Navia Weekly Roundup (AUGUST 12 – AUGUST 16, 2024)

Table of Contents

Week in the Review

Indian markets showed resilience despite bad job data and unchanged RBI rates. During the earnings season, FMCG stocks rallied steadily, and the Pharma sector saw significant gains. The Nifty index remained range-bound but positive, with key levels to watch at 24,250 on the downside and 24,750 as resistance.

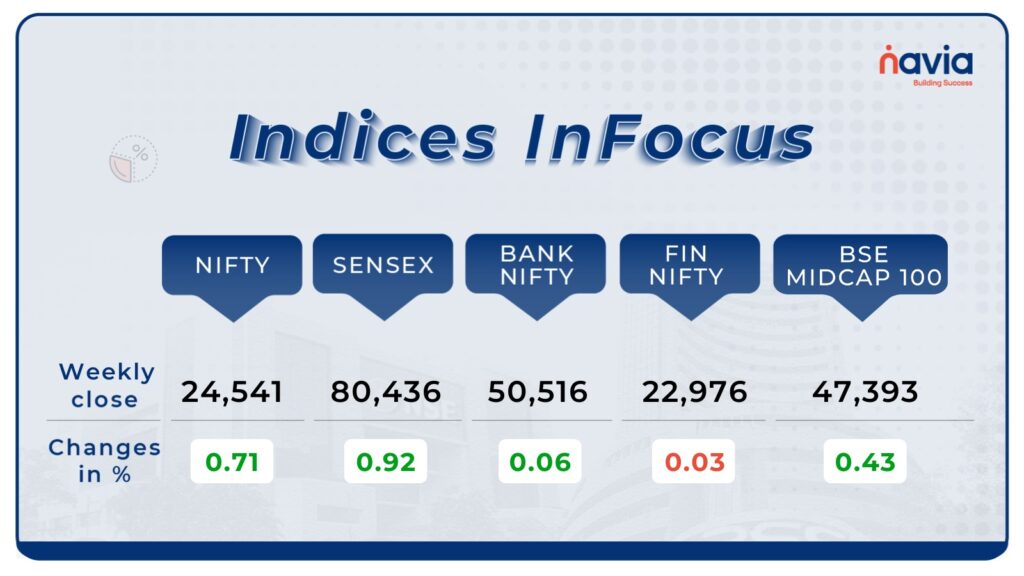

Indices Analysis

India’s benchmark index, the Sensex, jumped by approximately 730 points, closing at 80,436. Amid this rise, seven stocks in the BSE FMCG index reached their highest prices in the past year. Achieving a 52-week high is significant as it marks the highest value a stock has reached over the last 12 months,

Interactive Zone!

Last week’s poll:

Q) In India, which of the below alternatives is not accessible?

a) Commodity futures

b) Options for indexing

c) Futures based on indices.

d) Options on commodities.

Last week’s poll Answer: d) Options on commodities.

Poll for the week: The worth of a derivative contract ____ throughout the term of the contract.

