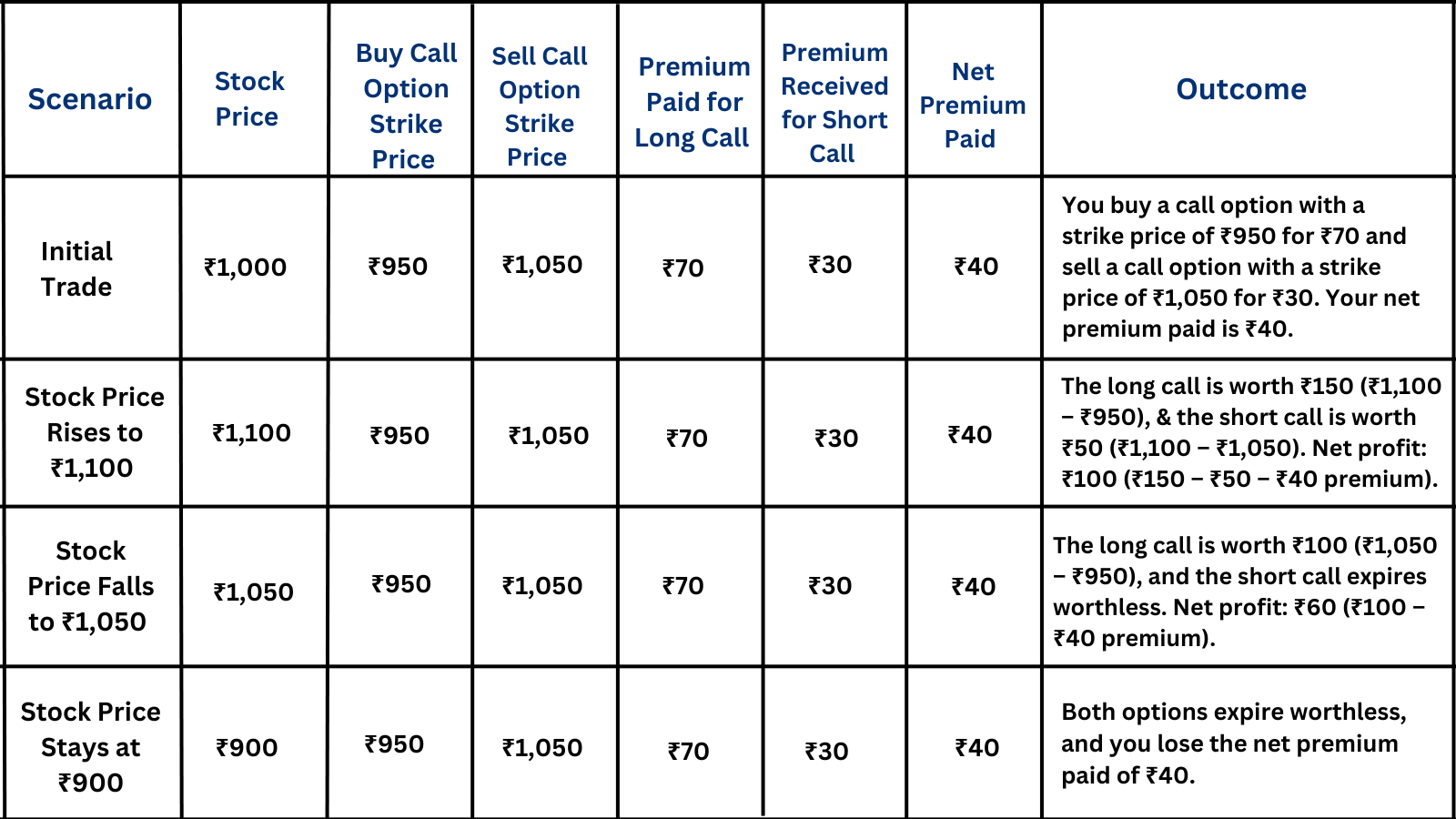

When you enter a bull call spread, you purchase a call option with a lower strike price (the long call) and sell a call option with a higher strike price (the short call). The premium received from selling the call option helps offset the cost of buying the call option, reducing the overall cost of the trade. However, this also limits the maximum profit potential, as the profit is capped at the difference between the strike prices minus the net premium paid.

Example of a Bull Call Spread

Let’s walk through a practical example of a bull call spread:

What is a Bear Put Spread?

