Share Buyback: A Bus Stand Breakdown

Table of Contents

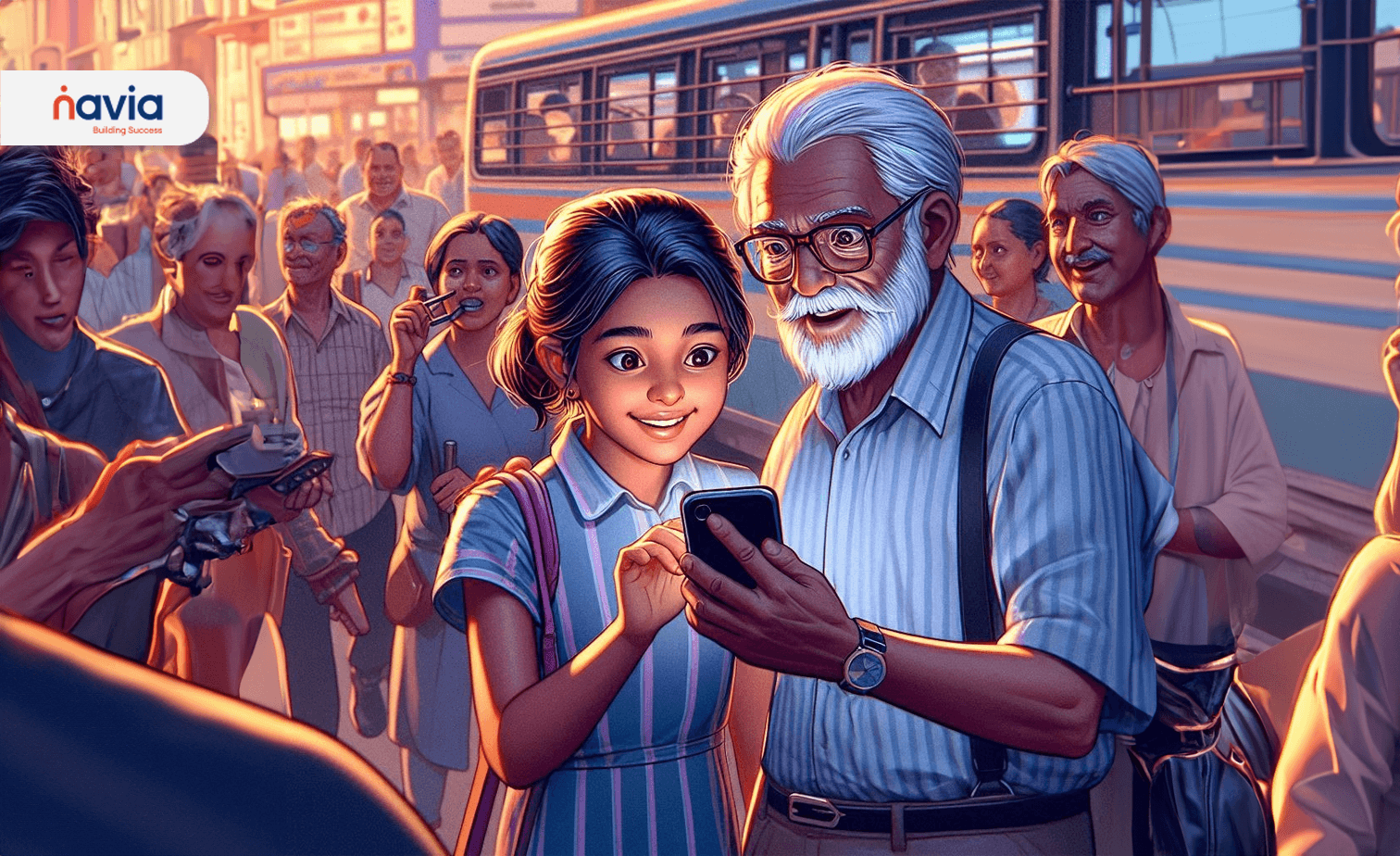

In a bustling bus stand, the cacophony of honking horns and hawkers vying for attention fills the air. Amidst the chaos, Ramya, a young and ambitious investor, stands with her uncle, Ravi. Ramya’s face is aglow as she shows her phone screen to Ravi. “Uncleji, look! TechWiz has announced a share buyback!” she exclaims. Ravi, a seasoned investor, adjusts his spectacles and takes a keen interest.

