Why the MON100 ETF is a Smart Choice for Tech-Savvy Investors

Table of Contents

Investing in the stock market is a dynamic way to grow wealth, and exchange-traded funds (ETFs) offer a convenient and diversified approach to this endeavor. The Motilal Oswal NASDAQ 100 ETF (MON100 ETF) is one such investment vehicle that allows Indian investors to gain exposure to the top 100 non-financial companies listed on the NASDAQ stock market. In this article, we will delve into the advantages of investing in the MON100 ETF, emphasizing the benefits of investing through systematic investment plans (SIPs).

Introduction to MON100 ETF

The MON100 ETF is an open-ended scheme that replicates/tracks the NASDAQ 100 Total Returns Index. This ETF provides investors with an opportunity to invest in leading technology and innovation-driven companies such as Apple, Microsoft, Amazon, and Alphabet. The fund aims to achieve returns that correspond to the performance of the NASDAQ 100 Total Returns Index, subject to tracking error.

Key Attributes of the NASDAQ 100 Index

➝ Tech-Focused: The NASDAQ 100 Index is heavily weighted towards the technology sector, making it an attractive option for investors seeking growth opportunities in tech-driven companies.

➝ Global Exposure: More than 40% of the sales of companies in the NASDAQ 100 come from outside the USA, offering global diversification.

➝ Low Correlation to Indian Equity: This ETF provides a low correlation to Indian equity, making it an effective diversification tool.

➝ Higher INR Returns: The potential benefit from INR depreciation can lead to higher returns for Indian investors.

Advantages of Investing in MON100 ETF

● Diversification: By investing in the MON100 ETF, investors gain exposure to 100 of the largest non-financial companies listed on the NASDAQ, thereby achieving significant diversification.

● Cost Efficiency: ETFs generally have lower expense ratios compared to mutual funds. The MON100 ETF, with a total expense ratio of 0.58%, is a low-cost investment option.

● Liquidity: ETFs can be bought and sold on stock exchanges like shares, providing liquidity and flexibility to investors.

● Transparency: The holdings of the MON100 ETF are disclosed on a daily basis, ensuring transparency for investors.

Systematic Investment Plans (SIP) in MON100 ETF

Systematic investment plans (SIPs) allow investors to invest a fixed amount regularly, irrespective of market conditions. Here’s why SIPs in the MON100 ETF are beneficial:

🔸 Rupee Cost Averaging: SIPs help in averaging the purchase cost over time, reducing the impact of market volatility.

🔸 Discipline and Consistency: SIPs instill investment discipline and encourage consistent investing, which is crucial for long-term wealth creation.

🔸 Affordability: SIPs make it affordable for investors to participate in the stock market with small, regular investments rather than lump-sum amounts.

🔸 Compounding Benefits: Regular investments over time benefit from the power of compounding, leading to significant wealth accumulation.

Performance of the MON100 ETF

According to the information provided by Motilal Oswal Mutual Fund, the MON100 ETF has demonstrated strong historical performance. Here are some key performance metrics as on the date of publishing this article.

1-Year Return: 31.75%

3-Year Return: 14.88%

5-Year Return: 25.42%

Since Inception (March 29, 2011): 22.98%

These returns highlight the potential for substantial growth, especially for long-term investors.

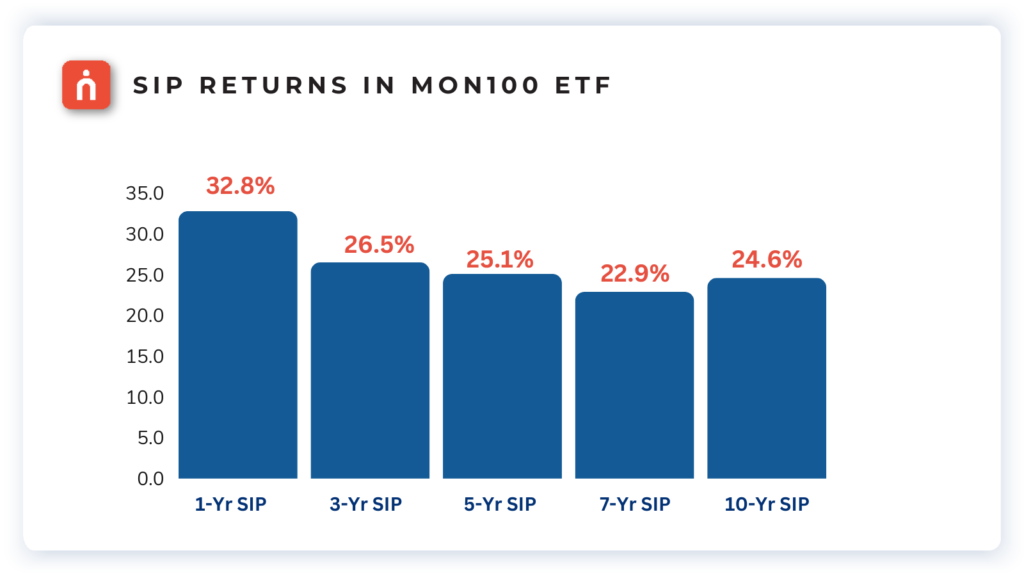

SIP Returns in MON100 ETF

Investing through SIPs in the MON100 ETF has shown impressive results. For instance, a monthly SIP of INR 10,000 over different periods would yield the following results:

1-Year SIP: Market value of INR 1,45,171 with a 32.8% return

3-Year SIP: Market value of INR 5,29,087 with a 26.5% return

5-Year SIP: Market value of INR 10,98,369 with a 25.1% return

7-Year SIP: Market value of INR 20,16,842 with a 22.9% return

10-Year SIP: Market value of INR 42,14,032 with a 24.6% return

These figures illustrate the potential of SIPs to generate substantial returns through disciplined and consistent investing.

Investment Process

Investors can buy or sell units of the MON100 ETF through the NSE/BSE in round lots of 1 unit through the Navia APP at Zero Brokerage and Zero Charges through nCoins.

Why Choose Navia’s Zero Brokerage Stock Investing App?

Investing in the MON100 ETF through Navia’s zero brokerage stock investing app offers several advantages:

🔸 Cost Savings: Zero brokerage ensures that investors save on transaction costs, enhancing overall returns.

🔸 User-Friendly Interface: Navia’s app is designed to be intuitive and easy to use, making the investment process seamless.

🔸 Easy Stock/ETF SIP baskets: Easily create a stock/ETF basket of your choice and start an SIP.

🔸 24/7 Accessibility: Investors can manage their investments anytime, anywhere, providing convenience and flexibility. Know more about the APP here. Check out the how to video’s here.

Conclusion

The Motilal Oswal NASDAQ 100 ETF (MON100 ETF) is an excellent investment option for those looking to diversify their portfolio with international exposure, particularly in the technology sector. The benefits of systematic investment plans (SIPs) further enhance its appeal, providing a disciplined and affordable way to invest. By leveraging Navia’s zero brokerage stock investing app, investors can optimize their returns and achieve their financial goals efficiently. Investing in the MON100 ETF aligns with the principles of cost-efficiency, transparency, and liquidity, making it a compelling choice for both novice and seasoned investors.

For more information, you can visit the Motilal Oswal Mutual Fund website.

We’d Love to hear from you