Navia Weekly Roundup (AUGUST 26 – AUGUST 30, 2024)

Table of Contents

Week in the Review

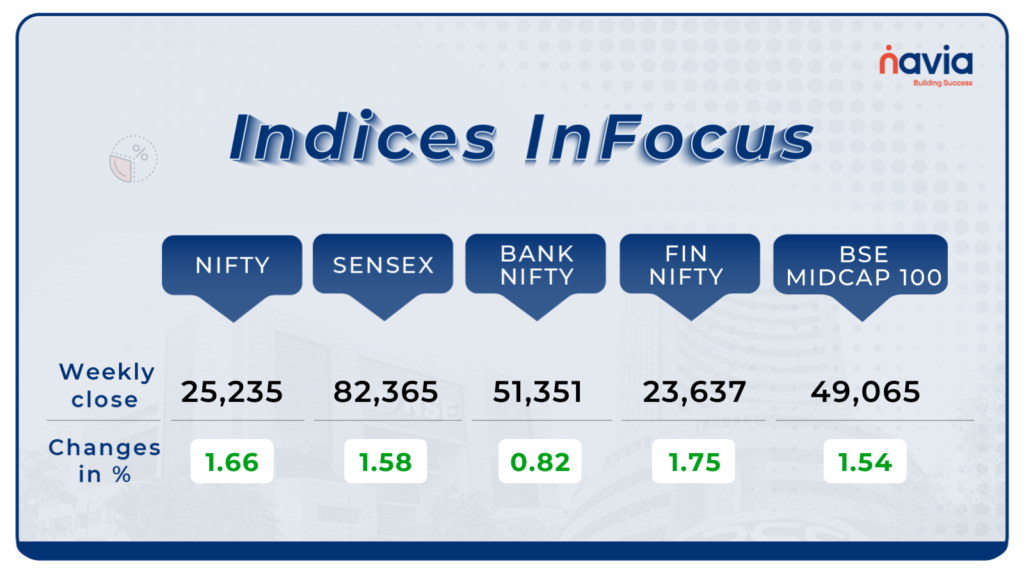

The winning run of the benchmark indices in the preceding week got extended further in the last week of August. As a result, NIFTY and SENSEX registered new highs in the last trading session of the month.

Indices Analysis

The NIFTY50 ended the week on a bullish note, closing above its previous all-time high of 25,078. While the broader trend remains positive, this previous high will now serve as an immediate support zone for the index.

During the recent twelve-day rally, the NIFTY50 has left bullish gaps around the 25,200 and 24,850 levels. In the event of a dip, traders should closely monitor price action around these zones, as a rebound could attract fresh buying interest.

Interactive Zone!

Last week’s poll:

Q) ____ is not the concern of the Securities and Exchange Board of India (SEBI)

a) Ensure that businesses operate in an ethical manner

b) Investor protection is crucial

c) Raising the earnings of the company’s shareholders

d) Brokers promoting efficient services

Last week’s poll Answer: c) Raising the earnings of the company’s shareholders

Poll for the week: The feature of shares in primary markets that makes it very easy to sell recently issued securities is known as____.

