Navia Weekly Roundup (JULY 22 – JULY 26, 2024)

Table of Contents

Week in the Review

The Indian market reached new record highs during the Budget week ending July 26, driven by positive global cues such as better-than-expected US GDP data, which suggested a potential early rate cut by the US Fed. However, the market experienced volatility due to F&O expiry, Union Budget announcements, and mixed earnings reports from Indian companies.

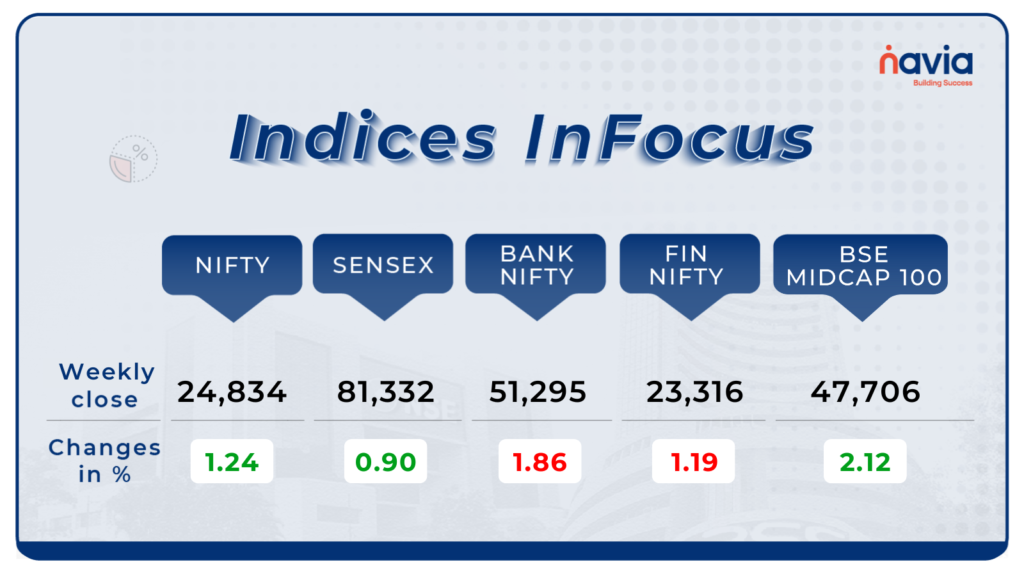

Indices Analysis

In this week, BSE Sensex rose 0.90 percent to finish at 81,332. while Nifty50 index added 1.24 percent to end at 24,834. On July 26, Nifty50 index touched fresh record high of 24,861.15, while BSE Sensex also went near to its record high of 81587.76

BSE Mid-cap Index added 3 percent led by IDBI Bank, Indian Hotels Company, Hindustan Petroleum Corporation, Biocon and Ashok Leyland, while Supreme Industries, Indian Renewable Energy Development Agency, Godrej Properties, Muthoot Finance, Endurance Technologies and Linde India lost 2-6 percent.

Interactive Zone!

Last week’s poll:

Q) The UP Stock Exchange is located in which of the below cities?

a) Kanpur

b) Bangalore

c) Mumbai

d) Mangalore

Last week’s poll Answer: a) Kanpur.

Poll for the week: Which of these factors drives the Sensex to fluctuate?