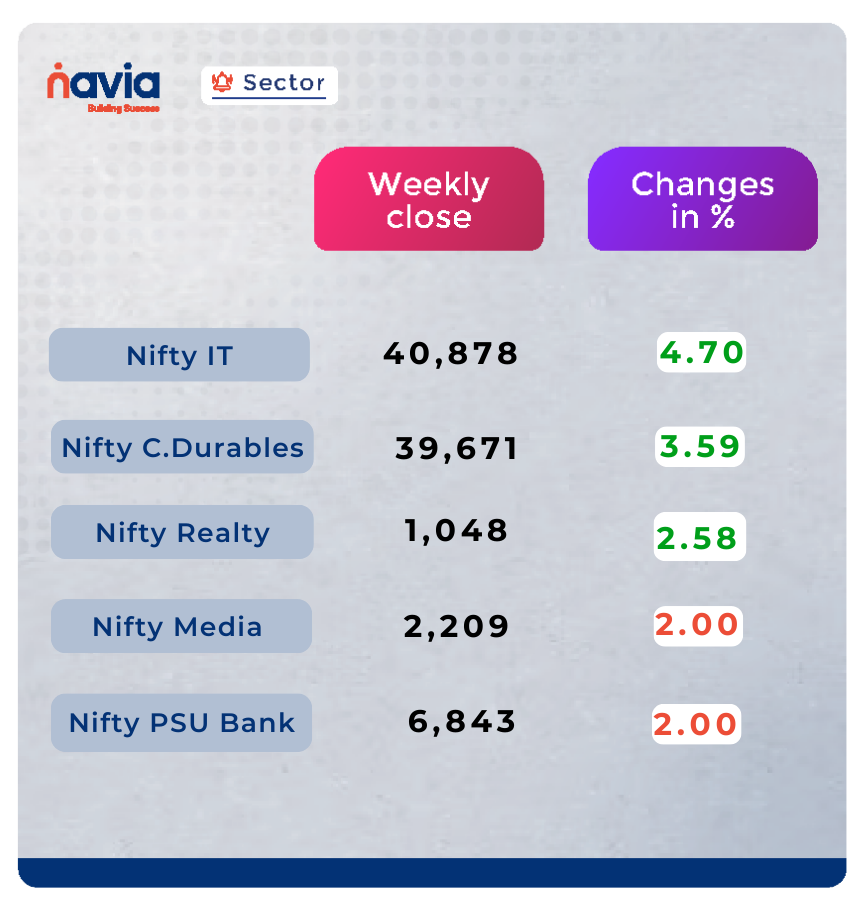

Sector Spotlight

Among sectoral indices, the NIFTY IT index was the lead gainer, spurting by 4.70%. NIFTY Consumer Durables rallied 3.59% while Realty gained 2.58%. On the other hand, NIFTY Media and PSU Bank tanked 2% each.

Explore Our Features!

Find the Best Stocks in Minutes with Navia App

Learn how to easily find top-performing stocks using the Navia app! Our tutorial offers a step-by-step guide to leveraging its powerful features for effective stock selection.