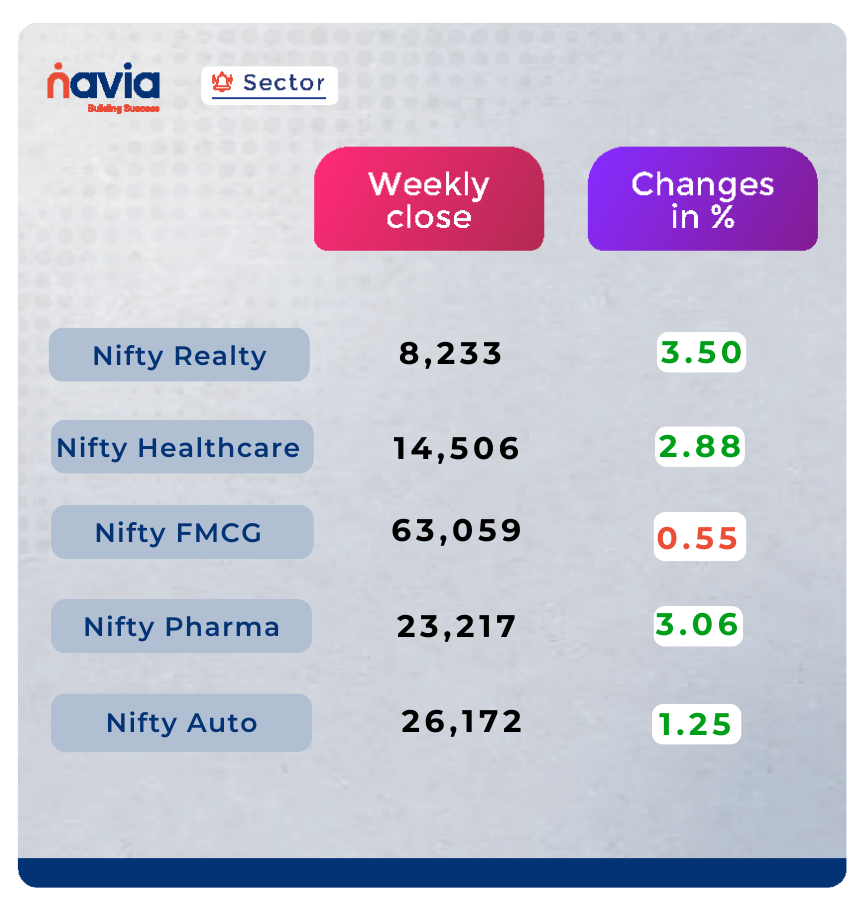

Sector Spotlight

All major indices ended in the green except for FMCG, which slipped marginally by 0.55%. Realty was up (+3.50%) and Healthcare (+2.88%) led the gains.

Explore Our Features!

Stay informed about market restrictions with Navia! Learn how to quickly check which securities are under a ban using the Navia app.