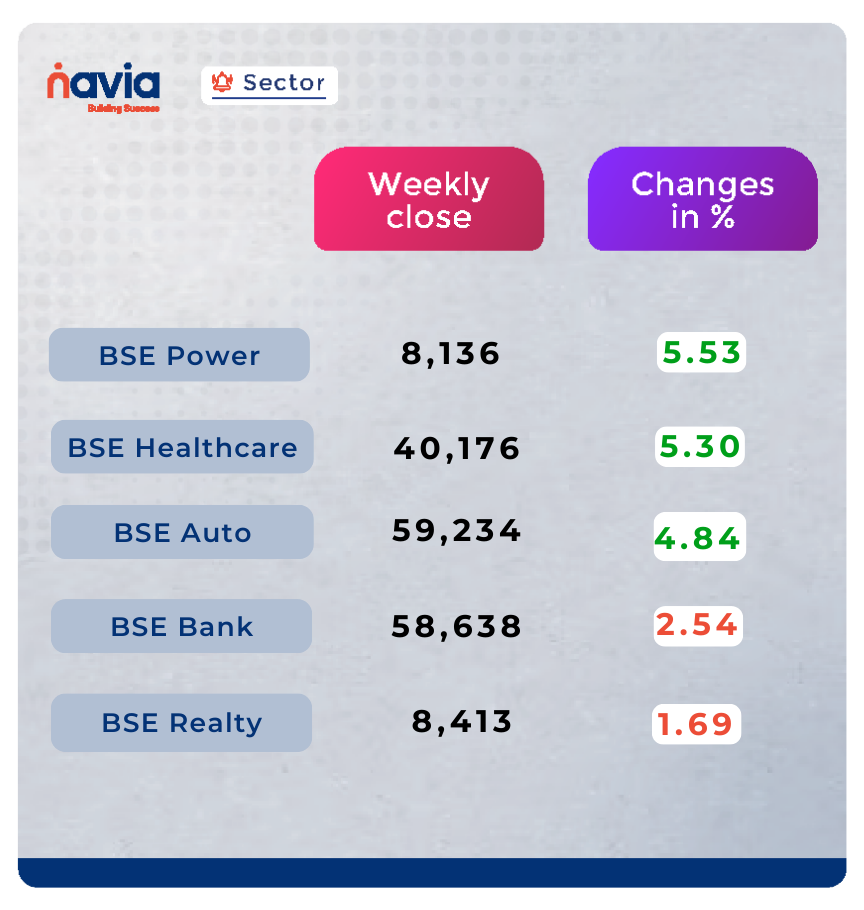

Sector Spotlight

On the sectoral front, BSE Power index rose 5.53 percent, BSE Healthcare index added 5.30 percent and BSE Auto index rose 4.84 percent. On the other hand, BSE Bank index shed 2.54 percent and Realty index fell 1.69 percent.

Explore Our Features!

Shortlist the BEST Stocks in Minutes with Navia App

Discover how to quickly shortlist the best stocks using the Navia app! Our tutorial provides a step-by-step guide to leveraging powerful features for efficient stock selection. Watch our tutorial to get started!