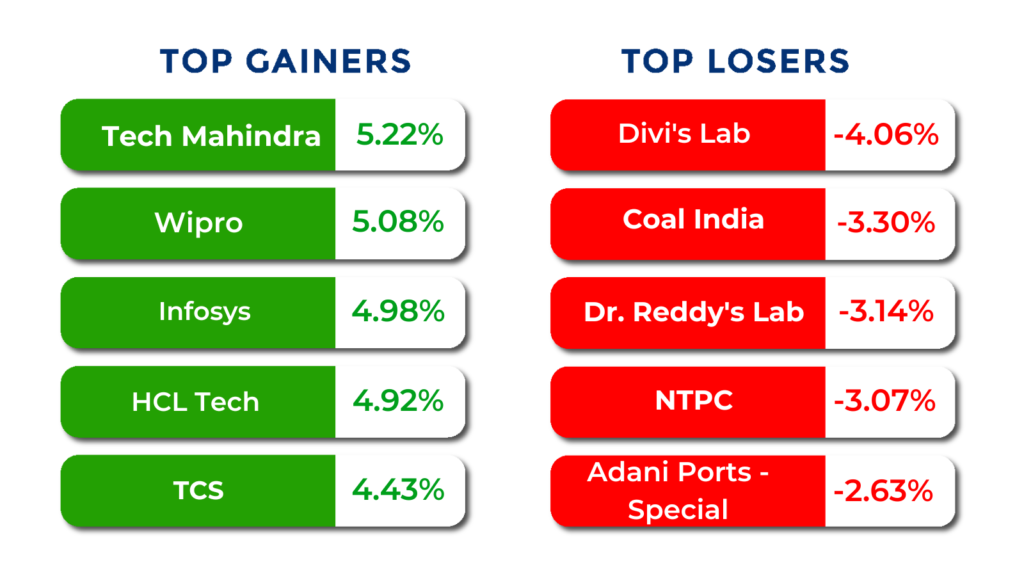

Top Gainers and Losers

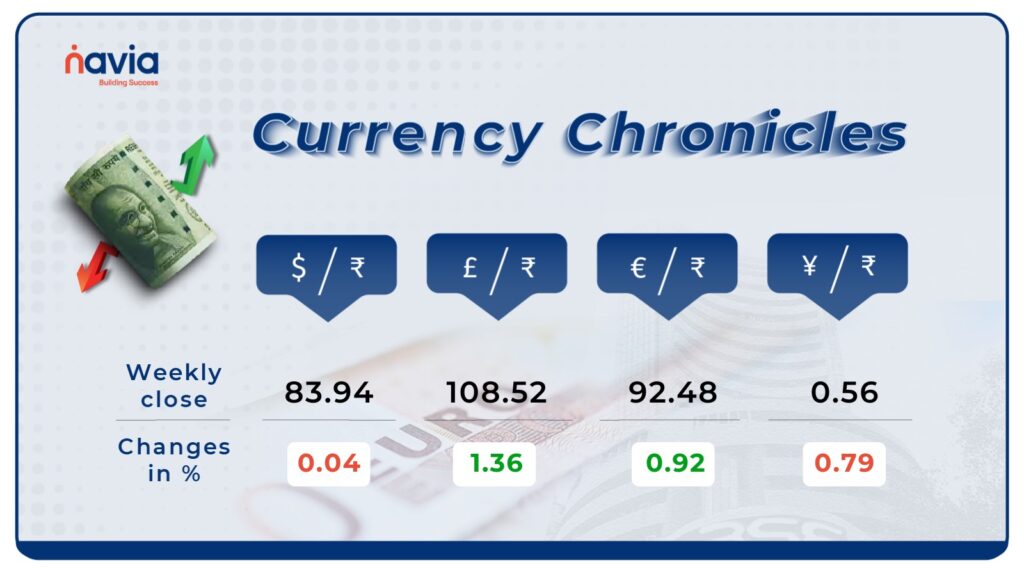

Currency Chronicles

USD/INR:

The Indian rupee remained largely stable against the U.S. dollar this week, closing at ₹83.94, just a fraction lower than the previous week’s close of ₹83.95. The currency showed minimal movement throughout the week.

EUR/INR:

The euro strengthened against the rupee, rising by 0.92% over the week to close at ₹92.48. The market sentiment for EUR/INR continues to be bullish, indicating ongoing confidence in the euro.

JPY/INR:

The Japanese yen also saw gains, increasing by 0.79% against the rupee. By the end of the week, the JPY/INR rate reached ₹0.56, with positive market sentiment supporting the yen’s performance.

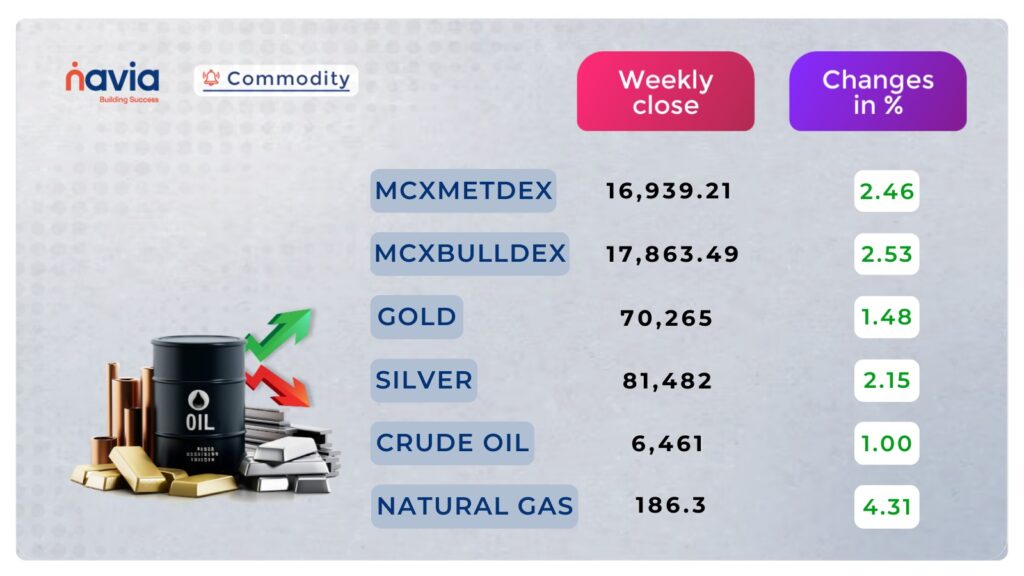

Commodity Corner

Gold may continue to gain from its safe-haven status amid escalating tensions in the Middle East, especially with concerns about potential Iranian retaliation. The current resistance level (R1) is at 70921, and the support level (S1) is at 69563

Amid ongoing concerns about potential supply disruptions due to the increasing threat of a broader conflict in the Middle East.The current resistance level (R1) is placed at 6,666 and the support level (S1) is placed at 6,345

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blog of the Week!

Share Buyback: A Bus Stand Breakdown

Curious about share buybacks? Learn what they mean, the pros and cons, and how to apply using the Navia app. Dive in and get the full scoop!

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?

We’d Love to Hear from you-

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.