A bear put spread is a bearish options strategy that involves buying a put option with a higher strike price and selling another put option with a lower strike price, both with the same expiration date. This strategy is used when you expect the price of the underlying asset to decrease moderately.

Snapshot of Bear Put Spread via Navia Mobile App

Snapshot of Bear Put Spread via Web Platform

How Does a Bear Put Spread Work?

When you enter a bear put spread, you purchase a put option with a higher strike price (the long put) and sell a put option with a lower strike price (the short put). The premium received from selling the put option helps reduce the cost of buying the put option, minimizing the overall cost of the trade. However, the maximum profit is capped at the difference between the strike prices minus the net premium paid.

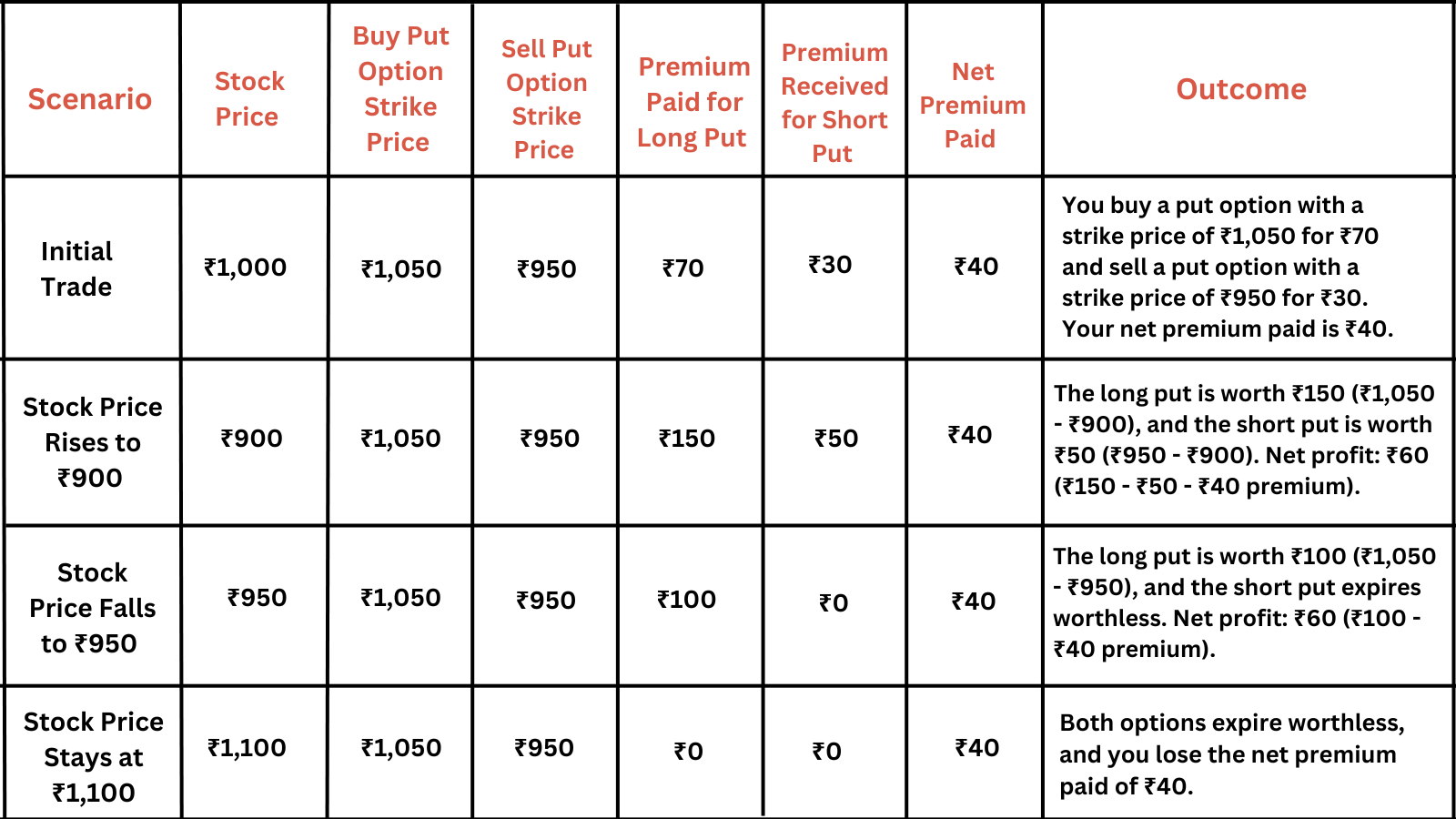

Example of a Bear Put Spread

Let’s explore an example of a bear put spread:

When to Use a Bull Call Spread

A bull call spread is most effective in the following scenarios:

🔷 Moderate Bullish Outlook: If you expect the underlying asset to rise moderately but want to limit your risk, a bull call spread allows you to benefit from the upward move while capping potential losses.