Understanding the Share Buyback: Ravi’s Insights

A share buyback, Ravi explains, is when a company repurchases its own shares from existing shareholders. “It’s like buying back a piece of your own business,” he says. “Now, this can be a good thing, but let’s not jump to conclusions. There could be several reasons behind this move. Maybe TechWiz has excess cash and no profitable projects in sight, so they’re returning some of that money to shareholders. Or, perhaps they believe their stock is undervalued and want to send a positive signal to the market.”

Pros and Cons of a Share Buyback

However, there’s another side to the coin. Sometimes, companies use buybacks to consolidate power. By reducing the number of outstanding shares, the management can increase their control over the company. “So, while it might seem like a win for shareholders, it’s essential to look beyond the surface,” Ravi cautions.

Ramya’s eyes widen. “But Uncleji, won’t this benefit all shareholders?” she asks. Ravi nods. “It can, but remember, the stock market is unpredictable. Just because a company announces a buyback doesn’t guarantee a rise in share price.”

Navigating the Buyback Process with Navia

As the bus arrives, Ravi concludes, “Investing is a marathon, not a sprint. Don’t get swayed by headlines. Do your own research. Understand the company, its financials, and the overall market trends before investing. A share buyback is just one piece of the puzzle.” Ramya nods, a thoughtful look replacing her initial excitement.

Step-by-Step Guide to Applying for the TechWiz Buyback

As the bus doors open and the crowd surges forward, Ramya steps onto the bus and pulls out her phone again, this time to navigate the Navia app. “Uncleji, I think I’m going to apply for the TechWiz buyback. But how do I do it on Navia?” she asks.

Ravi, ever patient and encouraging, smiles. “It’s simple, Ramya. Let me walk you through it.”

Step 1: “First, open the Navia app. If you’re already logged in, great! If not, go ahead and log in.”

Ramya nods, quickly entering her credentials as the bus hums along the busy street.

Step 2: “Next, navigate to the ‘Tools’ page,” Ravi continues. “There, you’ll find the buyback option.”

She swipes through the app, easily locating the section Ravi described.

Step 3: “Now, you’ll see the buybacks listed under two categories: ‘Current Buybacks’ and ‘Past Buybacks.’ You’ll want to focus on ‘Current Buybacks’ for TechWiz.”

Ramya taps on ‘Current Buybacks’ and smiles as TechWiz’s name pops up on the list.

Step 4: “Once you’ve found the right script, take a look at the details provided. If everything checks out, just hit the ‘Apply’ button.”

With a quick review of the information, Ramya confidently presses the ‘Apply’ button.

Step 5: “And that’s it,” Ravi concludes. “Once you’ve applied, your order is placed, and you’ll be part of the buyback process.”

For a clearer understanding, Watch the tutorial to master the Navia app and seize every buyback opportunity.

Ramya leans back in her seat, satisfied. “Thanks, Uncleji. It’s good to know how easy it is to navigate these things, even in a busy world like ours.”

Conclusion: Confidence in the Chaotic World of Investments

As the bus carries them through the city, Ramya feels a little more confident in her investing journey, with the Navia app and her uncle’s guidance making the process that much smoother. As the day unfolds, Ramya realizes that just like the bus stand, the world of investments is always buzzing with activity. With the right knowledge and tools, she knows she can navigate it with confidence. And just as Ramya is mastering her investment journey, you can too. Begin your journey with Navia today and steer your financial future with confidence!

We’d Love to hear from you