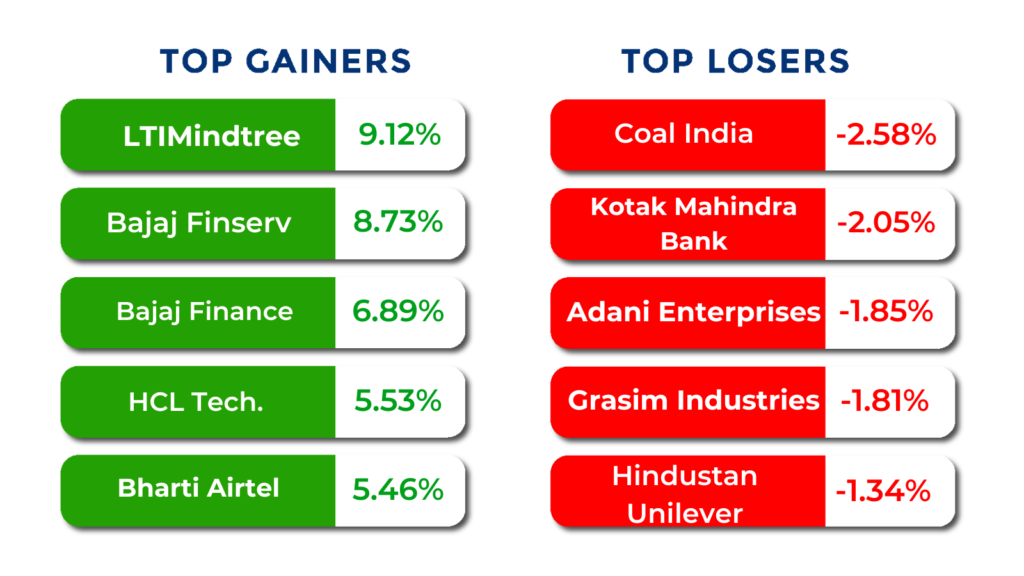

Top Gainers and Losers

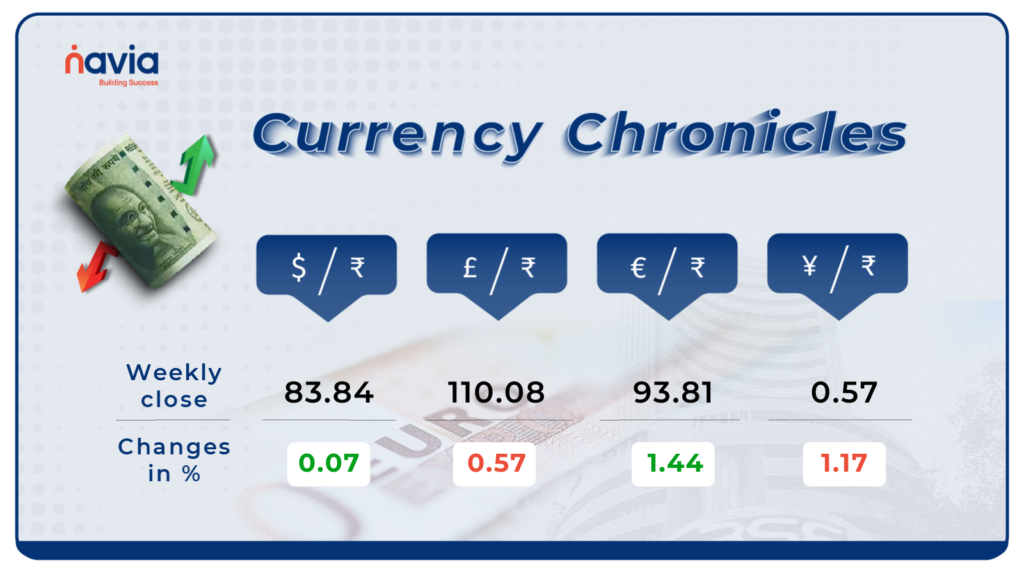

Currency Chronicles

USD/INR:

The Indian rupee strengthened slightly against the US dollar, closing at ₹83.84, up by 0.07% for the week. Market sentiment remains bullish, supporting the rupee’s modest gains.

EUR/INR:

The euro saw a decrease of 1.44% against the rupee, ending the week at ₹93.81. Despite this decline, the market sentiment for EUR/INR remains bullish, reflecting continued investor confidence.

JPY/INR:

The Japanese yen fell by 1.17% for the week, reaching ₹0.568515 by the end of the week. Bullish sentiment persists in the JPY/INR market, indicating a stable outlook despite the drop.

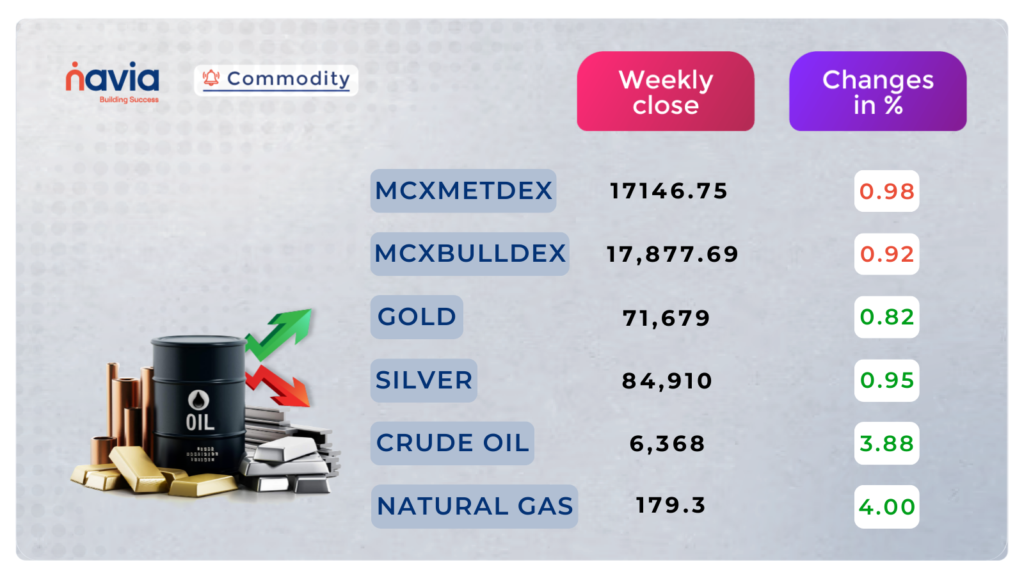

Commodity Corner

Currently, gold is experiencing positive consolidation at higher levels, driven by rising bets on a Federal Reserve rate cut next month. Traders are also awaiting key U.S. inflation data for further guidance. The current resistance level (R1) is at 72,903, and the support level (S1) is at 71,158

Currently, crude oil is experiencing positive momentum due to supply concerns in the Middle East, although signs of weakened demand are limiting gains. The current resistance level (R1) is placed at 6,470, and the support level (S1) is placed at 6,217.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blogs of the Week!

Exciting Updates in the Navia App: Your Feedback, Our Enhancements!

Discover the latest updates in the Navia App, designed to enhance your trading experience. Check out the blog for all the new features and improvements!

SEBI’s Consultation Paper on Index Derivatives Framework

Dive into SEBI’s latest proposals to boost market stability and investor protection. Discover the key changes and how they might impact your trading. Read more in our blog!

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?