🔷 Cost-Conscious Trading: The premium received from selling the call option helps offset the cost of buying the call option, making this strategy more affordable than simply buying a call option outright.

🔷 Defined Risk and Reward: This strategy offers a clear risk-reward profile, which is attractive to traders who prefer knowing their maximum potential profit and loss in advance.

When to Use a Bear Put Spread

A bear put spread is most effective in the following scenarios:

🔸 Moderate Bearish Outlook: If you expect the underlying asset to decline moderately but want to limit your risk, a bear put spread allows you to profit from the downward move while capping potential losses.

🔸 Hedging Existing Positions: This strategy can be used to hedge against potential losses in a long stock position, providing downside protection while minimizing the cost.

🔸 Defined Risk and Reward: Like the bull call spread, the bear put spread offers a defined risk-reward profile, making it easier to manage your trades.

| Strategy | Outlook | Action | Risk | Reward | Best Used When |

| Bull Call Spread | Moderately Bullish | Buy lower strike call, sell higher strike call | Limited to net premium paid | Capped at difference between strikes minus premium | Expecting a moderate rise in the underlying asset’s price |

| Bear Put Spread | Moderately Bearish | Buy higher strike put, sell lower strike put | Limited to net premium paid | Capped at difference between strikes minus premium | Expecting a moderate decline in the underlying asset’s price |

Benefits of Bull Call and Bear Put Spreads

🔷 Reduced Cost: Both strategies involve selling an option to offset the cost of buying another option, making them more cost-effective compared to buying options outright.

🔷 Defined Risk: The maximum risk is limited to the net premium paid, making these strategies attractive for risk-averse traders.

🔷 Defined Profit Potential: The maximum profit is capped, providing a clear understanding of the potential reward, which is helpful for planning and managing trades.

Drawbacks of Bull Call and Bear Put Spreads

➝ Capped Profit: While these strategies limit risk, they also cap the potential profit, which may not be appealing in cases of strong market moves.

➝ Time Decay: Both strategies are subject to time decay (Theta), which can erode the value of the options as they approach expiration.

➝ Requires a Specific Market Outlook: These strategies are most effective when you have a moderately bullish or bearish outlook. If the market does not move as expected, the strategies may result in a loss.

How to Use Navia Mobile App for Better Option Trading

The Navia Mobile App is an excellent tool for implementing bull call and bear put spreads effectively. Here’s how you can use the app to enhance your trading experience:

🔷 Strategy Builder: The Navia Mobile App offers a built-in strategy builder that allows you to create custom bull call and bear put spreads. You can experiment with different strike prices and expiration dates to find the best combination for your market outlook.

🔷 Real-Time Data: Access real-time market data, including underlying asset prices and option premiums. This information is crucial for making informed decisions when entering or adjusting spread positions.

🔷 Option Calculator: Use the app’s option calculator to estimate the potential profitability of your bull call or bear put spread. Input the relevant data and analyze different market scenarios to understand the risks and rewards.

🔷 Portfolio Tracking: Monitor the performance of your spread positions in real-time. The app allows you to track your trades and make adjustments as needed based on market movements.

Conclusion

Bull call and bear put spreads are powerful options strategies that allow traders to capitalize on moderate market movements while managing risk. By understanding the anatomy of these spreads, when to use them, and how they work, you can better navigate the complexities of options trading and achieve your financial goals.

The Navia Mobile App enhances your ability to implement these strategies by providing real-time data, an option calculator, and a strategy builder. Whether you’re a beginner or an experienced trader, using the Navia Mobile App can help you execute bull call and bear put spreads more effectively, ensuring you make the most of your trading opportunities. Happy trading!

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.

We’d Love to Hear from you-