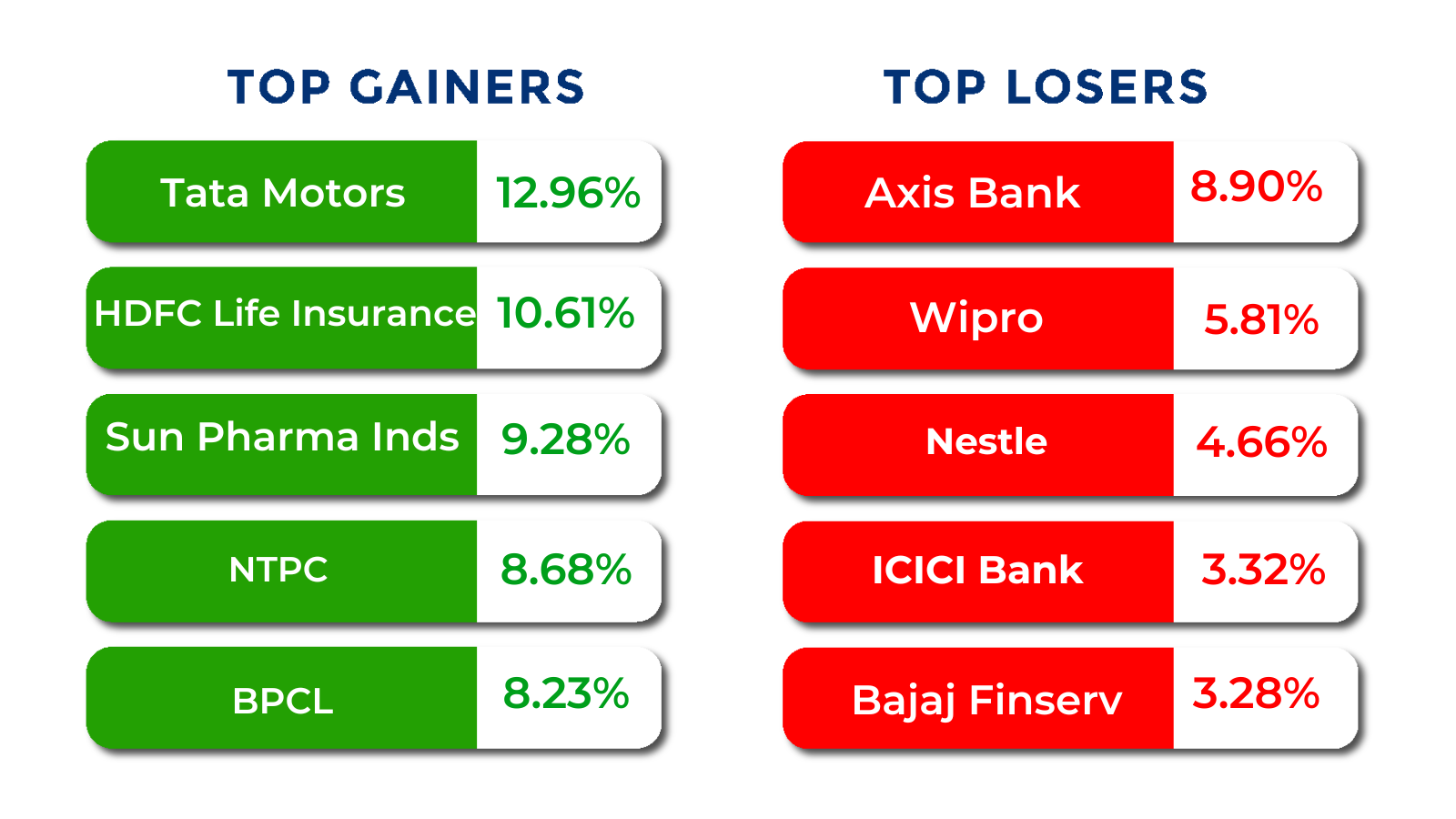

Top Gainers and Losers

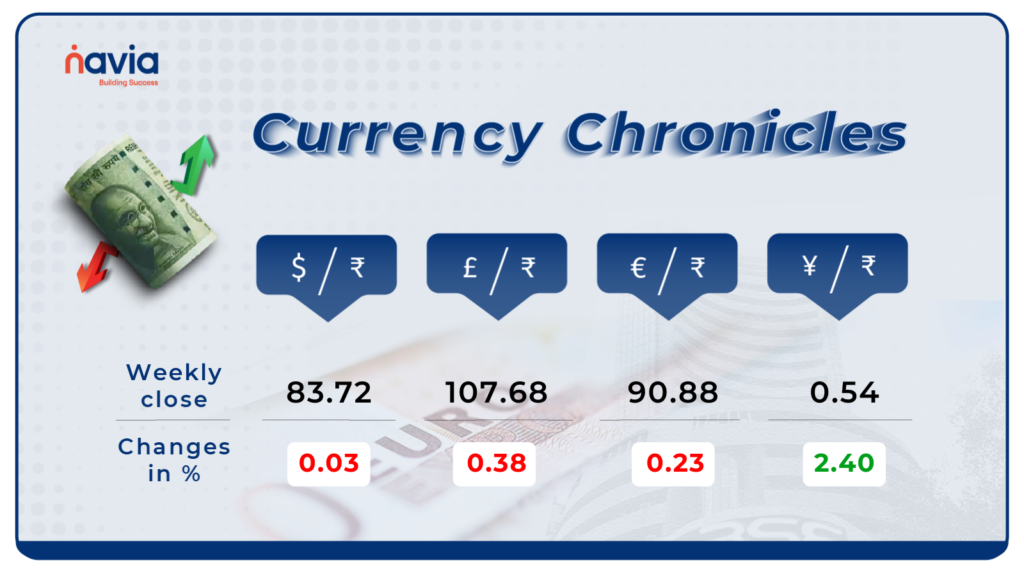

Currency Chronicles

USD/INR:

This week, the Indian rupee lost further ground against the US dollar, declining by 6 paise. The rupee closed at 83.72 on July 26, down from its July 19 closing of 83.66. The continued depreciation highlights the ongoing challenges for the domestic currency in maintaining its value against the dollar

EUR/INR:

The EUR to INR exchange rate decreased by 0.23% for the week, ending at ₹90.88. Despite this slight decline, the market sentiment for the euro remains bullish, suggesting confidence in the euro’s stability and potential for future growth against the Indian rupee.

JPY/INR:

The JPY to INR exchange rate showed a significant increase of 2.40% for the week, closing at ₹0.545846. The bullish sentiment in the JPY/INR market underscores strong performance and growing confidence in the Japanese yen’s strength against the Indian rupee.

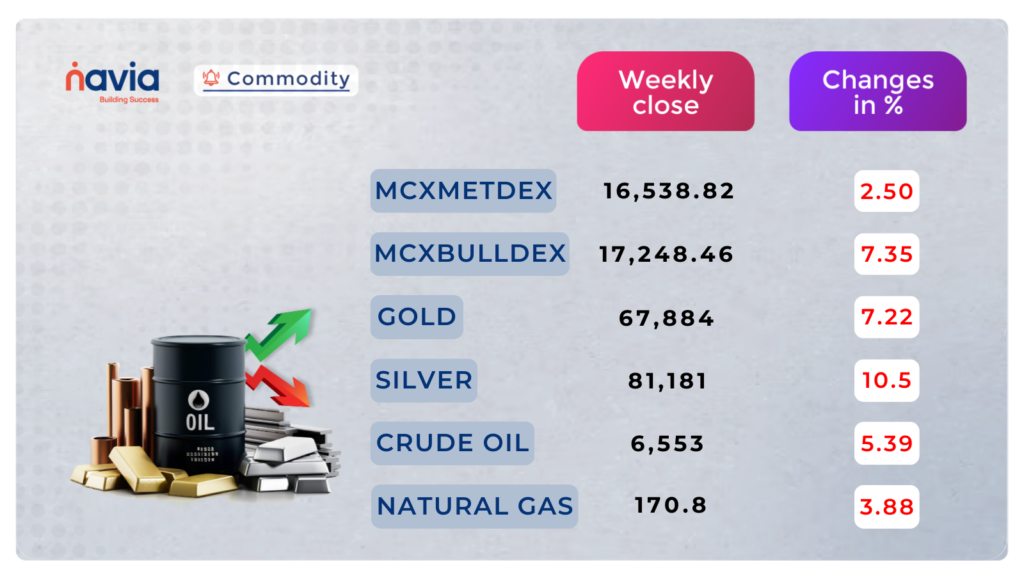

Commodity Corner

Currently, trading below the 68,000 level, strong selling has occurred in silver, touching the March 2024 price levels The current resistance level (R1) is at 70,097, and the support level (S1) is at 67,327

Crude oil currently concerns over weak demand in China, the world’s largest crude importer, the current resistance level (R1) is placed at 6,668 and the support level (S1) is placed at 6,453

Natural gas prices also fell due to continued concern about high inventories. The current resistance level (R1) is placed at 190, and the support level (S1) is placed at 168.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blogs of the Week!

Unlocking Growth: Benefits of Mirae Asset NYSE FANG+ ETF (MAFANG ETF)

Unlock growth with the Mirae Asset NYSE FANG+ ETF! Get insights into top tech companies and key megatrends. Read more to see how this ETF can boost your investment strategy.

Why the MON100 ETF is a Smart Choice for Tech-Savvy Investors

Ready to ride the tech wave? Dive into the benefits of the MON100 ETF and see how SIPs can boost your portfolio with top tech giants. Discover smart investing with diversification, cost savings, and compounding magic. Read more and get ahead in your investment journey!

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?

We’d Love to Hear from you-

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.